Markets finished the week relatively flat, bolstered by technology sector stocks, with the consumer staples and healthcare sectors lagging, writes Ian Slattery.

Ian Slattery

With almost a quarter of S&P 500 companies having reported earnings so far, profits are up 13% and earnings estimates are still forecast to grow 6% in 2019. Since 1955, in years when corporate earnings grew by at least that amount, the stock market rose 83% of the time.

On the economic front, the data remains mixed. Initial jobless claims in the US fell below 200,000, the lowest since 1969. The unemployment rate remains near a 50-year low and the labour market remains solid. However, the IMF did cut their 2019 global growth projections from 3.7% to 3.5%. In China, growth fell to 6.6%, the lowest rate since 1990. Meanwhile, in Europe, the German IHS Markit manufacturing purchasing managers index fell into contraction, dropping to 49.9 in January.

Equities

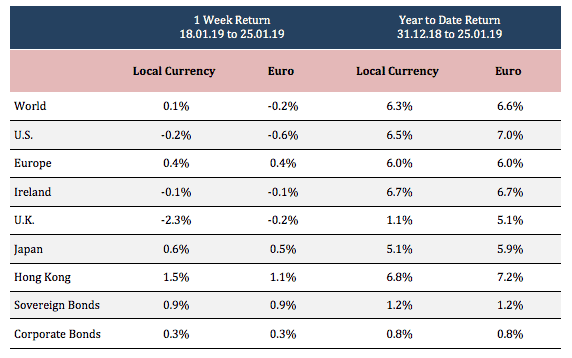

The MSCI World Index advanced 0.1%, with Asia leading the move higher. Hong Kong was up +1.5% and Japan 0.6% higher.

Up to 25% of companies from the S&P 500 will report quarterly earnings during the week ahead.

Fixed Incom/e & FX

The US10-year yield nudged lower to 2.76% with the German yield falling to 0.19% on regional growth concerns.

The EUR/USD strengthened to 1.141 but the EUR/GBP declined to 0.864 despite Brexit deal uncertainty.

Commodities

The rebound in oil stalled as analysts forecast that production in the US is set to rise further. Oil finished the week at $53.69 and the softer US dollar supported the rise in Gold to $1,303 per troy ounce and Copper to $6,030.

THE WEEK AHEAD

Wednesday 30th January:

- Euro Economic Sentiment

- US GDP & FOMC Meeting

Thursday 31st January:

- Eurozone GDP Flash

- US Jobless Claims

Friday 1st February

- UK PMI Manufacturing

- US ISM Manufacturing

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €21.9bn in investments of which pension assets amount to €10.2bn. Find out more about Zurich Life’s funds and investments here.

w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc