Tensions between the US administration and North Korea might have dominated the headlines last week but the real focus will be on the US to see if there is an interest rate rise this year. Ian Slattery reports.

Ian Slattery, Zurich

Rising tensions between the US administration and North Korea led to a modest correction in risk assets last week, as the VIX volatility index spiked nearly 50% (albeit from a subdued level). The relationship deteriorated as Pyongyang stated that its missiles have the capability to reach the US territory of Guam. Whilst relations remain taut, the intervention of China coupled with the release by North Korea of a Canadian pastor over the weekend has helped to ease the tensions.

The US dollar also fell against a basket of major currencies on the back of the North Korea concerns and also reduced inflation expectations

In economic news, US consumer prices and retail sales data disappointed on Friday, and this has once again focussed attention on the likelihood of a further interest rate rise this year from the Federal Reserve. The US dollar also fell against a basket of major currencies on the back of the North Korea concerns and also reduced inflation expectations.

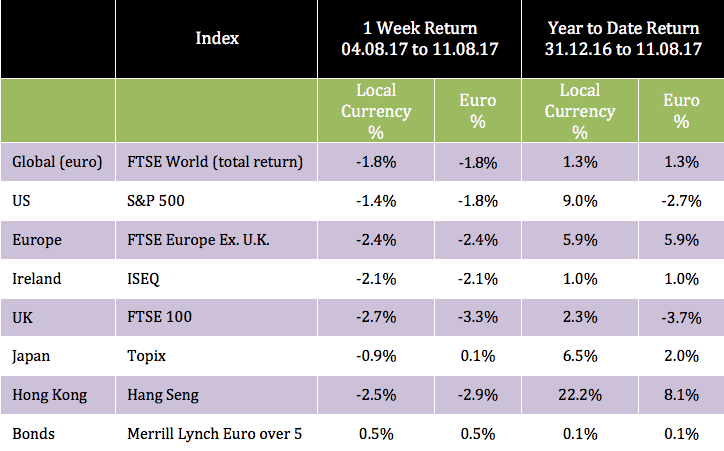

The global index fell by 1.8% last week, led by the UK which was down 3.3% in euro terms. Bonds had a positive week with the Merril Lynch over 5 year index returning 0.5%, on the back of heightened geopolitical concerns.

Gold also had a positive week, as its role as a safe haven asset led to a rise of 2.4%. Oil once again failed to hold above the $50 mark, and finished the week at $48.8, down 1.5%.

US 10-year Treasuries prices moved higher, with the yield (which moves inversely to price) moving to 2.19%, from 2.24% a week previously, based on the aforementioned political risk. The EUR/USD rate closed at $1.18, whilst EUR/GBP was at £0.91.

THE WEEK AHEAD

Tuesday 15th August

In the UK headline CPI inflation figures go to print, where the consensus expects a slight tick up to 2.7% year-on-year (last 2.6%).

Wednesday 16th August

The final estimate of Q217 euro area GDP growth is expected to be confirmed at 0.6% (quarter-on-quarter).

Wednesday 16th August

The minutes of the July FOMC are released where the market will look for further information regarding the balance sheet normalisation process, and the potential timing of the next interest rate rise.

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €21.5bn in investment assets and have a reputation for delivering consistent performance. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc