Eurozone, manufacturing and services PMIs had their best showing since April 2011 and the European Commission’s economic sentiment gauge hit a 17-year high, writes Ian Slattery.

Ian Slattery

Global markets rose last week fuelled by political developments on both sides of the Atlantic. Most significantly, optimism grew in relation to the US tax reform bill whilst coalition talks in Germany alongside the ongoing Brexit negotiations were seen as positives by the market.

However, stocks did pull back on Friday on the news that former National Security Adviser Mike Flynn had pleaded guilty to lying to the FBI and was prepared to cooperate in the ongoing investigation into Russia’s alleged interference in the 2016 presidential election.

Global markets rose last week fuelled by political developments on both sides of the Atlantic.

Data releases were also positive, with Q3 GDP growth in the US being revised upwards to 3.3%. In the eurozone, manufacturing and services PMIs had their best showing since April 2011 and the European Commission’s economic sentiment gauge hit a 17 year high.

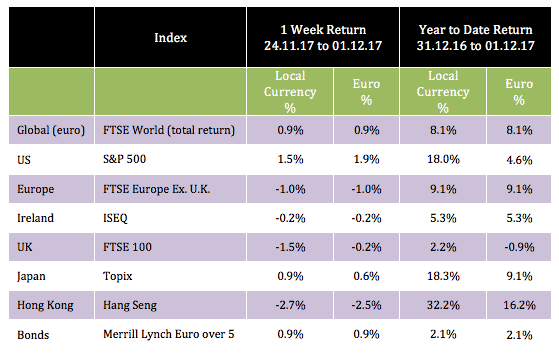

The global index in euro terms returned 0.9% last week, led by US stocks. Hong Kong was the worst performer in local terms, down 2.7%, although it remains up over 30% year to-date. Oil fell 1.0% over the course of the week, closing at $58.40/barrel.

The ten-year US bond yield closed the week at 2.36%, not much changed from 2.34% a week ago. The ten-year German equivalent closed at 0.30%. The EUR/USD rate finished the period at 1.19, whilst EUR/GBP was at 0.88.

THE WEEK AHEAD

Tuesday 5 December

US non-manufacturing PMI data is released where the consensus forecast a slight fall to 59.0, from the last reading of 60.1.

Thursday 7 December

The third estimate of eurozone GDP growth for Q3 is expected to be confirmed at 0.6% (quarter-on-quarter).

Friday 8 December

US non-farm payroll data goes to print where the consensus is for a figure of approximately 210,000 jobs created in the US economy.

The team at Zurich Investments is a long-established and highly-experienced team of investment managers who manage approximately €21.9bn in investment of which pension assets amount to €9.9bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc