Gavin Fox highlights how the shortfall of skilled staff in tech circles has resulted in a huge rise in outsourced work – but businesses need to take care with contracts.

Compliance, risk, governance: since 2008’s economic meltdown these have become everyday terms in the business world. Indeed, in financial services they have become the foundations upon which the banking sector was rebuilt.

However, compliance and effective governance are not just the concerns of bankers and insurers, and they concern more than just financial management. One such area that has come under a lot of scrutiny from Revenue in recent years is contractor management.

In a bid to cut out tax avoidance, a number of regulatory practices have been implemented across Europe that contractors operating in Ireland must adhere to. From a business’s perspective, ineffective contractor management can lead to project disruption, hefty fines and even legal battles.

The dangers of poor contract management are sizeable

So, why does this matter so much to the tech industry? Findings from a CIO report carried out by Harvey Nash found that 65% of businesses reported a skills shortage holding them back, while 44% of hiring managers think that the skills shortage will get worse in future.

A Harvey Nash technology survey is showing that over 40% of the respondents counted themselves as contractors. In contrast, the same survey in 2016 revealed that almost three in 10 technologists working in Ireland were contract workers, demonstrating a year-on-year increase of more than 10%.

Furthermore, 35% of people working as consultants have originated from outside Ireland. In a bid to remain innovative and attract talent, tech departments and companies may end up overlooking their commitments to compliance under business pressures to ensure the delivery of their product.

This is where the concern lies.

DAUNTING PROCESS

While hiring a contract resource might seem straightforward, the myriad documentation and increasingly complex legislation can take time for managers and business owners to process, particularly if they are unfamiliar with it.

Over the years, Harvey Nash has carried out contract audits for a range of companies across Ireland and the EU – with all manners of shortcuts taken by managers unearthed, from simple oversights to blatant malpractice, including:

- Managers listing consultants as hardware rather than run them through the books as contractors.

- Hiring managers using their own (separate) company through which they hired consultants, creating demand.

- Sole traders on-site rather than limited companies.

- Managers hiring contractors that were non-compliant in their tax practices.

KNOWING THE PITFALLS

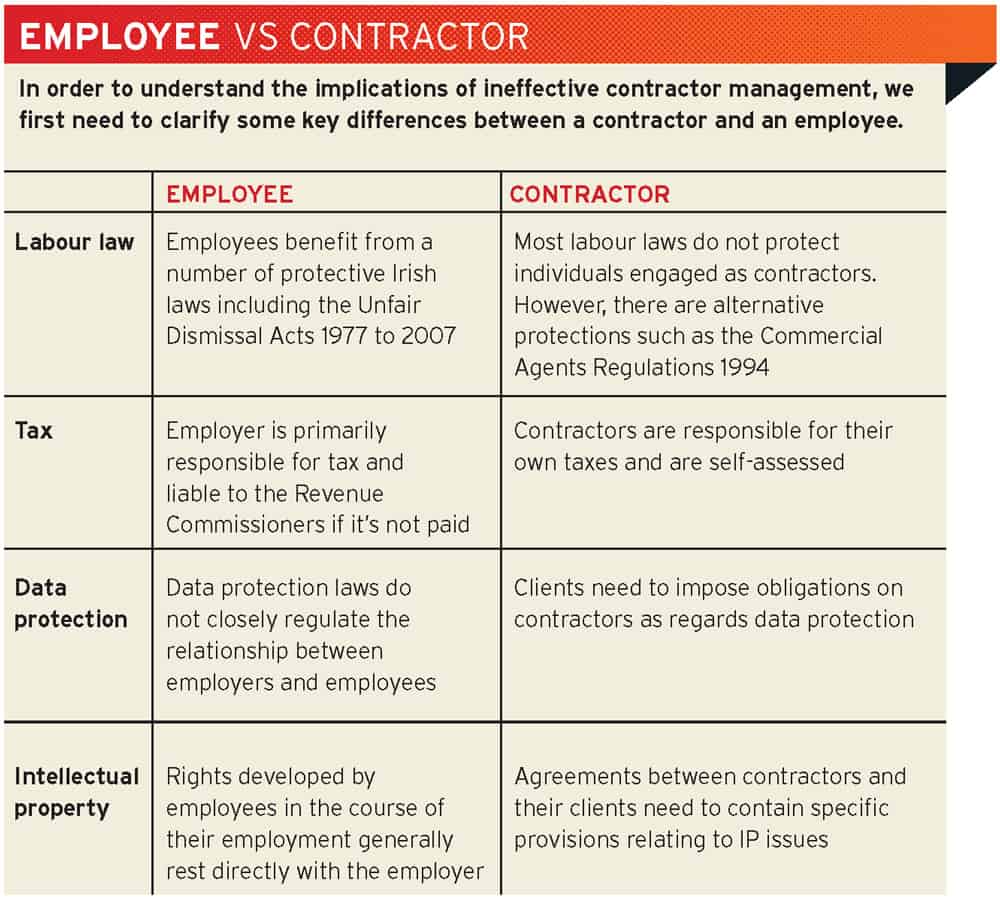

The difference between an employee and a contractor very often comes down to the type of contract in place. It might seem inconsequential, but the differences between a contract for service and a contract of service are hugely important in distinguishing between the two.

Put simply, a contract for services is a formal, legally binding agreement between a business and a self-employed individual. Whereas an employment contract (known as a contract of service) is between an employer and an individual who then becomes employed by the company.

Things become trickier when establishing whether a person is an employee or an independent contractor

Things become a little trickier when establishing whether a person is in fact an employee or an independent contractor, as the courts have shown that they will look beyond labels and focus on the factual situation and surrounding circumstances in determining what type of relationship exists between the business and the person carrying out the work.

The courts look at a whole range of criteria to assist them in determining an individual’s employment status and will have regard to the following factors:

- Measure of control exercised over how the work is carried out.

- Whether the individual supplies labour only or whether they supply equipment.

- Opportunity to make a profit.

- Requirement of personal service in carrying out the duties.

- Responsibility for payment of tax.

The consequences arising from the determination of an individual’s employment status can be far-reaching and will affect their obligations in relation to the manner in which they make tax and PRSI payments and social welfare entitlements, such as jobseekers’ and disability benefits, and other rights and entitlements under employment legislation. This includes protections in respect of unfair dismissal, redundancy, working time, the payment of wages, and holidays, to name but a few.

Gavin Fox, Harvey Nash

AVOIDING REPERCUSSIONS

As outlined above, the dangers of poor contract management are sizeable. Not only does it expose you to additional tax and fines from the Revenue Commissioners, but you can also be brought before the Workplace Relations Commission and the Labour Court.

That potentially means expensive legal costs, reputational damage and hefty compensation settlements – all because of ill-informed recruitment practices.

With this in mind, we would strongly advise any business working with contractors to:

- Conduct a contract audit: The best place to start is with an audit of all your employment contracts. This will give you a clear understanding of the lay of the land, identify where your company is exposed and even highlight areas where cost savings could be made with your contractors.

- Engage with statement of work: A client should define its project-specific activities, deliverables and timelines for a vendor providing services to the client.

FULL COMPLIANCE

In addition to this, here are some actionable tips to ensure you don’t end up in such a situation:

- Only contract limited companies: By contracting a limited company rather than a sole trader or partnership, you are clearly establishing a relationship with another business rather than an individual. The contractor is an employee of their own limited company, and thus is not entitled to any of the rights afforded to employees within your organisation. Furthermore, it is the responsibility of their limited company to ensure they’re tax compliant. More specifically, only contract Irish limited companies. After 60 working days in Ireland, EU-based limited companies are obliged to register as an employer in Ireland and pay Irish payroll taxes.

- Ensure they’re tax compliant: Even when you do engage in the services of a Irish limited company, it is good practice to ensure they are VAT-registered and registered for all relevant taxes. Copies of the limited company’s Certificate of Incorporation and VAT registration should be obtained. The last thing you want is for a contractor, integral to a project, being shut down by Revenue for failing to keep their taxes up to date. Requesting a tax clearance certificate can offer great peace of mind.

- Bulletproof contract for service: Make sure the contractor signs a contract for service. Before they do this, however, have your legal department go through the contract with a fine-tooth comb to ensure that there can be no confusion about the contractor’s employment status.

About the author: Gavin Fox is a director at Harvey Nash, leaders in STEM recruitment in Ireland