Equities were positive, as trade tensions dissipate and the global index was up 0.9% last week in euro terms, writes Ian

Ian Slattery

Slattery.

Global markets were higher last week, as tariffs announced by the US and China were lower than feared. In a reversal of recent trends, Asian stocks led the global market higher, whilst the US, although still positive, lagged the global average.

China’s response to US tariffs was perceived as being measured, with investors choosing to focus on the continued strength of the global economy. The leading economic index in the US climbed once again in August, and whilst PMIs in Europe were not stellar, they were above the 50 mark, which signifies continuing expansion.

Brexit negotiations faltered in Salzburg, as the EU broadly rejected the UK’s Chequers proposal, with the Northern Ireland border remaining a key stumbling block to progress.

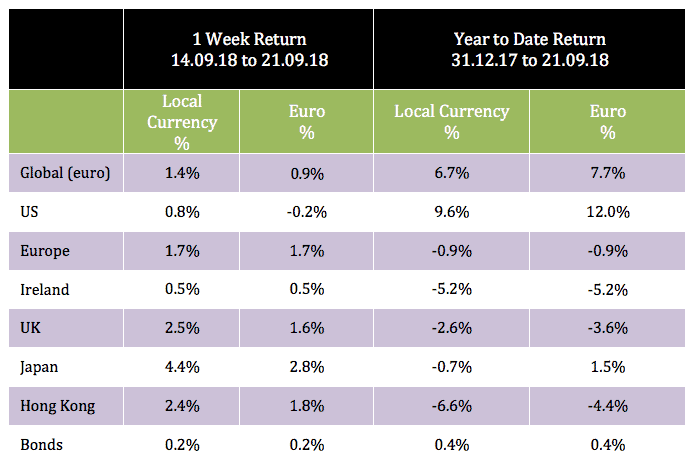

The global index was up 0.9% last week in euro terms, as Asian markets led the index higher. A weaker dollar, reduced returns overall for a euro investor.

Oil was up over the course of the week, and closed at over $70/barrel. Gold lost some ground as a ‘risk on’ attitude was evident in markets and closed at $1,199 per troy ounce.

The 10 year US bond yield finished at 3.06%, having reached a level seen only three times since 2011. The German equivalent also closed higher at 0.46%.

The EUR/USD rate finished the week at 1.175 with the EUR/GBP rate at 0.90.

THE WEEK AHEAD

Wednesday 26th September

The Federal Reserve meets for the latest US interest rate decision, where the market fully expects an increase to the 2%-2.25% range.

Thursday 26th September

The final reading for Q2 US GDP goes to print where the consensus forecasts the growth figure to come in at 4.3% (QoQ).

Friday 27th September

Eurozone CPI data for September is released, with the core figure expected to come in at 1.2% (YoY) from 1.0%.

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €22.9bn in investments of which pension assets amount to €10.4bn. Find out more about Zurich Life’s funds and investments here.

w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc