In the latest review of the markets, Ian Slattery reports that equities closed up for the week on the back of earnings data.

Ian Slattery

Equities were choppy during the week on mixed data but finished the week strongly on the back of better than expected earnings from Citigroup and JP Morgan.

China was also the focus of some attention as export figures released on Wednesday for September stoked deflationary concerns. However, this was offset on Friday as producer prices (also known as prices at the factory gate) rose for first time in nearly five years.

The Federal Reserve released the minutes of their September rate decision meeting on Wednesday which showed that the decision not to increase rates had been a closer call than previous meetings, with many commentators suggesting that the vote of chair Janet Yellen swayed the committee into the 9-3 vote in favour of holding rates.

The Federal Reserve released the minutes of their September rate decision meeting on Wednesday which showed that the decision not to increase rates had been a closer call than previous meetings, with many commentators suggesting that the vote of chair Janet Yellen swayed the committee into the 9-3 vote in favour of holding rates.

Sovereign bond yields rose during the week as the market expectation of a December rate hike increased slightly over the five days of trading. Gold also fell as the Dollar Index, which measures the US dollar against a basket of peers, strengthened further, continuing the move upwards seen since the start of October.

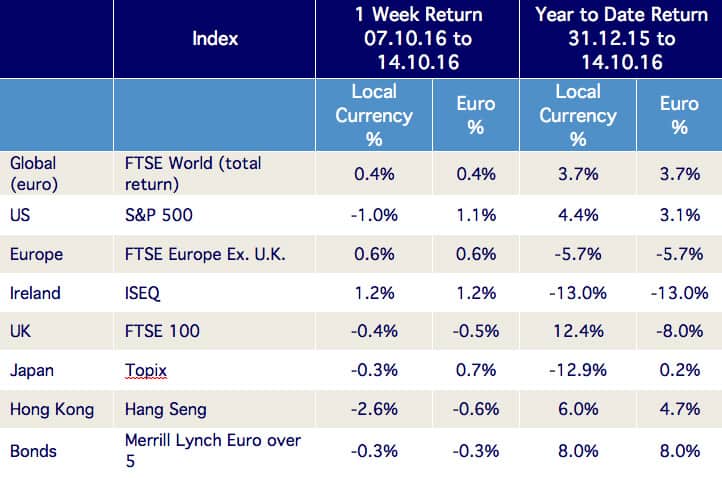

The global index edged up 0.4%, with Europe up 0.6%. Ireland outperformed with a weekly return of 1.2%, although it remains down 13% year-to-date. Oil had a mixed week, as markets questioned the resolve of OPEC to cut production, but was up over 1%. Gold fell again, down -0.4% at the close on Friday. The 10-year German bond yield rose from 0.02% to 0.06% over the course of the week, whilst euro currency weakness enhanced returns for Irish investors with holdings outside of the eurozone.

THE WEEK AHEAD

Tuesday & Wednesday October 18th/19th

Goldman Sachs, Johnson & Johnson, Morgan Stanley and Intel are amongst the big names reporting earnings this week.

Wednesday October 19th

Q3 GDP data for China goes to print where the consensus is for a year on year increase of 6.6%, down slightly from the last reading of 6.7%.

Thursday October 20th

No changes are expected at the latest ECB rate decision meeting. However, President Draghi is likely to be questioned on whether the asset purchase programme will be extended past March 2017, when it is due to end.

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €13bn in investment assets and have a reputation for delivering consistent performance. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc