The markets were mixed this week but Brexit fears and Italy’s budget standoff with the European Commission (EC) did have a negative impact on European markets, writes Ian Slattery.

Ian Slattery

Trade concerns weighed on US markets but equities held above their October lows and regained some lost ground with materials, real estate and industrial shares outperforming. Technology and internet shares declined, led by Amazon.

Brexit fears and Italy’s budget standoff with the European Commission (EC) dragged European markets lower. Banks were amongst the worst performers, while the British pound came under pressure against both the US dollar and euro.

Apple’s shares came under increased scrutiny as worries escalated that iPhone sales would disappoint. Two key Apple suppliers (Japan Display & Lumentum Holdings) both lowered their earnings guidance for the year.

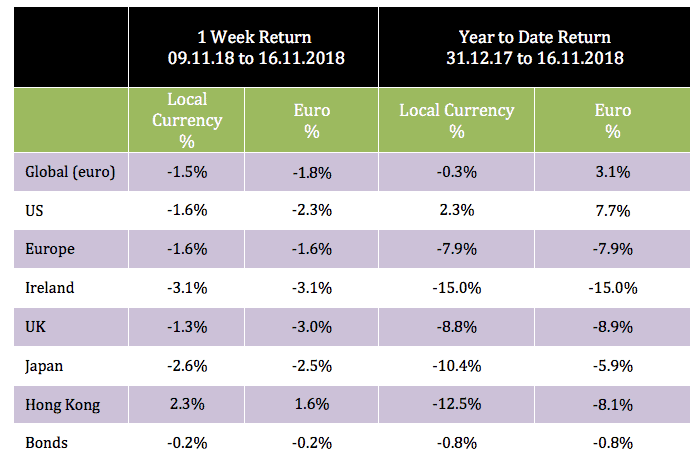

The global index declined 1.8% in euro terms last week, led lower by higher valuation growth stocks.

Oil declined once again, closing just over $56 /barrel due to continued strong supply. Gold ended marginally higher at $1,222 per troy ounce, while Copper also finished the week higher at $6,224 per metric tonne.

The 10 year US bond yield fell to 3.06%, while the German equivalent declined to 0.37% as investors sought out safe haven assets on the back of equity and crude oil weakness. The EUR/USD rate finished the week at 1.142.

THE WEEK AHEAD

Tuesday 20th November:

US Housing Starts are expected to pick up (+1.6%) after falling 5.3% last month. Building Permits declined 0.6% last month and another decline (-1.6%) is forecast this month.

Wednesday 21th November:

US Durable Goods Orders are expected to decline (-2.4%) m-m, with little change forecast in Jobless Claims (213k). The consensus range for New Home Sales is 5.1-5.3 million.

Friday 23rd November:

The Eurozone Composite Flash PMI is expected to remain above 50, signaling rising output versus the previous month. The prior reading for the composite PMI was 52.7.

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €23.5bn in investments of which pension assets amount to €10.8bn. Find out more about Zurich Life’s funds and investments here.

w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc