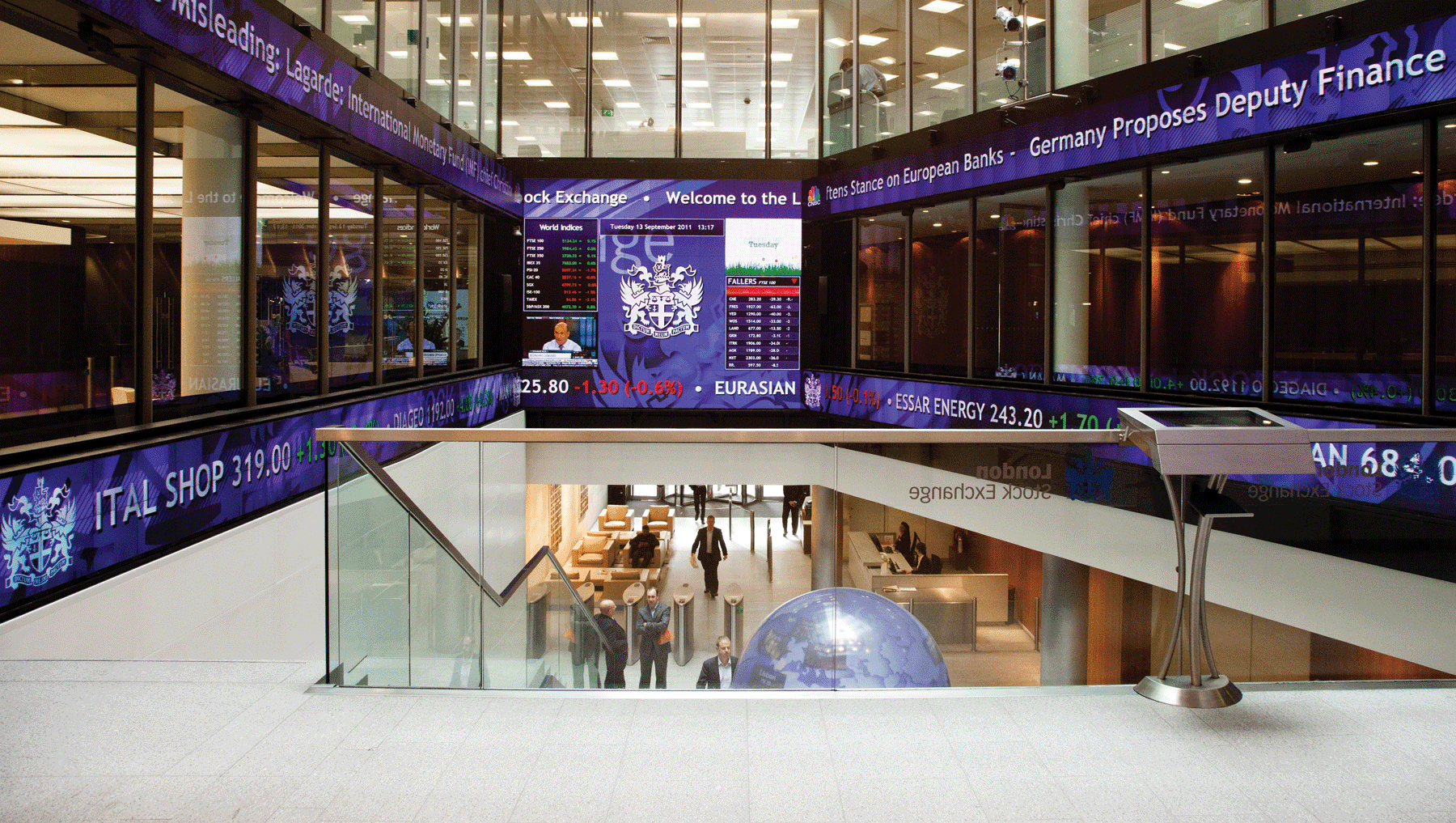

London offers companies access to an unparalleled pool of international capital, writes Alastair Walmsley from London Stock Exchange.

London has for hundreds of years been the world’s financial capital, welcoming businesses from all over the globe to its well-regulated and investor-friendly markets. Equity financing has been the cornerstone of this sophisticated financial ecosystem, the mechanism through which entrepreneurs have fuelled their aspirations, driven innovation and, in turn, created jobs.

In recent times, in Ireland and the UK, we have seen that this funding ladder has been undermined by an over-reliance on debt, a tool that is both heavily subsidised and more lightly regulated than equity. A balance between the two is key, particularly when promoting growth financing. Bank lending now supplies nearly 70% of all EU corporate funding, versus 18% in the US.

In forsaking equity for debt finance we are choking the growth of the job creators and innovators of tomorrow. In a world where banks have drastically cut back on financing activities, Irish companies have found it increasingly difficult to access the capital they need to grow.

At London Stock Exchange we believe that equity is the right tool to fund the growth of SMEs. Promoting equity as a growth-orientated funding tool from seed capital to business angel investment, to venture capital to public markets, would relieve the pressure on the banks and see a return to a sustainable funding environment.

We have seen a relative resurgence in IPOs during the first quarter of 2013 with £1.65bn being raised at admission compared to £411mn during the same period in 2012. There has been a notable increase in technology and life science issues in London showing that London’s markets are open for innovative businesses.

Source of capital

As well as the obvious primary fundraising function, the public markets also continue to be used as a critical, ongoing source of capital: investors who are convinced by a company’s performance and prospects are often willing to support it by buying into further share issues in the months and years after it has admitted. Despite the difficult economic environment, companies on AIM, our market for small and growing companies raised over £2.4bn in further fundraising last year alone.

We also believe there should be different markets to cater for the needs of companies with varying sizes and aspirations. We recently launched our new High Growth Segment to complement our existing markets and give companies an additional route to go public. The segment is a launch pad for fast growing companies that are larger than a typical AIM company, aspire to join the Premium segment of the Main Market, but may not meet all of the eligibility criteria at the time of admission. To be eligible for the High Growth Segment of the Main Market, companies need to show a 20% compound annual growth rate (CAGR) in revenues over a three year period, with a minimum free float of 10% worth £30mn or more.

London Stock Exchange remains the international destination of choice for Irish companies looking to raise capital through a public quotation. There are over 50 Irish companies on our markets today with a combined market capitalisation of over €50bn. A recent example is Escher Group, an Irish retail software solutions company that floated in August 2011. After raising £15mn at admission, they have had an impressive post-IPO performance with shares now trading over 60% higher than at IPO. To date, Irish companies have raised €6.70bn in capital at admission on our markets and followed this with further fundraising amounting to €8.43bn. This demonstrates the vital role the public markets play in supporting the growth strategies of firms throughout their life as public companies. There are a number of other benefits which complement the primary capital-raising function; improved public profile, the ability to attract new customers and increased credibility for winning contracts are just some of the positive side-effects companies have experienced following a London flotation.

A pool of resources

There is clearly investor interest in Irish issues on the London markets and the reasons for companies maintaining a London quote (or moving to London) are not just geographical. The proximity and ease of access obviously play a part: a one-hour flight from Dublin means that holding board meetings and AGMs is much easier and less costly than a public quotation any further away than the short hop over the Irish Sea.

More importantly, London has access to the deepest pool of international liquidity as well as being the most international exchange in terms of companies listed, ensuring Irish companies sit amongst their global peers. Similarities in regulatory requirements and listing processes between Ireland and London offer another distinct advantage, shown by the number of companies that opt for a dual listing.

One thing is certain: equity finance is proven and has long fuelled the growth of some of Ireland’s greatest companies. Against a backdrop of an over reliance on debt and reduced bank lending, London has maintained its position as the go-to place for Irish companies looking for a deep pool of international capital to fund their growth ambitions.