Illustration by Shana Byrne

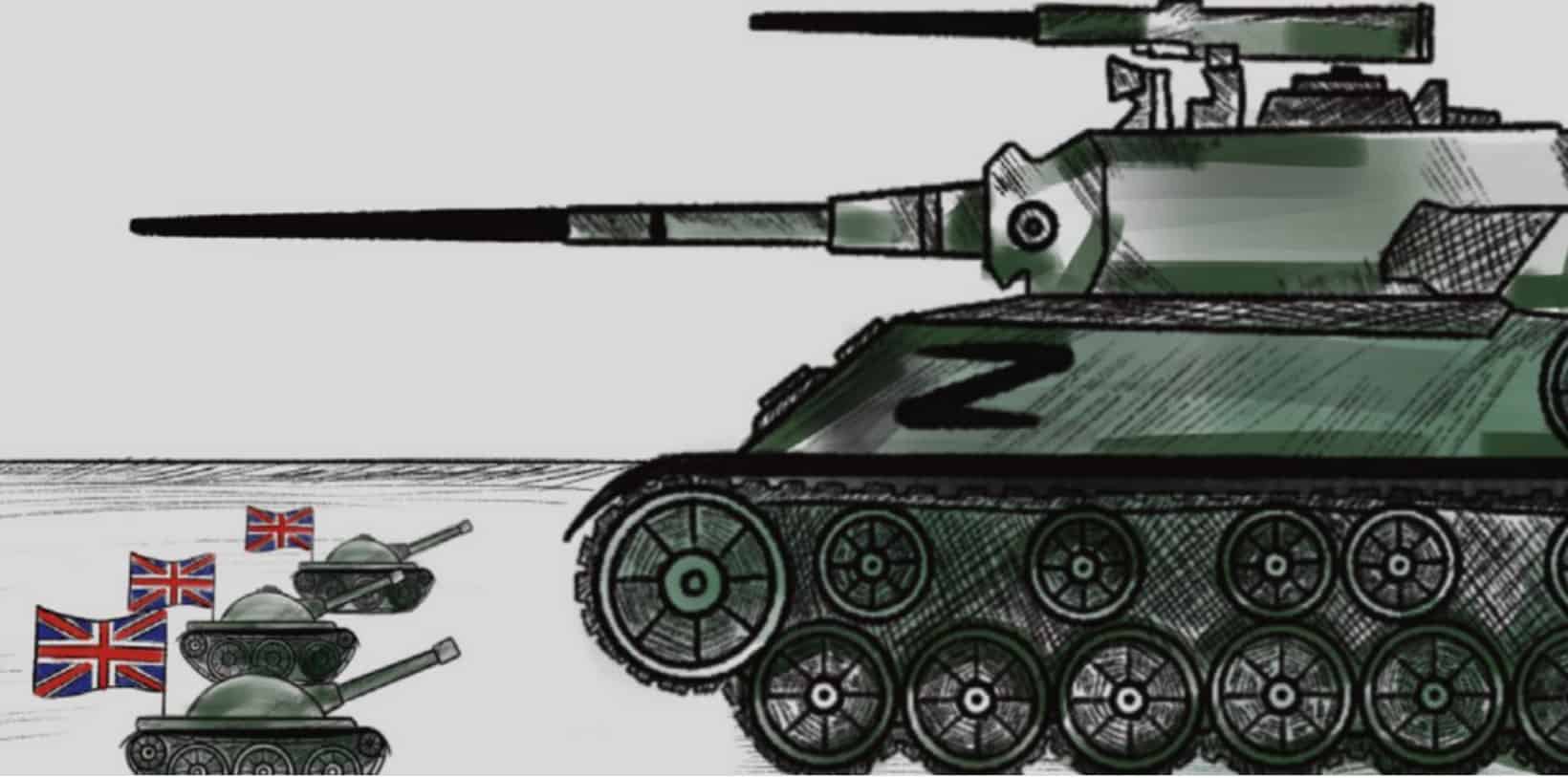

Decades of deindustrialization have hollowed out the UK economy and made it woefully ill-prepared for wartime disruptions. As the financial speculators who funded its current-account deficits turn against the pound, policymakers should consider Keynesian taxes and increasing public investment.

Note: This piece was originally published in the December 2022 issue of Business & Finance magazine.

By Robert Skidelsky

LONDON – A wartime economy is inherently a shortage economy: because the government needs to direct resources toward manufacturing guns, less butter is produced. Because butter must be rationed to make more guns, a war economy may lead to an inflationary surge that requires policymakers to cut civilian consumption to reduce excess demand.

In his 1940 pamphlet “How to Pay for the War,” John Maynard Keynes famously called for fiscal rebalancing, rather than budgetary expansion, to accommodate the growing needs of the United Kingdom’s World War II mobilization effort. To reduce consumption without driving up inflation, Keynes contended, the government had to raise taxes on incomes, profits, and wages. “The importance of a war budget is social,” he asserted. Its purpose is not only to “prevent the social evils of inflation,” but to do so “in a way which satisfies the popular sense of social justice whilst maintaining adequate incentives to work and economy.”

Joseph E. Stiglitz recently applied this approach to the Ukraine crisis. To ensure the fair distribution of sacrifice, he argues, governments must impose a windfall-profit tax on domestic energy suppliers (“war profiteers”). Stiglitz proposes a “non-linear” energy-pricing system whereby households and companies could buy 90% of the previous year’s supply at last year’s price. In addition, he advocates import-substituting policies such as increasing domestic food production and greater use of renewables.

Stiglitz’s proposals may work for the United States, which is far less vulnerable to external disruption than European countries. With a quarter of the global GDP, 14% of world trade, and 60% of the world’s currency reserves, the US can afford belligerence. But the European Union cannot, and the UK even less so.

While the UK has been almost as aggressive as the US in its response to Russia’s actions, Britain is far less prepared to manage a war economy than it was in 1940: it makes fewer things, grows less food, and is more dependent on imports. The UK is more vulnerable to external shocks than any major Western power, owing to decades of deindustrialization that have shrunk its manufacturing sector from 23% of gross value added in 1980 to roughly 10% today. While the UK produced 78% of the food it consumed in 1984, this figure had fallen to 64% by 2019. The British economy’s growing reliance on imported energy has made it even less self-sufficient.

For decades, the financial sector propped up the UK’s hollowed-out economy. Financial flows into the City of London allowed the country to neglect trade and artificially maintain higher living standards than its export capacity warranted. Britain’s current-account deficit is now 7% of GDP, compared to a current-account surplus of 1.3% of GDP in 1980. Until recently, the British formula had been to finance its external deficit by attracting speculative capital into London via the financial industry, which had been deregulated by the “big bang” of 1986.

This was brilliant but unstable financial engineering: foreigners sent the UK goods that it otherwise could not afford, Britain sent them sterling in return, and foreigners used the pound to buy British-domiciled assets. But this was a short-term fix for the long-term decline of manufacturing, enabling the UK to live beyond its means without improving its productivity.

In his 1930 Treatise on Money, Keynes distinguishes between “financial circulation” and “industrial circulation.” The former is mainly speculative in purpose. But an economy that depends on speculative inflows experiences financial booms and busts without any improvement to its underlying growth potential. The UK’s strategy echoed this observation: it did little to develop exportable goods that could improve the current-account balance, and its success depended on foreigners not dumping the pound.

This was brilliant but unstable financial engineering: foreigners sent the UK goods that it otherwise could not afford, Britain sent them sterling in return, and foreigners used the pound to buy British-domiciled assets.

But the speculator’s logic, as George Soros explains, is to make a quick buck and get out before the crash. Relying on speculators is like a narcotics addiction: a temporary high becomes a necessary crutch. The energy crisis brought on by the Russia-Ukraine war was the equivalent of cold-turkey withdrawal, blowing an even larger hole in the UK’s trade balance. The current-account deficit is expected to increase to 10% of GDP by the end of 2023, providing short-term investors with a strong incentive to sell their sterling-denominated bonds.

The pound’s ongoing decline will make UK imports more expensive. And since import prices will likely rise faster than export values, the decline in the sterling’s exchange rate will probably widen the current-account deficit, not least because the country’s diminished manufacturing sector depends heavily on imported inputs. As the pound depreciates, the price of these imports will increase, resulting in even greater erosion of living standards.

This leaves policymakers with few good options. The Bank of England has already raised interest rates to maintain inflows of foreign capital, but high interest rates will likely crash housing and other asset markets that have become addicted to rock-bottom rates over the past 15 years. Taking steps to balance the budget may temporarily calm markets, but such measures would not address the British economy’s underlying weakness. Moreover, there is no evidence that fiscal consolidation leads to economic growth.

One possible remedy would be to revive government investment. UK public investment fell from an average of 47.3% of total investments between 1948 and 1976 to 18.4% between 1977 and 2007, leaving overall investment dependent on volatile short-term expectations.

The only way the UK could “pay for the war” is to implement an industrial strategy that aims to increase self-sufficiency in energy, raw materials, and food production. But such a policy will take years to bear fruit.

All European countries, not just Britain, face an energy crisis as a result of the disruption of oil and gas supplies from Russia, and policymakers are eager to increase energy inflows. But any deal with Russia as it wages its war on Ukraine with apparent disregard for human life would carry enormous moral and political costs.

One possible way forward may be to reach an agreement to ease economic sanctions in exchange for a resumption of gas flows. Given its special economic vulnerability, and following Brexit, Britain is well placed to explore this idea on behalf of – but independently from – the EU.

A limited agreement could ease Europe’s energy crisis while allowing continued military support for Ukraine. But it should be conditional on Russia reducing the intensity of its horrific “special military operation.” Negotiation of a limited energy-sanctions deal could, perhaps, open the door to a wider negotiation aimed at ending the war before it engulfs Europe.

As for the UK, in the short term it will remain dependent on City-generated financial inflows to prevent a catastrophic near-term collapse of the pound, forcing the new British Chancellor, Jeremy Hunt, to scramble to “restore confidence” in the British economy. In lieu of Keynesian taxes or public investment, that will most likely mean drinking more of the austerity poison that caused Britain’s current malady.

About the author: Robert Skidelsky, a member of the British House of Lords and Professor Emeritus of Political Economy at Warwick University, was a non-executive director of the private Russian oil company PJSC Russneft from 2016 to 2021. Philip Pilkington, a macroeconomist and investment professional, is the author of The Reformation in Economics (Palgrave Macmillan, 2016).

About the author: Robert Skidelsky, a member of the British House of Lords and Professor Emeritus of Political Economy at Warwick University, was a non-executive director of the private Russian oil company PJSC Russneft from 2016 to 2021. Philip Pilkington, a macroeconomist and investment professional, is the author of The Reformation in Economics (Palgrave Macmillan, 2016).

Read more:

Putin Escalates, Europe Hesitates