Equities see negative week as volatility returns to markets, writes Ian Slattery, as he highlights events across the investment landscape.

Ian Slattery

Equities endured a torrid time last week as markets fell on concerns over the threat posed by higher bond yields. Strong economic data, starting with the US jobs report on 2 February, and ‘hawkish’ comments from major central banks accentuated the view that market participants may have underestimated the path of future rate rises on both sides of the Atlantic. Volatility, as measured by the VIX Index, awoke from its slumber and rose to a level above 49 on Tuesday, after starting the week at 18.

Q417 earnings in the US continued to come in with broadly positive results materialising. According to Bloomberg, nearly three quarters of companies on the S&P 500 have reported and over 80% have delivered better-than-expected profits.

Volatility, as measured by the VIX Index, awoke from its slumber and rose to a level above 49 on Tuesday

On the political front, Congress in the US passed a budget agreement for the next two years, which suspends the debt ceiling and avoided another government shutdown.

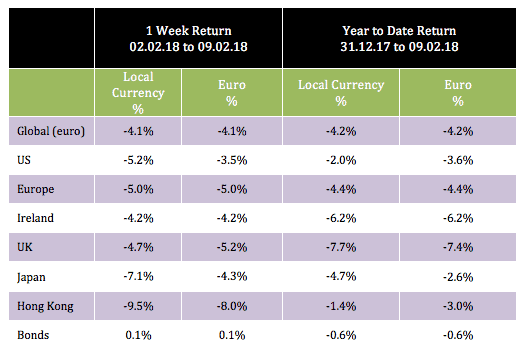

The global index fell by just over 4% last week, and is now also down over 4% year-to-date. Hong Kong was worst hit, down almost 10% in local terms.

Oil moved lower last week and closed at below $60/barrel for the first time this year. Copper and gold also fell by -4.8% and -1.3%, respectively.

The ten-year US bond yield finished the week at 2.85% with the 3% point being a key level to watch for in the coming weeks. The EUR/USD rate closed the period at 1.23.

THE WEEK AHEAD

Tuesday 13 February

In the UK the consensus expects headline inflation to come in at 2.9%, slightly down on the last reading of 3%. The core figure is expected to rise to 2.6% from 2.5%.

Wednesday 14 February

The big event of the week will be the release of US CPI data where the consensus expects the year-on-year figure to come in at 2%.

The second estimate of Q417 GDP for the eurozone goes to print, where the quarter-on-quarter growth figure is expected to be confirmed at 0.6%.

The team at Zurich Investments is a long-established and highly-experienced team of investment managers who manage approximately €22.4bn in investment of which pension assets amount to €10.1bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc