Equity markets move higher once again, the new Federal Reserve Chairman has been announced and oil continues to rise, writes Ian Slattery.

Ian Slattery

Equity markets moved higher once more last week, with earnings and economics, the Fed Chair announcement, and talk of tax cuts in the US leading the agenda. The US economy added 261,000 jobs in October, which was below forecasts that had the number at over 300,000. However, any negativity was offset by a revision upwards of the previous two months figures by 90,000.

In the US the Republican Party released further details of their tax plans, which are centred on a call for a large corporate tax rate cut. However, this may need to be offset by changes on the individual side which are likely to be met by opposition on both sides of the aisle. The naming of Jerome Powell as Janet Yellen’s replacement at the Federal Reserve did little to move markets, with most participants seeing it as a continuation of the current policy strategy.

The naming of Jerome Powell as Janet Yellen’s replacement at the Federal Reserve did little to move markets, with most participants seeing it as a continuation of the current policy strategy.

On the earnings front, nearly 80% of companies on the S&P 500 have reported since the end of Quarter 3, with a broadly positive trend materialising led by the tech, healthcare and materials sections.

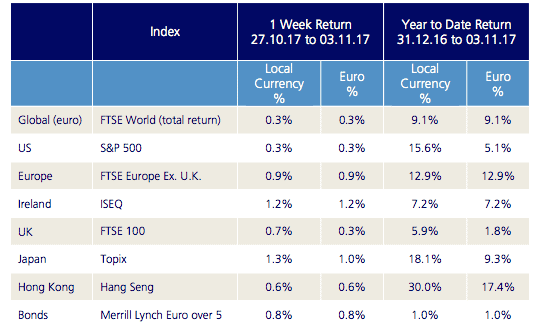

The global index in euro terms was up 0.3% last week, led by Japan and Europe. Oil rose by over 3% and is now above $55/barrel.

The ten-year US bond yield closed the week at 2.33% with the German equivalent closing at 0.36%.

The EUR/USD rate closed at 1.16, from a rate of 1.05 at the start of the year.

THE WEEK AHEAD

Tuesday 7th November

The Royal Bank of Australia makes its latest interest rate decision overnight, where no change is expected in the current rate or policy.

Tuesday 7th November

Eurozone retail sales for September go to print, with the consensus expecting a year-on-year growth figure of 1.9%.

Thursday 9th November

Chinese inflation data for October is released and is forecast to edge up to 1.8% (year-on-year) from 1.6%.

The team at Zurich Investments is a long-established and highly-experienced team of investment managers who manage approximately €21.9bn in investment of which pension assets amount to €9.9bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc