Sluggish domestic economy was already a problem before Covid-19, writes Marc Coleman, Founder of Octavian Research Advisory and Public Affairs consultancy

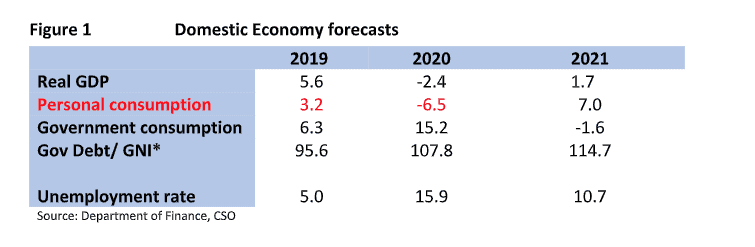

As Figure 1 shows, even before Covid-19 struck, personal consumption and domestic demand were sluggish last year running at around half the rate of growth in Government consumption and real GDP.

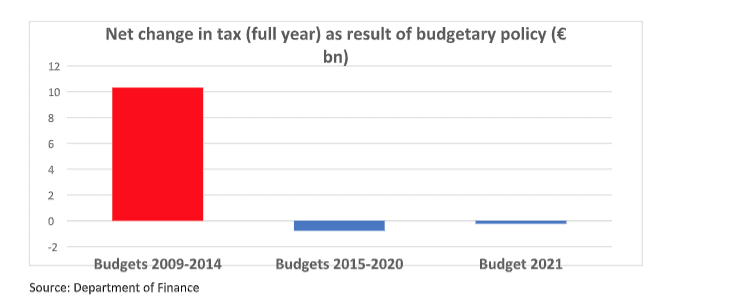

As Chart 1 shows, a key reason is likely to be the fact that austerity tax increases accumulated over the six budgets during the last recession (2009 to 2014) amassed over €10 billion worth of full year tax increases. However, despite rapid growth and recovery in subsequent years, these austerity tax increases were not reversed. The accumulated net tax reductions in the budgets between 2015 and 2020 were less than €1 billion and the net impact of tax reductions in Budget 2021 is approximately one quarter of a billion.

Chart 1 Legacy issues: Tax rises 2009-2014 & subsequent tax reductions

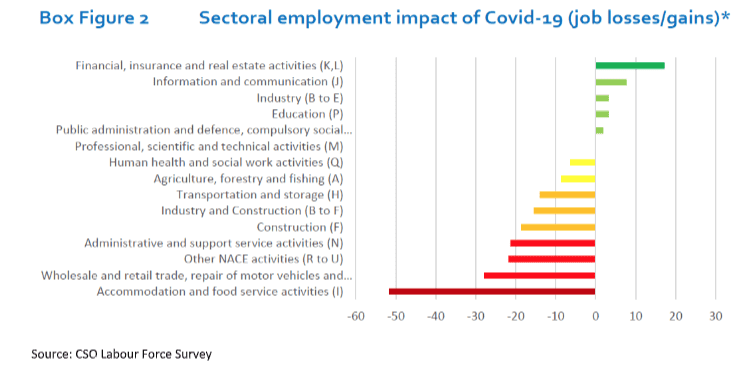

As Box Figure 2 above shows, the sectors most impacted by COVID-19 in employment terms – accommodation and food services, wholesale and retail and “other activities” – are those most sensitive to disposal income and domestic demand. By contrast the sectors among those most secure and less vulnerable are those driven by public expenditure. In terms of the overall thrust of budgetary policy therefore it is noteworthy that the strong emphasis on preserving employment and keeping businesses open on the “supply side” does not seem to have any corresponding initiative to stimulate demand in a domestic economy that was already underperforming (compared to GDP growth of over 60 per cent between 2015 and 2019 inclusive, the more domestic indicator of GNI* grew by just over 20 per cent).

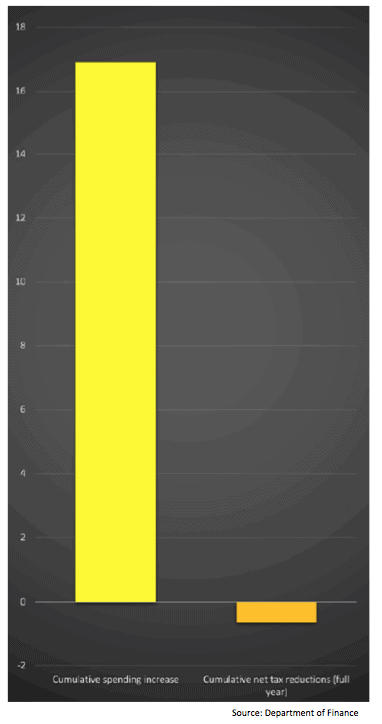

Chart 2 Public spending increases 2015-2020 and net tax reductions compared

The contrast between increases in public spending since the end of the recession – some €16 billion in total – and net tax increases of €0.7 billion suggests an already strong emphasis on public expenditure rather than reversing crisis related tax increases.

By contrast spending “austerity” (total public spending actually grew between 2008 and 2014 by 6 per cent) was more than reversed during this period.

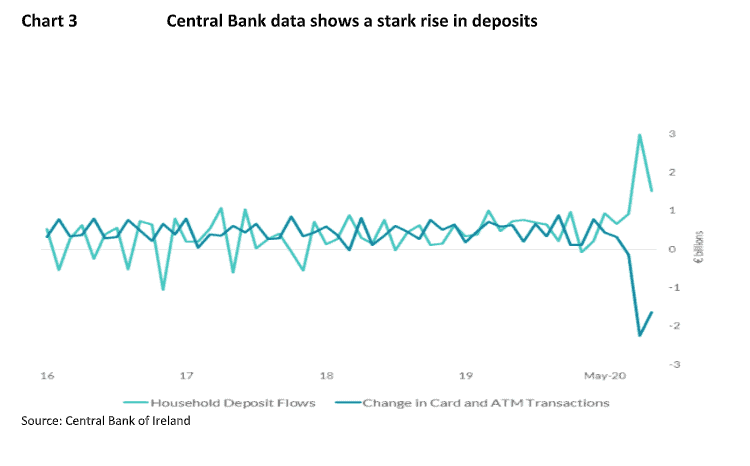

The relevance of this analysis shown below by very stark figures from the Central Bank of Ireland in Chart 3 below: The very dramatic rise in bank deposits and sharp contraction in bank and ATM withdrawals points to a sharp contraction in consumer confidence suggesting that demand side pressures are as strong an issue for recovery as are business supports and employment.

External outlook looks positive, Brexit aside

While not fully reversing the extent of declines in 2020, the outlook for growth in most economies is relatively robust according to the World Economic Outlook. The Budget is framed against the expectation of a “No Deal” Brexit implying the exposure of Irish exports to the UK to full WTO “Most Favoured Nation” tariffs. The latest forecasts from the IMF imply that, subject to correct design implementation, sectoral initiatives expected in the National Economic Plan can target export growth in offsetting markets which are large enough and which have sufficient growth momentum to offset the export impact of Brexit.

Some issues

The state’s ability to borrow in the near future helps it to avoid austerity measures that characterised the last recession. Ireland still retains the tax rises from that recession, however, and massive state spending increases in providing business supports will eventually face the need for corresponding confidence measures to boost demand.

The debt impact of the budget brings Government debt as a share of GNI* significantly above 100 per cent. As NTMA CEO Conor O’Kelly has pointed out, the state will face no evident limitations in the foreseeable future. But he has also pointed out that this will not last forever. Changing political conditions – the ability of governments to repay existing debt, for instance – could alter borrowing conditions even for sovereign borrowers in the years ahead and even if markets are not currently doing so, Government would be wise to set its own limit for how high it wants national debt to go. Finally to the extent that it is borrowing, a priority on Green energy and sustainable public investment have the added advantages in that they create assets that future generations – who will pay back the debt – benefit from (thus creating intergenerational justice) but that they also contribute to mitigating climate change for future generations as well. In that regard the sustainability theme of the budget is well timed.