By Keith Tully, corporate insolvency specialist, Real Business Rescue

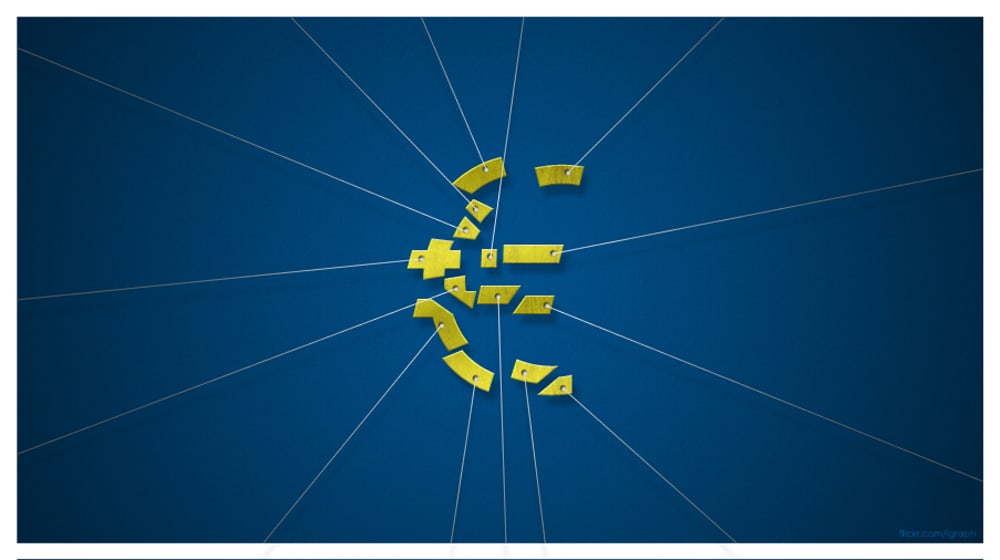

Maintaining a measure of financial flexibility is vital for companies of any size and in any field but accessing funding when it’s required has become a real struggle for many businesses right across Europe and beyond.

The good news though is that there is a growing range of alternative financing options being made available to businesses that have been rebuffed by traditional or mainstream lenders. Here’s a look at five of those alternative routes to financial flexibility.

1. Short-term loans

There are now a number of short-term loan providers operating in the UK and Ireland and elsewhere in Europe, with deals offered on the basis of relatively high levels of interest but via very straightforward processes.

These deals won’t be right for every company but for those in need of quick access to cash they can play a valuable role within a broader business finance scenario.

As with many of the emerging alternatives to mainstream financing solutions, short-term loan markets are helped by the creation of increasingly robust and reliable online platforms which serve to streamline and simplify the processes involved in important ways.

2. Alternative overdrafts

Ever since the financial crisis towards the end of the last decade, most banks have become relatively reluctant to offer credit terms of any sort to businesses and they’ve become notably less willing to offer overdraft facilities. For small and medium-sized enterprises (SMEs) in particular this has made life more difficult and put added pressure on operational cash flows in many cases.

Alternative overdrafts are offered as standalone solutions precisely to help SMEs cope with cash-flow imbalances and to manage their financial situations more easily.

3. Asset refinancing

An inability to access credit through mainstream lenders can be particularly frustrating for companies that have valuable assets but very limited overall financial flexibility. In these situations, asset refinancing can be an important option as it opens up the possibility of retaining access to assets while freeing up cash quickly.

The process essentially involves a company selling ownership of certain assets while retaining access to them.

4. Invoice factoring and discounting

One particular asset which SMEs and larger companies alike can commonly overlook as a potential means of raising cash are unpaid invoices. Late payments of invoices can be a real headache for companies facing cash flow issues and invoice discounting and factoring solutions effectively offer a means through which these invoices can be sold for a fee in return for upfront cash.

Importantly, the processes involved in auctioning invoices are becoming ever easier and more straightforward with the introduction of specialist websites designed specifically to that end.

5. Peer-to-peer lending

Another form of financing which is benefiting from the development of online technologies and platforms is peer-to-peer (P2P) financing, which brings together investors looking for worthwhile returns and companies that can persuade them of their profit-making potential.

The relevant platforms and processes have taken off dramatically across Europe in recent years, with more and more businesses being funded by multiple third parties on the basis of P2P propositions.

Determining what form of alternative financing might be well suited to your needs as a company is not easy but there is an increasing amount of viable and valuable solutions now being offered. The key is for business bosses to understand the specifics of any deal being considered and to be aware of all the options available. Getting advice and guidance from experts on all the key issues can be crucial.

Photo (above): Alan Klim

About the blogger

Keith Tully from Real Business Rescue is leading corporate insolvency specialist. He knows what it takes to keep struggling businesses afloat and what qualities are required of company directors. Keith has been involved in insolvency since 1992, during which time he’s worked for both independent and national business rescue firms.

Keith Tully from Real Business Rescue is leading corporate insolvency specialist. He knows what it takes to keep struggling businesses afloat and what qualities are required of company directors. Keith has been involved in insolvency since 1992, during which time he’s worked for both independent and national business rescue firms.

He is knowledgeable in an array of business-related topics, but his specialties include acting on behalf of financial institutions as well as negotiating with HM Revenue and Customs to arrange time to pay schemes.