The US market performed the strongest they have in the last two months and eurozone stocks had a seventh consecutive week of gains. Ian Slattery reports.

Ian Slattery

Stocks closed the week higher as strong earnings continued to lift risk assets. Eight out of the 11 US stock sectors showed upside earnings revisions in May, with the percentage rising to 66.6%. The market continues to be led by pro-cyclical stocks, with tech, energy, and consumer discretionary outpacing the broader market so far in 2018.

The US market saw its best week in two months, whilst eurozone stocks had a seventh consecutive week of gains above 0.5%. Stocks were helped further by softer-than-expected CPI inflation data, which helps assuage concerns regarding a tightening interest rate environment.

Key geopolitical development of the week was the US withdrawal from the Iran nuclear deal

The key geopolitical development of the week was the US withdrawal from the Iran nuclear deal. Market reaction was somewhat muted as the decision has been expected from all quarters. Oil moved higher as a result with tensions in the Middle East liable to be heightened by the opening of the US Embassy in Jerusalem this week.

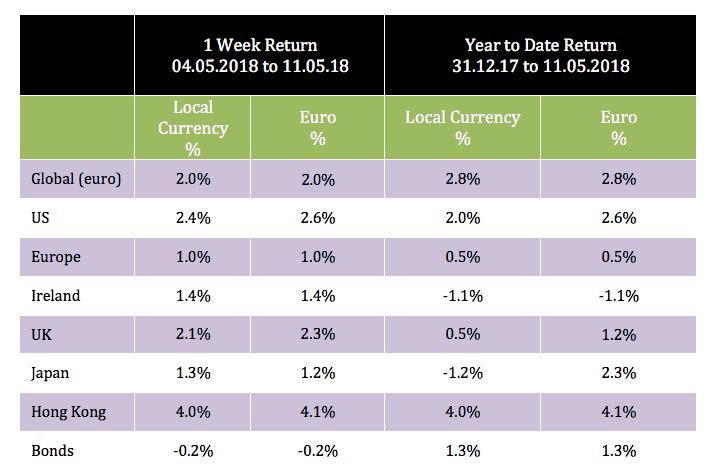

The global index was up 2% last week, extending its gains this year and led by a strong performance in the US. Commodities were broadly positive with gold, oil, and copper all seeing gains.

The 10 year US bond yield finished the week at 2.97%, off its weekly highs on the back of the aforementioned weaker inflation data. The German equivalent was at 0.56%, from 0.54%. The EUR/USD rate finished at 1.19, whilst EUR/GBP was at 0.88.

THE WEEK AHEAD

Tuesday 15 May

The 2nd estimate for eurozone Q1 GDP goes to print, with quarter-on-quarter growth expected to be 0.4%.

The closely watched UK unemployment rate is forecast to remain steady at 4.2%, when the latest UK Labour Market Report is released.

US retail sales growth is forecast to dip slightly to 0.4% from 0.6%, as the April report is published.

The team at Zurich Investments is a long-established and highly-experienced team of investment managers who manage approximately €22.4bn in investment of which pension assets amount to €10.1bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc