Ian Slattery reports on the markets for this week as EU and US stocks show upward movement.

Ian Slattery

Non-fundamental events took centre stage last week as North Korea raised tensions in the region once again by firing a missile over Japan on Tuesday morning. The regime has also now tested a nuclear weapon over the weekend; the sixth such launch in their history. Hurricane Harvey also made landfall in Texas, which has seen several hundred thousand people displaced and caused disruption in energy markets.

On the economic front, Friday’s US non-farm payrolls data disappointed, generating 156,000 jobs in August, which was below expectations. Additionally the unemployment rate ticked up slightly to 4.4%, from a previous reading of 4.3%.

However, stocks on both sides of the Atlantic still managed to move higher over the course of the week as manufacturing and consumer spending in the US both saw positive data releases. In Europe, economic sentiment reached its highest level in more than a decade and export orders increased at the fastest rate since 2011, despite fears regarding the effects of a stronger euro currency on the sector.

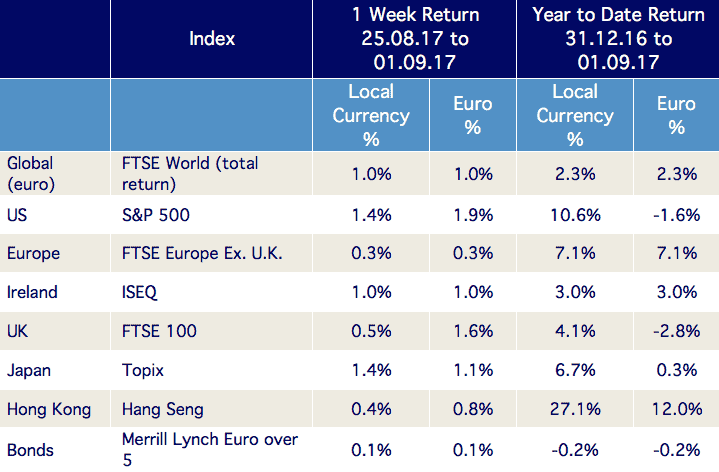

The global index moved higher last week, returning 1% in euro terms. Gold was positive over the course of the period, returning 2.6% on the back of heightened geopolitical tensions. The influential US ten year bond yield closed at 2.17%, whilst the German equivalent was at 0.38%. The EUR/USD rate stood at $1.19.

The week ahead

Thursday 7th September

- No change in monetary policy is expected when the ECB governing council meets in Frankfurt. However, comments from President Draghi will be closely watched for any hint of QE tapering.

- The consensus view is for eurozone Q2 GDP to be confirmed at 0.6% (quarter-on-quarter) in its final reading.

Friday 8th September

Chinese trade data for August goes to print, where both import and export figures are forecast to rise, with the trade balance remaining broadly similar to the last reading.

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €21.5bn in investment assets and have a reputation for delivering consistent performance. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc