Marc Coleman is founder of Octavian Research, an economic research publication and public affairs consultancy. In this blog post, he discusses balancing economic recovery and social cohesion.

The escalation in Ireland’s public debt as a result of the COVID-19 crisis is significant. Where Germany has gone from 60 per cent of GDP to 77 per cent, Ireland has gone from a level of 100 per cent of Gross National Income (adjusted), or GNI*, to a level approaching 120 per cent. What counterbalances this somewhat is that, as reported in my first article on this crisis, household indebtedness going into the crisis was significantly lower than before the previous crisis.

For overall private sector indebtedness, however, once the debt of non-financial corporations is included, private sector indebtedness overall remained high in Ireland by EU standards going into the crisis, at 202% in 2019, as reported by the Central Statistics Office (CSO) this week. This compares with an EU average of 35%. The imbalance looks somewhat frightening. And it should be. However, it is not quite as bad as appears at first sight, and for two reasons.

Firstly, Ireland’s population is growing strongly as – at least before COVID-19 – was its economy. GDP, while not a measure of the domestic economy’s performance, does measure the degree of economic activity going on in the state, both domestic and international.

Building on the success of the IDA’s model of attracting FDI, Ireland has witnessed a structural shift upwards in its attractiveness as a location to invest.

The last five years has seen a staggering rise of almost 80 per cent in GDP in Ireland. Compared to 15 years ago, the population has increased by over 700,000 to reach 5 million. The projected population for 2040 is some 7 million, representing almost a doubling of the state’s population in 40 years.

The second reason relates to Ireland’s success in attracting Foreign Direct Investment. Building on the success of the IDA’s model of attracting FDI, Ireland has witnessed a structural shift upwards in its attractiveness as a location to invest as a result of a number of factors, most principally its emergence as a stable member of the EU with a common law system, a good professional services sector, low corporation taxes and, until now, a stable political system. The impact of this is shown in the staggering inflows into the Irish economy which, last year, saw investment of a staggering €161 billion. To put this in perspective, this represents more than 5 per cent of all investment last year in the EU. That is five time’s Ireland’s share of the EU population.

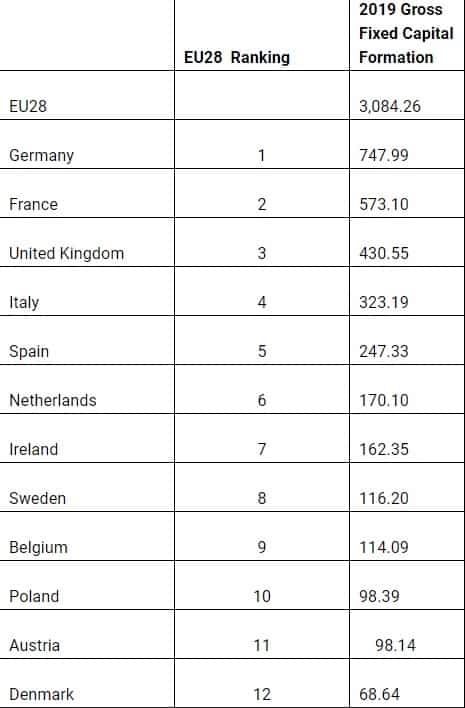

As the figure below shows, Ireland ranked 7th overall amongst the EU28 and total investment in Ireland was on a par with the Netherlands, a country whose population is some three times larger than the Republic. Ireland’s investment level also exceeded that of several larger countries (and some larger economies) including Sweden, Belgium, Poland, Austria and Denmark.

Capital Investment 2019: (€ billions). Source: Eurostat.

This helps to explain Ireland’s higher private sector indebtedness (to invest, one must borrow). It also represents both a threat and an opportunity.

It is a threat because – unless sectorally and regionally balanced – this investment could exacerbate the economic divisions of the COVID-19 crisis. Already before the COVID crisis the influx of FDI and professional services activity in the capital was imbalancing labour markets, exacerbating shortages of accommodation, and leading to some “crowding out” of the small business sector in terms of accessing office space, staff and professional services. In the post COVID economy, many of the sectors benefitting from the influx have kept going or have been marginally or even positively affected by the crisis (Biopharma, Information Technology, Financial Services). By contrast the already suffering domestic economy has been floored.

The multinational sector needs to partner with indigenous SME side of the Irish economy.

The investment levels are also an opportunity, however, because if it can be harnessed correctly, it could be a powerful tool for recovery. To achieve this, the multinational sector needs to partner with indigenous SME side of the Irish economy as recommended in “An Economic Response to COVID-19”, my strategy for economic recovery published last April. That strategy called for a short term July stimulus of business supports for small business which has since occurred. It also called for long range thinking on investment.

The public capital programme for next year as contained in Budget 2021 is €10.1 billion. While more significant than last year and a welcome step up, it is a very small percentage of the massive flows of investment going into the private sector.

When it comes to private investment, Ireland is the mouse that roars. When it comes to public investment, however, it still squeaks. Curing that imbalance will be instrumental to ensuring the nation’s balanced economic recovery and social cohesion.

Marc Coleman is founder of Octavian Research, an economic research publication and public affairs consultancy that wrote the world’s first researched strategy response to the Covid crisis (download

Marc Coleman is founder of Octavian Research, an economic research publication and public affairs consultancy that wrote the world’s first researched strategy response to the Covid crisis (download