Deanna O’Connor reviews the FDI highlights of the past year and looks at emerging trends.

Overall, 2016 was a record year for FDI in Ireland, as evidenced by the IDA’s results for the 12-month period – which recorded the highest level of employment in its client companies in history, with 199,877 people employed in inward-investment companies. It is also estimated that for every ten jobs created by an FDI company there are seven knock-on jobs created in the wider economy.

A record number of 244 investments were secured over the course of 2016, up from 213 the previous year, with international services, pharmaceuticals and medical devices, and financial services all showing significant employment increases during the year.

The long-established pharma sector is witnessing change as Ireland wins significantly in the capital intensive bio-pharma investment sphere, supporting the commercialisation of a range of new drugs (although some older plants are facing challenges to their position due to older products and technologies).

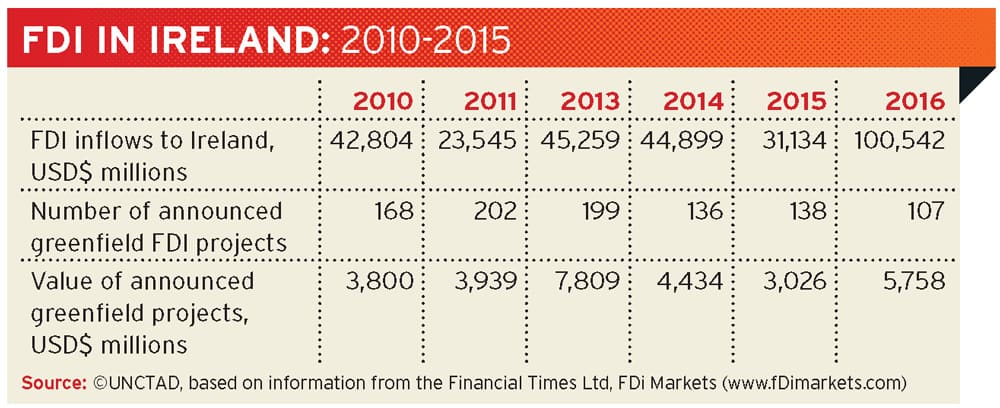

According to the United Nations Conference on Trade and Development (UNCTAD) World Investment Report 2016, Ireland ranked fourth in the world (behind the United States, Hong Kong and China) as a host economy in 2015, with USD$101bn FDI inflows, up from 11th place in 2014 with USD$31bn.

The report also credits the boost to Ireland’s figures with strong activity in cross-border M&A sales, which in Europe have seen a strong rebound–achieving the highest level since 2007.

Dublin was ranked third in the world in a list of top cities for attracting FDI this year, in fDi Magazine’s Global Cities of the Future ranking, a bi-annual index published by the Financial Times. The capital moved up a place ahead of Hong Kong, with only Singapore and London ahead, and placed third in both the economic potential and business friendliness subcategories. Its reputation as a hub for ICT continues, with software and IT accounting for 45.2% of all Dublin’s FDI from 2011-2015.

Ireland’s FDI was noted to have bucked the European, and indeed global, trend in 2015, with a 4% increase in projects versus a 9% drop across the continent as a whole.

On a global scale, 2011 was the pinnacle for FDI with 15,000 projects reported worldwide, a number that has since declined to 11,930 in 2015, with a 5% decrease on this number forecast for 2016’s results. However, on a global scale the fDi Report 2016 predicts annual growth of 3-5% in the 2017-20 period.

BREXIT IMPLICATIONS

Prior to Brexit it was predicted that the number of FDI projects for 2017 would decrease–however, after the unexpected result there was a significant increase in enquiries to IDA offices from firms considering relocating their headquarters to Ireland, and IDA chairman Frank Ryan has said that additional resources were deployed to deal with the interest.

Many of these companies would have done their due diligence prior to the Brexit referendum and moved on to narrowing down their options and site visits in the wake of the vote. It is widely expected that companies will make the crucial decisions in Q2 2017.

Dublin was ranked third in the world in a list of top cities for attracting FDI

It is unlikely that many will be waiting on decisions to be made between the UK and the EU; political timelines and commercial timelines are not compatible, especially for financial services companies that need to go through lengthy regulation procedures.

Just last month The Irish Times reported that Irish Life Investment Managers (ILIM) had received over 50 enquiries from companies considering reclocating from the UK to Ireland. managing director Patrick Burke revealed that the source was largely financial services companies, many with existing operations here. “We’ll be in a position to meet the current level of demand over the coming two to three years if it was reflected on a one-in-five hit ratio on the level of enquiries,” Burke said.

However, he warned that lack of infrastructure and housing supply could go against Ireland compared to other destinations better equipped to deal with an influx and support big business, such as Frankfurt and Luxembourg.

THE TRUMP EFFECT

According to the Irish-US Economic Relationship 2016 report by the American Chamber of Commerce Ireland, US investment flows to Ireland surged to a record $58.1 billion in 2014. Ireland performed strongly within Europe during 2015, accounting for nearly 20% of total US investment flows to Europe in the January-September period. The comparable shares for France and Germany were 3% and 2% respectively.

In 2014, US investment stakes in Ireland ($310 billion) were greater than many regions of the world, including Latin America ($139 billion), Central America ($118 billion), Africa ($64 billion), the Middle East ($52 billion) and China ($66 billion).

US investment flows to China in the first nine months of 2015 were just 16.8% of those to Ireland in the same period; comparable figures for India, Brazil and Russia were 7%, 6.2% and less than 1% respectively–reflecting Ireland’s track record as a high-performance, attractive and stable investment location within Europe.

But what will happen as the geopolitical landscape suffers the aftershock of the Trump election? We have already seen motor companies reaffirm commitment to the US, to the detriment of Mexican operations, even before Trump took office. In his January 11th press conference, just over a week before inauguration, he brought up the issue of American pharmaceutical companies locating abroad, saying: “We’ve got to get our drug industry back. Our drug industry has been disastrous. They’re leaving left and right. They supply our drugs, but they don’t make them here, to a large extent.”

What his protective administration will mean for Irish FDI remains to be seen. Martin Shanahan, IDA CEO, remained philosophical at the announcement of the agency’s 2016 results, commenting that he expects that US companies will still need to internationalise.

Given the long relationships and levels of investment US companies have put into building their Irish bases, it is unlikely they will up sticks in a mass exodus. We hope.

WHERE ARE THE NEW INVESTMENTS IN FDI COMING FROM?

Traditionally, American companies have been a cornerstone of our FDI–however, expect to see more coming from growth markets, particularly in the Asia Pacific region. The IDA has three outposts in China, as well as offices in Australia, India, Japan, Korea and Singapore.

We can expect more fruits of their labours to ripen in the years to come. Out of 244 investments made in 2016, 176 came from North America, 49 from Europe and 19 from growth markets–Japan, India, China, Russia, Australia and Mexico were all sources of FDI during the last year.

Ireland has built quite a reputation as a hub for certain sectors like medical device manufacturing. While these stalwarts will likely remain unchallenged in their dominance, some of the newer entrants are interesting and potentially will attract more of their own ilk.

Cyber risk is an area that is increasingly at the forefront of business issues. As the depth and spread of technology use becomes ever more pervasive, it is incumbent upon every business to assess and manage risk within their business processes.

Firms that are involved in preventing and controlling cyber risk will be set to experience huge growth as the importance and severity of the issue dawns on more businesses. Recent entrants to the Irish FDI scene include Cylance, IDT911 and CipherTechs.

Cylance uses artificial intelligence to proactively prevent, rather than just reactively detect advanced persistent threats and malware. They announced the opening of an office in Cork in October 2016, generating 150 jobs in what is seen as an endorsement of the emerging cybersecurity cluster in Cork. For Cylance it was the latest in a series of international moves to meet the global demand for the company’s next-generation endpoint protection product, and to provide an in-region presence to support customers across EMEA.

FDI remains one of the cornerstones of our economy and a testament to the foresight of visionary thinkers

Identity theft and data risk management firm IDT911 established its European base in Galway, with the aim to launch itself into the European market and scale upwards, bringing 60 new jobs to the region. The company, which is headquartered in Arizona, specialises in helping businesses and customers to defend against data breaches and identity theft.

And CipherTechs, which provides security solutions for businesses in areas of IP networking, firewalls, application security, risk assessment, traffic management, encryption, redundancy and strong authentication, established its EMEA headquarters in Kilkenny, creating 36 new jobs over five years at its Security Operations Centre. Kilkenny was chosen as the location for their EMEA facilities on the basis of the available skills pool, strong broadband service, proximity to third-level institutions/research facilities and quality infrastructure.

CONSUMER BUSINESSES

International fashion and retail businesses that have set up here include Ralph Lauren, Zalando and Wayfair. Ralph Lauren Ireland established an eCommerce hub in Dublin in 2016 to support the company’s omni-channel business, with an eCommerce technology team to carry out platform and digital technology innovation and a finance operations team providing fraud and payments services.

Zalando, the most trafficked fashion site in Europe (although as yet unavailable to Irish consumers), set up a Fashion Insights Centre in Silicon Docks–paying a record rent on a five‑year lease for Denis O’Brien’s restored Victorian warehouse property at Grand Canal Quay.

They came to Ireland in search of top-quality candidates in the field of research and development, big data analysis, data science and engineering, aiming to create 200 jobs in Dublin by 2018.

Wayfair Inc, one of the world’s largest online destinations for home furnishings and décor, announced the expansion of its multi-lingual European Operations Centre in Galway last May, opening a new 30,000sq ft facility and creating an additional 160 new jobs to add to their existing 200 Galway-based team members.

THE OUTLOOK

Overall, while FDI investments were previously expected to drop off somewhat in 2017, and the effects of the Trump administration may prove deleterious to the Irish-American FDI relationship, Brexit will likely provide a temporary upswing, at least in this area of the economy.

Asia-Pacific and to a lesser extent Latin America remain interesting new growth areas. Overall, as the numbers employed by IDA-supported companies in 2016 (199,877) are neck-and-neck with the numbers employed by indigenous firms supported by Enterprise Ireland (201,108), FDI remains one of the cornerstones of our economy and a testament to the foresight of visionary thinkers like Professor Charles Carter, Eustace Shott and TK Whitaker.

Among the highlights of FDI in 2016 were new investments including:

Oracle expanding in Dublin with plans to recruit 450 new hires to drive its cloud business.

First Data to establish an R&D hub in Nenagh, Co. Tipperary, creating 300 new highly skilled jobs.

Credit Suisse opened a front office trading floor in Dublin that will house 100 new staff.

HubSpot in Dublin will hire an additional 320 staff.

Shire announced plans to expand its global biotech manufacturing capacity with an investment of US$400m, creating 400 new positions in Dunboyne, Co Meath.

Kellton Tech, a global IT company, established its EMEA headquarters in Drogheda, Co Louth, creating 100 jobs over five years.

Wayfair Inc, one of the world’s largest online destinations for home furnishings and décor, announced the expansion of its multi-lingual European Operations Centre in Galway, creating approximately 160 new jobs.

Amazon announced the creation of 500 new jobs in Dublin.

Surmodics in Galway announced an investment of e16.5m and the creation of 100 new jobs in Ballinasloe.

Fazzi Healthcare Services established a new Irish-based coding and healthcare services company in Limerick, creating 300 jobs over the next five years.

Cylance is expanding EMEA Operations, opening a Cork office and generating approximately 150 jobs over the next three years.