A review of the markets reveals that risk assets rallied as markets reacted to central bank meetings, writes Ian Slattery, Zurich Life Assurance plc.

The two highly anticipated central bank meetings dominated markets last week as the Federal Reserve left US rates unchanged but made it clear that the possibility of an increase in December is still on the table. The Bank of Japan (BoJ) signalled a tweak in its monetary policy stance, announcing a shift towards utilising interest rates rather than the money supply going forward.

Risk assets rallied as the outcomes from the BoJ and Fed policy meetings were met positively by the market. The tone of both meetings was seen as ‘dovish’, implying that neither institution is in a rush to raise interest rates.

Gold rose for a fifth day as a weakening US dollar and a fall in bond yields helped the metal advance, whilst oil had another volatile week as talks between oil producing states continued.

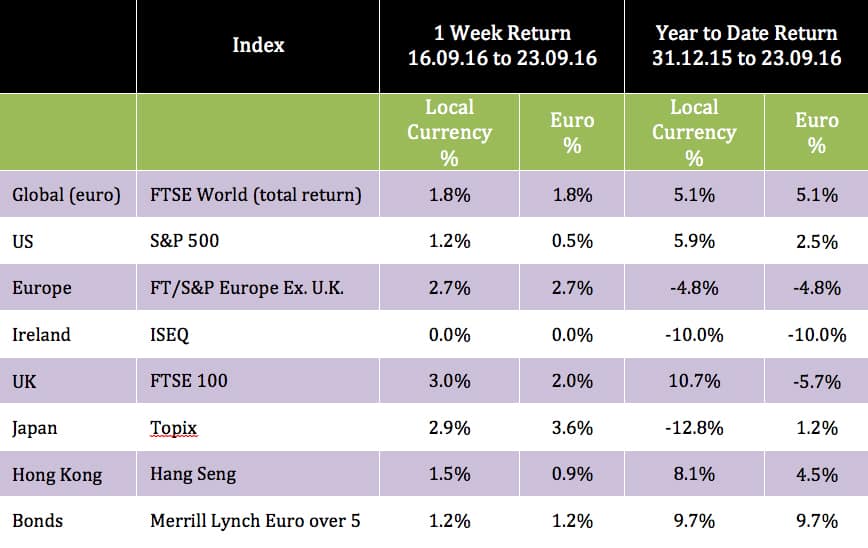

The global index was up for the week, returning 1.8%, pushing the year to date return to over 5% in euro terms. The UK and Japan were amongst the strongest markets in local terms, as currency fluctuations continue to strongly influence returns for euro-based investors.

Ian Slattery

Oil was up over 3%, as markets anticipate the finalisation of a Saudi-led deal on production levels amongst oil-producing nations. Copper finished up over 3% and remains in positive territory for the year in dollar terms. Silver and gold were both up on the week with gold remaining up over 26% year-to-date, and silver up an impressive 42%.

The influential US 10-year bond yield was down on the week to finish at 1.62%, as the ‘dovish’ Fed tone helped support bond prices. The German equivalent was also pushed back into negative territory, closing out the week with a yield at -0.08%.

The euro/dollar currency pair was trading at $1.12 per euro, having moved from a rate of $1.09 at the end of 2015.

THE WEEK AHEAD

Tuesday September 27th

The Bank of Japan release the minutes from last week’s meeting. Given the policy shift announced there should be plenty of interest in any further details that are made available.

Thursday September 29th

Final Q2 US GDP figures go to print where growth is expected to be revised to 1.2% quarter-on-quarter from 0.8%.

Friday September 30th

Final UK GDP figures are also released for the second quarter of the year. Growth is expected to be revised to 0.6% quarter-on-quarter from 0.4% and 2.2% year-on-year, from 2%.

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €13bn in investment assets and have a reputation for delivering consistent performance. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc