The S&P 500 Index moved towards another record and the Small Business Optimism Index hit a 34-year high but European stocks were more muted, writes Ian Slattery.

Ian Slattery

Equities moved higher last week, albeit on lighter pre-Christmas trading volumes, as the US raised interest rates by 0.25% to a range of 1.25%-1.5%. US government debt was little changed as the market had already priced in the third rate hike of 2017, and the fifth in the current cycle.

The influential S&P 500 Index moved towards another record high, with the proposed sale of 21st Century Fox to Disney for over $50 billion grabbing the headlines. US data was also positive with higher than expected retail sales whilst the Small Business Optimism Index hit a 34-year high.

The proposed sale of 21st Century Fox to Disney for over $50 billion grabbed the headlines

European stocks were more muted, even as the European Central Bank (ECB) struck a more ‘dovish’ tone at their latest meeting. Ryanair weighed on Irish stocks as the impact of union recognition on the company’s operating model remains to be seen.

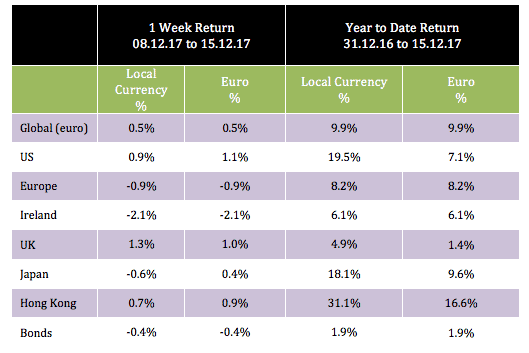

The global index in euro terms returned 0.5% last week, led by the US and UK. Oil fell for a third week in a row, falling by just 0.1%, as the price pauses for breath following a large upward movement since the summer. Copper regained some positive momentum, returning 5.2%, and is now up 24.5% during 2017.

The ten-year US bond yield fell slightly to 2.35%, as markets were little changed following the expected interest rate rise. The ten-year German equivalent closed at 0.30%, with no change from a week previously. The EUR/USD rate finished the period at 1.17, whilst EUR/GBP was at 0.88.

THE WEEK AHEAD

Thursday 21 December

The regional Catalonian elections take place where markets will closely watch for any indications of heightened political tensions. And US Q3 GDP is expected to be confirmed at 3.3% (year-on-year).

Friday 22 December

Final UK Q3 GDP also goes to print where the median forecast is for an unrevised figure of 0.4% (quarter-on-quarter).

The team at Zurich Investments is a long-established and highly-experienced team of investment managers who manage approximately €21.9bn in investment of which pension assets amount to €9.9bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc