It was double digit growth for corporate earnings, but it wasn’t all good news as industrial production and retail sales in the US fell, writes Ian Slattery.

Ian Slattery

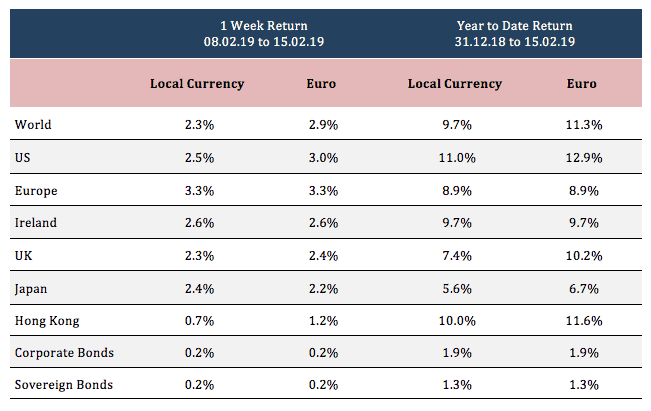

Markets continued their strong start to the year with global equities advancing 2.3% (2.9% in euro terms) last week. The move came on the back of increased optimism that a trade deal will be reached between the US and China. With the Federal Reserve commentary also having turned dovish since the latter part of 2018, fears have dissipated that interest rates will be raised aggressively this year. In fact, some analysts are forecasting no further rate hikes in 2019.

Meanwhile, Q4 corporate earnings are on track to have grown 13% from a year ago, which would mark the fifth straight quarter of double digit earnings growth. It wasn’t all good news last week, however. Industrial production fell 0.6% in the estimate for January, while retail sales in the US slumped 1.2% in December. Considering that retail sales account for about a quarter of consumer spending and consumer spending accounts for 68% of Gross Domestic Product, this is a figure that needs to be monitored closely. Finally, growth in Europe continues to wane, with Germany just avoiding slipping into recession in the final quarter of the year.

Equities

The MSCI World Index advanced 2.3% in local currency terms. Europe and the US posted the strongest gains. Stocks in the energy and industrial sectors led gains in the US, with utilities and financials lagging.

Fixed Income & FX

Inflation continues to show limited upward pressure. The US 10-year yield is at 2.66% while the German yield ticked up to 0.10%. The Euro weakened against the US dollar to 1.127 but remained at 0.876 against the British pound.

Commodities

OPEC and Russia confirmed cutbacks in production, sending oil prices 5% higher for the week to $55.59. Gold and Copper prices finished the week at $1,322 per troy ounce and $6,193 respectively.

THE WEEK AHEAD

Tuesday 19th February:

- UK Labour Market Report

- Japan Merchandise Trade

Wednesday 20th February:

- US Federal Reserve Minutes

- Euro Consumer Confidence

Thursday 21st February:

- US Retail Sales & Jobless Claims

- ECB Minutes & French CPI

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €21.9bn in investments of which pension assets amount to €10.2bn. Find out more about Zurich Life’s funds and investments here.

w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc