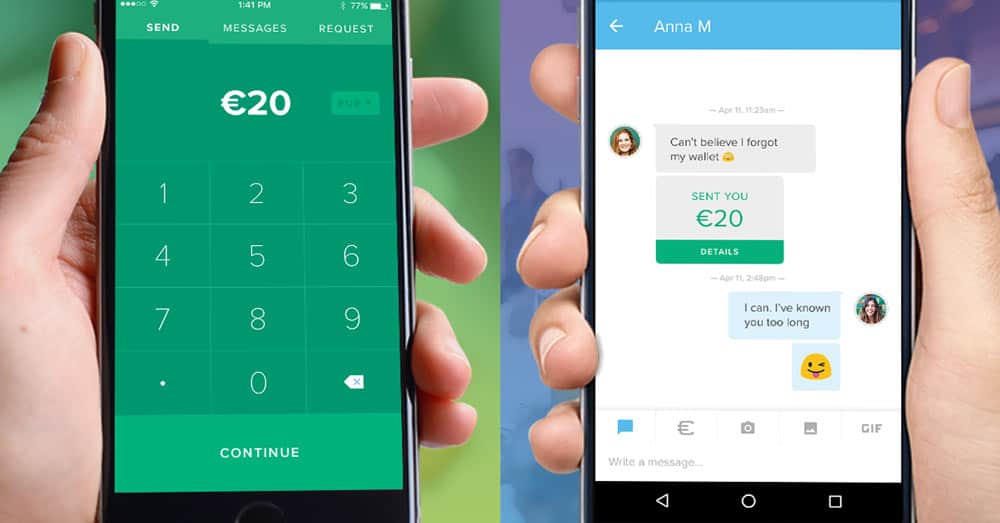

Circle social payments app

Circle Managing Director Europe Marieke Flament on making money fun and the bank of the future

Since the mobile payments platform Circle Pay debuted it has become a popular alternative to that antiquated reimbursement tool called cash. The peer-to-peer payments company was founded in 2013 by Jeremy Allaire and Sean Neville, and has so far raised over $140 million in funding. Backers include Jim Briar (one of the first investors in Facebook), Goldman Sachs and IDG China.

With their European operations based primarily between London and Dublin, Marieke Flament is managing director for Europe. Flament began her career as a financial analyst for luxury goods conglomerate LVMH and prior to joining Circle in 2016 was VP EMEA for Hotels.com. As a French woman, living in London and married to a Spaniard, who has worked in Shanghai and Hong Kong, the benefits of free, instant, global digital money transfers are crystal clear to her. However, it is the younger generation, who operate their lives in a social media environment, that Circle primarily targets. The app allows users to send money as simply as sending a text message and add fun elements, such as an emoji or a .gif.

Marieke Flament, MD for Europe, Circle

We caught up with Flament in Circle’s Dublin office to hear more about the future of banking, the importance of blockchain, and the fintech scene in Dublin versus London.

B&F: Circle as a company began in 2013 primarily as a bitcoin wallet, but is now fully focused on peer-to-peer money transfers. Is B2B in your future or do you plan to stay focused on the consumer finance market?

FLAMENT: We are extremely focused on consumer. We started from the get-go to be based on blockchain. At the start it was a bitcoin wallet, because that’s the first thing you can do without being regulated, so that was the easiest way to have an MVP [minimum viable product] to actually start testing those user messages.

Fundamentally we think the bank of the future is not going to be a digitised version of what we know today but a completely reinvented way of how we exchange money.

The first product is the app, so sending and receiving money is the core product and will always remain free, and you can send euro, pound and dollars. We give you the mid market rate so whatever you see is whatever you get. That product will always be free, that will never change.

Over time what we are seeing and what we are starting to test with are additional ideas like savings or investments in crypto-assets that could actually be things that add value to consumers.

Technology has really changed the way we use money. Can you tell us a bit more about how that has been crucial to the way Circle operates?

The vision has always been the same – make money work the way the internet does. It sounds super simple but it’s actually very difficult. There are new technologies today that enable you to do that, one being blockchain, then everything that is related to artificial intelligence and machine learning, because rather than needing to have a lot of staff that will do things manually, you actually have all of that on an automated basis so your costs will go down and you operate in a much more cost-efficient way. Then the third one is the fact that everything today is cloud-based so you don’t need to have very heavy infrastructure to run a company and you can do that in the cloud. So all those three things help us build a vision but also help us do that in a very cost effective manner.

Today, because of the way we have built Circle from the get-go, using blockchain, one thing that people don’t often realise is that we are one of the largest crypto-trading desks in the world. To give an idea, in the month of May alone, €800 million passed through the crypto-trading desk. What that helps us do is to make sure that customers will get the mean market rate, so the Google rate that they can see, when going from euro to dollar, while we build all those capabilities from the bottom up.

Technology isn’t just crucial to the way Circle operates, but also to the way Circle’s user base operates – it is squarely (no pun intended) aimed at the youth market.

We believe that the way people interact, they are very used to social media. There is a Circle app, but we are trying to embed ourselves in other places. For example we are now in iMessage because iMessage really is an API and when you are having a chat with your friends in iMessage you can actually send money within a chat. This is the only application at the moment that has an open API for you to code within it. But the more that happens the more we will be moving into that trend.

The idea is that you can have your conversations where you are having them in your normal setting and then within that you can send and receive money. The premise is basically the way we handle that is fundamentally changing.

It’s certainly a far cry from the stuffy image of traditional banking. Was this something that was a hard sell to investors or a USP for Circle?

Is it too fun to be seen as banking? That’s interesting. This makes you more in control of how much money you send and receive, and you can actually request it back. Yes it’s a fun way but in a way it makes you more owner of the money you have. We have done studies – it’s the size of the GDP of Iceland that people are owed in terms of not wanting to ask for it back, not really wanting to ask people for their money back. So it’s a lot of money that we leave on the table. This way of asking with an image or with a .gif can help you do that. A lot of our user base is very young; 90% are under 35 years old and 60% are under 25 years old so it’s definitely a product that is for younger millenials. That’s also what we see, that there is an appetite and a need for redesigning the way we handle finance today.

How can this work on a global scale?

What we want to reshape and transform is really the consumer aspect. So it’s on a global basis, how do you shape and transform the services that are person-to-person? Imagine a Circle wallet, today that Circle wallet could actually be talking to another wallet that is in another country and do that seamlessly, the same way for example you’re on Gmail and I’m on Yahoo and we’re sending each other emails and it works on an smtp protocol.

We believe blockchain is very important because if you think about it, today there is no protocol of money. There is a protocol for the internet, http, and there is a protocol for email, it’s smtp, but that is not there yet for money. Money is data.

We are creating a blockchain protocol which is codenamed Spark – the idea is to create the equivalent of an smtp of money, to enable different wallets to be able to talk to each other. So on one hand we are very focused on the consumer product and the other hand on actually creating the ecosystem to enable us to have all of those things together.