US markets stayed close to all-time highs as they continued to digest the potential policies that the new Trump administration may employ, writes Ian Slattery.

Despite a global financial and political environment undergoing a time of transition, equities continue to move higher. In the US, markets stayed close to all-time highs as they continued to digest the potential policies that the new Trump administration may employ.

Ian Slattery

The other big theme of the week was the strength of the US dollar, which climbed to a 13-year high on continued expectations of increased US government spending and an interest rate hike next month.

The Japanese equity market rose strongly during the week as the weaker yen was seen as a positive for export sensitive stocks. The Nikkei 225 is now 20% above its recent low, which some analysts would consider the start of a technical ‘bull market’. US Treasuries continued their sell off this week, with the difference (or spread) between US and German 10-year benchmark yields hitting its widest in 27 years, further highlighting the divergent monetary policy between the world’s two biggest trading blocs.

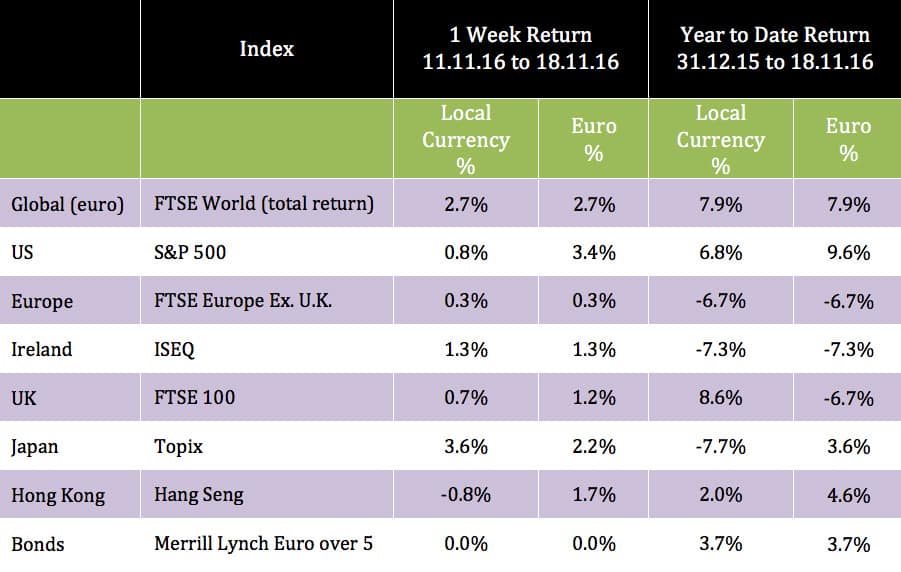

The global index rose 2.7% last week, as the strong returns seen since the US election continued. Gold slipped further last week and returned -1.6% as it was hit by dollar strength and rate expectations.

The global index rose 2.7% last week, as the strong returns seen since the US election continued. Gold slipped further last week and returned -1.6% as it was hit by dollar strength and rate expectations.

Copper fell back 1.7% last week, but this must be viewed in the context of the near 11% rise the week before. Oil was up over 5% and closed at just short of $46/barrel.

In the US, markets stayed close to all-time highs as they continued to digest the potential policies that the new Trump administration

The 10-year US treasury yield closed at 2.35%, up another 20 basis points over the course of the week, whilst the 10-year German equivalent fell back last week to 0.27% from 0.31%, contributing to the record spread between the two.

The euro weakened against the dollar with the EUR/USD rate moving from 1.09 to 1.06, as the dollar extended it record winning streak versus the eurozone currency.

THE WEEK AHEAD

Wednesday November 23rd

UK Chancellor Philip Hammond will deliver his first Autumn Statement where he is expected to give an indication of financial policy for the next few months.

Wednesday November 23rd

The minutes of the Federal Reserve’s November interest rate meeting are released. They will be closely examined as per usual, but the market now fully expects a rate rise at the December meeting.

Friday November 25th

The second estimate of UK GDP for Q3 is released where the consensus is for an increase of 0.5% for the quarter, with the year-on-year figure coming in at 2.3%.

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €20bn in investment of which pension assets amount to €9.5bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds, Twitter: @ZurichLife, LinkedIn: linkedin.com/company/zurich-life-assurance-plc