Global markets move higher helped by a weaker euro currency and positive corporate earnings buoyed developed markets, writes Ian Slattery.

Ian Slattery

Q1 GDP growth for China came in at 6.4%, slightly ahead of expectations, while positive corporate earnings supported more developed markets.

Healthcare stocks lagged the market as the sector was brought into focus by a number of democratic presidential hopefuls, who are once again eyeing reform within the health insurance sector.

The Federal Reserve’s ‘Beige Book’, which tracks economic activity, suggested that inflation expectations may remain muted, which could see the Fed show patience in relation to any interest rate changes. However, President Trump’s announcement ending sanction waivers in relation to Iran oil exports, could put upward pressure on energy prices.

With the stabilisation of GDP growth in China, authorities are likely to look once again move forward with moulding a more sustainable economic growth model

Equities

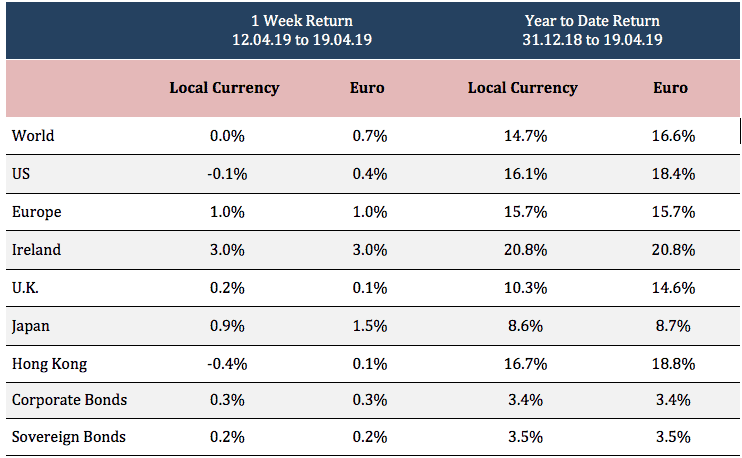

The MSCI World Index was flat in local currency terms, but Irish investors were helped by a weakening euro currency.

Geographical performance was mixed last week, with the influential US market down slightly but with the majority of other major markets in positive territory.

Fixed Income & FX

The US 10-year yield was broadly flat moving to 2.56% from 2.57% whilst the German equivalent ticked down to 0.03% from 0.06%.

The Euro US Dollar exchange rate closed the week at 1.125, whilst Euro/GBP was at 0.865.

Commodities

Oil finished the week up slightly, and closed at just short of $64 per barrel, but is likely to see an impact from President Trump’s Iran announcement.

Gold and copper prices finished the week at $1,275 per troy ounce and $6,460 respectively.

THE WEEK AHEAD

Tuesday 23rd April

Eurozone consumer confidence and US new home sales figures are both released.

Wednesday 24th April

Earnings season continues, with Microsoft and Facebook amongst firms reporting.

Friday 26th April

US GDP growth for Q119 goes to print.

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €24bn in investments of which pension assets amount to €10.7bn. Find out more about Zurich Life’s funds and investments here.

w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc