In his latest market round-up, Ian Slattery looks at how equities preformed and highlights events this week that could impact share price.

Ian Slattery

The Federal Reserve and trade policy were the main focus for markets last week as President Trump confirmed reports that he will impose a 25% tariff on imported steel and a 10% tariff on aluminium. The announcement was at odds with some of his own economic advisors and led to sharp rebukes from some of the US’ main trading partners, including Canada and the EU.

Fed Chair Powell also gave his first public speech last week where he reiterated the view that the economy is strengthening and that inflation will begin to move towards its 2% target. Fed minutes from the January meeting also contained an upward revision to growth expectations.

The ‘hawkish’ Fed combined with geopolitical concerns in the US and Italy led stocks lower for the week

The ‘hawkish’ Fed combined with geopolitical concerns in the US and Italy led stocks lower for the week, closing out the worst month for equities in two years.

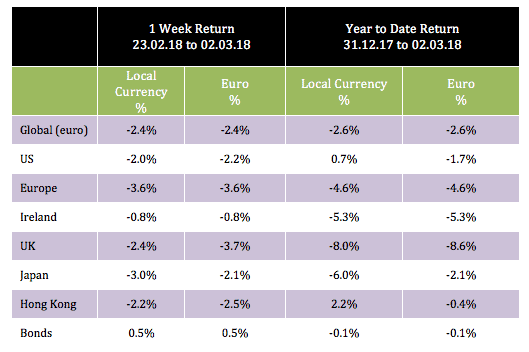

The global index fell by 2.4% last week, with eurozone equities returning -3.6%.

Oil moved lower last week, and closed back at roughly $61/barrel, as protectionist trade policy concerns weighed on commodities. Copper fell over 3%, whilst gold lost 0.5% but remains up 1.5% in 2018 in dollar terms.

The ten-year US bond yield finished the week at 2.86%, down slightly from 2.87% (yields move inversely to price) from a week ago. The German equivalent was unchanged at 0.65%. The EUR/USD rate closed the period at 1.23 and EUR/GBP was at 0.89.

THE WEEK AHEAD

Thursday 8 March

No change is expected when the ECB meets, although the subsequent press conference will shed further light on the council’s deliberations.

Friday 9 March

The Bank of Japan will conduct its March meeting. No change in policy is expected although there have been hints at upcoming changes.

Non-farm payroll data in the US goes to print where the consensus expects 195,000 jobs to be created. Wage growth is also expected to tick up slightly, following last month’s upside surprise.

The team at Zurich Investments is a long-established and highly-experienced team of investment managers who manage approximately €22.4bn in investment of which pension assets amount to €10.1bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc