Global stocks were down slightly and the Central Banks discussion around the possibility of introducing tighter policy conditions impacted on bonds. Ian Slattery reports.

Global stocks finished the week slightly down, despite Friday’s US payroll data being a positive surprise. 220,000 jobs were added, exceeding forecasts whilst there were also upward revisions for figures for both April and May.

Ian Slattery

Other economic news emanating from the US was mixed; a positive reaction to the highest manufacturing PMI reading in nearly three years was tempered by lower than envisaged reading for factory orders.

Oil weighed on markets once again, as data showed an increase in US production levels, in addition to OPEC exports, hitting their highest level this year. It was also a difficult week for Bonds, as a number of Central Banks discussed the possibility of tighter policy conditions. Core eurozone bonds lost value, and the German ten year yield (which moves inversely to price) closed at its highest level since January 2016.

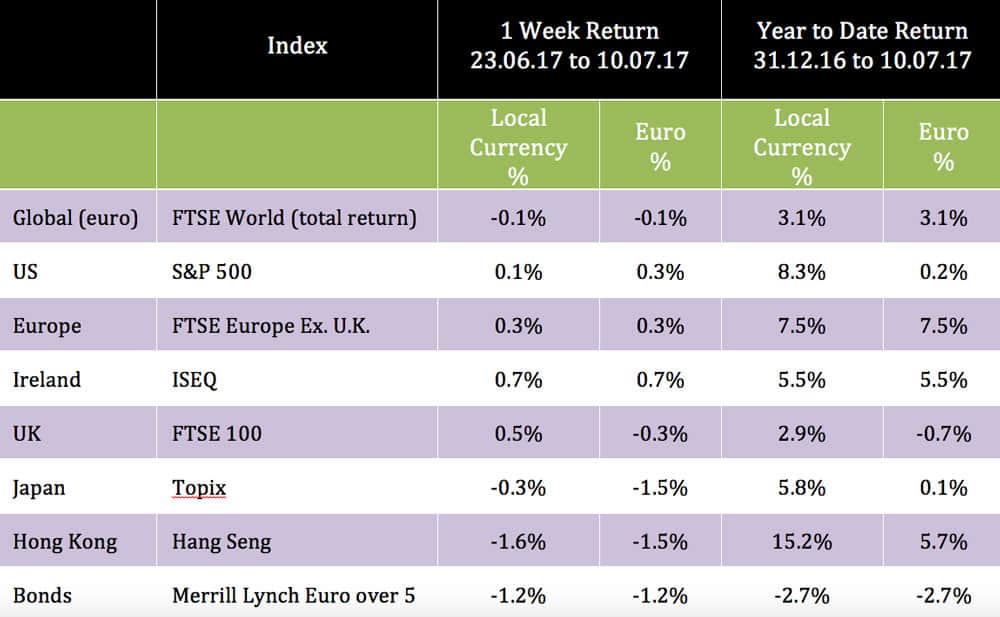

The global index ticked down slightly over the course of the week, returning -0.1%.

UK jobs data goes to print, where the unemployment rate for May is forecast to rise to 4.7%

Gold also lost value, as the prospect of higher interest rates weighed on its outlook. Copper and Oil also moved lower, down 2.3% and 3.9% respectively.

US 10 year Treasuries were higher, with the yield moving to 2.39%, from 2.30% a week previously. As mentioned above, the equivalent German yield also rose, moving to 0.57% from 0.47%. And the EUR/USD rate closed at $1.14 whilst EUR/GBP was at £0.88.

THE WEEK AHEAD

Wednesday July 12th

UK jobs data goes to print, where the unemployment rate for May is forecast to rise to 4.7% from 4.6%.

Thursday July 13th

The start of the latest US earnings season provides the big focus this week, with financials leading the way. JP Morgan, Citigroup and Wells Fargo all report on Thursday.

Friday July 14th

The latest US CPI readings are released, where the market expects the annualised inflation rate to increase slightly from 1.7% to 1.8%.

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €21.6bn in investment of which pension assets amount to €9.6bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds, Twitter: @ZurichLife, LinkedIn: linkedin.com/company/zurich-life-assurance-plc