Welcome to our weekly look back through 50 years of Irish business. This week, we’ve rummaged through the archive and emerged with the top stories, as published in Business & Finance, from the 1990s.

The 1990s

Goodman on the brink (1990)

Goodman on the brink (1990)

Saddam Hussein’s invasion of Kuwait brought Larry Goodman’s Goodman International to the brink of ruin. The Iraqi dictator owed Larry Goodman £170m and the invasion made it very unlikely the money would ever be paid.

Goodman had already lost almost £95m on his stake in UK company Berisford and £22m on Unigate. For his bankers who were owed £440m, the invasion of Kuwait was the last straw.

The Dáil was recalled to pass special legislation providing for the appointment of an examiner. This staved off the immediate likelihood of a receivership or liquidation, but Goodman’s troubles were far from over.

Following allegations made by Granada TV’s World in Action programme, the Beef Tribunal was established in 1991. The following year conflicting evidence from Des O’Malley and Albert Reynolds led to the collapse of the Fianna Fáil/Progressive Democrats coalition.

Xtra-vision unwinds (1990)

Perhaps nothing illustrated the excesses of the late 1980s bull market better than the rise and fall of video rental company Xtra-vision. When it was floated in May 1989 the shares went from 48p to 90p on the first day’s trading, giving company founder Richard Murphy a paper value of over £25m.

If all seemed too good to be true, it was. The apparent profits the company was making ignored its crazy depreciation policy which wrote off tapes, most of which had a useful economic life of six weeks, over three years. When the company slammed on the breaks in 1990 it rapidly became clear that, apparent profits or no, cash was haemorrhaging from the company at an alarming rate.

Two rights issues which raised £10m each failed to save the day and eventually the company was 48% acquired by leasing company Cambridge. When Cambridge went into receivership in 1993 the future of Xtra-vision was once again thrown into doubt.

It eventually went into examinership in 1994 and was acquired by a consortium of British venture capital houses. Shareholders received just 25p per share.

The year of scandals (1991)

The year of scandals (1991)

The autumn of 1991 produced two business scandals, at Greencore and Telecom, within weeks of one another.

The scandal at Greencore broke first at the beginning of September 1991 when it emerged that chief executive Chris Comerford had begun legal action. Comerford claimed that he was entitled to part of the £8.6m that Greencore had paid for the 49% of Sugar Distributors, which it did not already own. He put his share of the money at £2.15m.

Following the revelations, Comerford was forced to step down as chief executive of the company. Company secretary Michael Tully also parted company with Greencore.

Towards the end of that month a further scandal erupted when it emerged that the then Telecom Eireann chairman Michael Smurfit had had a shareholding in UPH which had owned the Johnston Mooney & O’Brien site in Dublin’s Ballsbridge. Telecom had subsequently bought the site for £9.4m from another company.

Smurfit was forced to step down as Telecom chairman despite having taken the company from an £82m loss in 1984 to profits of £93m in 1990. The subsequent reports by inspector John Glackin largely exonerated Smurfit but were critical of stockbroker Dermot Desmond’s role in the affair.

The Maastricht Treaty (1991)

Not content with the Single European Act, European Commission president Jacques Delors pressed ahead with his plans for economic and monetary union. The Maastricht Treaty envisaged a single European currency by 1999 and set rigid budgetary criteria for members of the proposed euro-currency club.

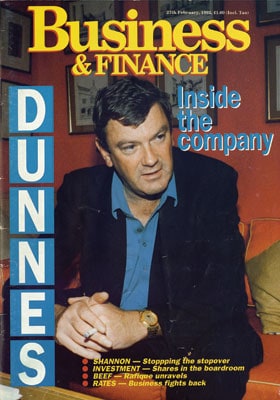

Ben Dunne busted (1992)

Ben Dunne busted (1992)

In February 1992, the apparently impossible happened. Supermarket boss Ben Dunne was busted in Florida for possession of cocaine. This was to mark the signal for the start of a bout of savage infighting among members of the Dunne family.

Ben Dunne was ousted as chairman of Dunnes Stores by his sister, Margaret Heffernan.

The currency crisis (1992-93)

Sterling’s spectacular ejection from the EMS on September 16th 1992 plunged Ireland into an exchange rate and interest rate crisis. As sterling plunged, Ireland’s unofficial fixed rate against the DM meant that we climbed above parity, eventually hitting 110p against sterling.

It wasn’t the real world. To maintain our DM parity, interest rates were raised to penal levels with overnight rates heading over 100% as the markets refused to believe that our exchange rate was realistic.

We were expected to devalue in November along with the Spanish and Portuguese, but a general election got in the way. Finally our economic policymakers were forced to accept reality and the Irish pound was devalued by 10% on January 30th 1993. Contrary to the expectations of many, the sky did not fall; interest rates did.

GPA crash-lands (1993)

There was nothing as spectacular as the rise of GPA – except its collapse.

Chairman Tony Ryan had spent 17 years building the Shannon-based company into the world’s biggest aircraft leaser. After several false starts it was planned to float the company in June 1992 to raise the company about $800m. It was not to be. The price was pitched too high and investors were not interested.

Following the abortive flotation it all unravelled at a frightening speed. Bankers, who had been expecting a capital injection, suddenly took fright at the $6bn which the company owed. They also baulked at GPA’s $20bn order book. GPA rapidly approached insolvency. Meanwhile, General Electric was watching the situation closely. At the 11th hour it rescued GPA in May 1993. As part of the rescue it cherry-picked GPA’s best assets.

The wild wild East (1994)

As the economies of the former Soviet Union opened up, Irish companies were to the fore in exploiting new opportunities. Russia was the first port of call for most of them. However, other former Soviet republics were liberalising their economies also.

After years of lagging behind its larger neighbour, Ukraine – the second largest of the former Soviet republics – was embracing the market too. Once again Irish companies were on the spot.

By far and away the largest Ukrainian project with which Irish companies were involved was the $15m refurbishment of Kiev’s Borispol Airport. This was a joint venture between the Dublin shopfitting and design company MDA and American David Brodsky’s IPM.

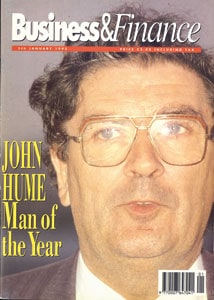

The peacemaker (1994-95)

The peacemaker (1994-95)

1994 and 1995 were great years for John Hume. The SDLP leader pulled off what many had thought impossible when he persuaded the IRA to call an indefinite ceasefire.

In the wake of the Shankill Road bombing and the Greysteel pub massacre it looked as if Northern Ireland’s violent agony was going to plumb fresh depths of ferocity and depravity. The end of a quarter of a century of violence was largely the result of Hume’s painstaking work over the previous six years.

While he was widely criticised when he commenced his dialogue with Sinn Fein’s Gerry Adams back in 1988, there are few who could argue with the end result.

Boom! Shake the room (1996)

Irish housebuilding was in the throes of an almost unprecedented boom. The total number of residential dwellings had risen from just 19,650 in 1991 to over 30,500 by 1996. Total employment in the industry reached 42,000.

A new generation of firms run by skilled trades people from the provinces emerged.

Looking for a mate (1997)

The national flag carrier, Aer Lingus, was back in profit again in 1997, but its future was still far from clear. With margins under pressure, costs on the increase and the prospect of a downturn in the global airline business very much on the cards, the group needed to seek out a large partner to help it survive in the new era of deregulation.

Meanwhile, the proposed flotation of Ryanair at the end of May 1997 generated mixed reactions from the Irish investment community. Fund managers did not have fond memories of the aborted 1992 GPA floatation in which Tony Ryan also had a significant shareholding. The upward readjustment of the group’s 1995 pre-tax profits from £5m to a chunky £15.7m raised more than a few eyebrows.

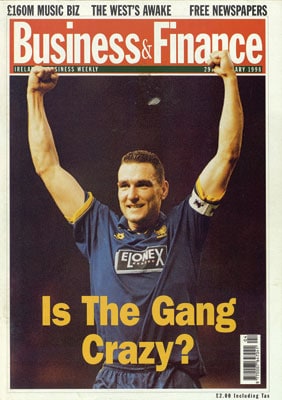

Is the gang crazy? (1998)

Is the gang crazy? (1998)

Property developer Owen O’Callaghan’s desire to see Wimbledon FC playing FA Premier League games in Dublin hung in the balance in 1998. The team, nicknamed The Crazy Gang and run on a shoestring budget since its entry into the English football league in 1997, found itself in a precarious position.

O’Callaghan was managing director of O’Callaghan Properties and was one of the best-known property developers in the country. Not noted as a keen soccer fan, O’Callaghan’s interest in Wimbledon FC was financial. He was sitting on 81 acres of land at Neilstown to the west of Dublin city and had previously secured planning permission to build a 40,000-seater stadium.

The original intention was to build a multi-purpose stadium with a retractable roof but these ambitious proposals were scrapped along with the ill-fated plan for a national stadium.

O’Callaghan then turned his attention to Wimbledon FC, which he believed would provide him with the ideal anchor tenant for his stadium.

Ultimately, the amount of opposition – particularly from League of Ireland clubs such as Bohemian FC – would prove crucial in preventing the move. In one media interview FAI chief executive Bernard O’Byrne mentioned the infamous Lansdowne Road riots of 1995 and asked “Do people want 5,000 English football fans every fortnight in Dublin?”

Rents crisis (1999)

Spiralling rents were a major source of grief for young professionals in 1999. These young professionals rented as a lifestyle choice after being priced out of the market by soaring house prices. Rents in the Dublin area alone went up by 24% in 1998.

The same dynamics of the home buyers’ market applied to the rental sector – basically, demand outstrips supply, although there were also a number of anomalies that exacerbated the problems in the rental market, especially at the lower end.

The pressures on the demand side were attributed to changing demographics, net-immigration and the crowding of the rental market by would-be buyers.

Next Friday we will be we looking at the Celtic Tiger era noughties.

*To read this article in its entirety, pick up a copy of the 50th Anniversary edition of Business & Finance, available now.