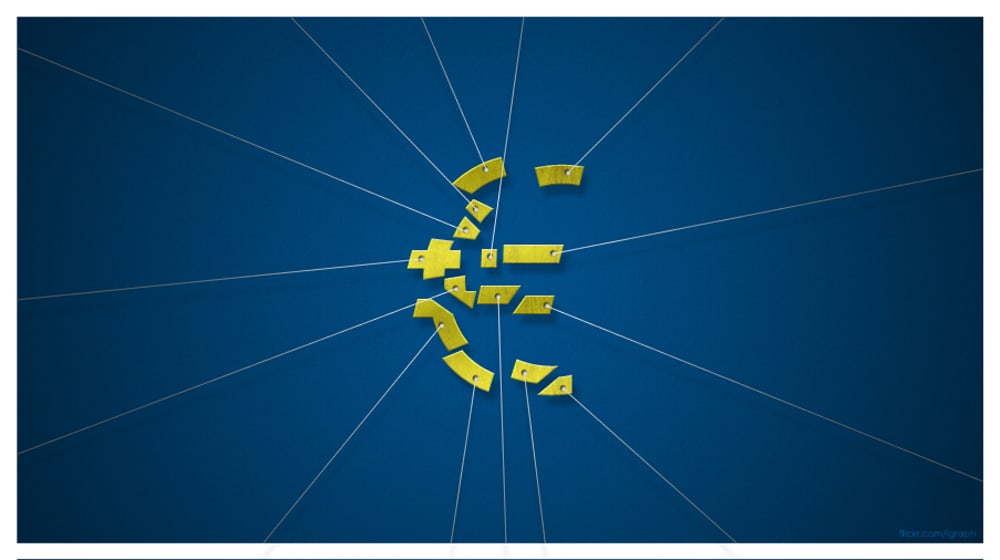

Following the recent publication of a report by the European Commission, an important dialogue has begun in earnest under the Capital Markets Union (CMU) initiative, writes Darina Barrett, head of Financial Services at KPMG in Ireland.

At the heart of the issue is how to remove unnecessary or disproportionate barriers to the cross-border distribution of funds? Although the removal of some of these barriers is likely to be a long game, firms need now to play an active part in the debate, to shape the European UCITS market for the next decade.

CMU is a key initiative for Europe. Broadening financing options for business and increasing the opportunities for investment requires significant change across a range of complex interconnected issues, both regulatory and structural.

So far, the European Commission has tackled mainly the regulatory barriers, with specific proposals to help loosen the financial system, and provide improved access to capital markets for SMEs.

True to its promise to look beyond pure regulatory measures, the Commission’s March report targets the barriers to investment, from national approaches and measures. Stopping short of naming and shaming, the Commission highlights that Member States need to do more on financial markets integration for capital markets activity to improve. However, some of the key national barriers are deep-rooted and achieving real change will be a challenge for all stakeholders.

The debate is especially timely as the industry now faces potentially the single biggest impact on cross-border fund distribution in a generation – Brexit. Nearly 35% of all promoters of funds in the IFSC are from the UK, with over 2,000 Irish domiciled funds distributed in the UK.

According to Commission statistics, about 80% of UCITS and 40% of AIFs are marketed across borders, but one-third of these are marketed into only one Member State, usually the state in which the investment manager is domiciled. Another third are marketed into no more than four other Member States.

The Commission’s research findings were that the cross-border fund market is successful but remains geographically limited: ‘The reasons for this may include the concentrated fund distribution channels in individual Member States, cultural preferences and a lack of incentives to compete across borders.’ Other reasons include the additional national requirements imposed by Member States when transposing the AIFMD and UCITS Directive.

SIX KEY BARRIERS

The Commission has identified six categories of national barriers. Its proposed removal will test Member States’ commitment to CMU and to the principles of harmonisation enshrined in the UCITS and AIFMD Directives.

- Host Member States can set national requirements on financial promotion and consumer protection, giving rise to initial research costs for firms and to additional ongoing costs.

- EU funds can be subject to regulatory fees imposed by home and host Member States that vary significantly in scale and calculation methods.

- A number of Member States impose special administrative arrangements to make it easier for investors to subscribe, redeem and receive payments from funds. Some Member States force funds to use certain institutions and provide additional information to both the regulator and investors.

- Despite the increasing use of online platforms to distribute funds nationally, barriers exist across borders.

- When fund documentation has to be updated, managers are required to give written notice to the host regulator, adding cost and time to the process.

- Different tax treatments create barriers to cross-border business. The Commission seeks feedback on how to promote best practice and avoid discriminatory tax treatment.

The debate is especially timely as the industry now faces potentially the single biggest impact on cross-border fund distribution in a generation – Brexit

NATIONAL INTERESTS

Meanwhile, ESMA has made it clear that retail investors should receive the same level of protection, independent of the location of the firm providing the service. This is seen as important both to the free movement of services within the EU in general and to the success of the CMU initiative in particular.

Critics of CMU have argued from the outset that national self-interests are the greatest obstacle to Europe having more vibrant capital markets. This concern is already resonating strongly in the debate about cross-border fund distribution.

There are conflicting views among European and national officials. Some believe the figures in the Commission’s report demonstrate that the 30-year-old UCITS passport has created the cross-border market within Europe.

Others cite the much higher number of funds, the lower average fund size and higher cost ratios compared with the US as evidence that the single market is not working properly.

They say that poorer economies of scale of European funds disadvantage European investors. If funds can do business more easily across borders, they can achieve larger economies of scale and compete to deliver better value and innovation for consumers.

Views differ not only about to what extent there is a problem but how to address it. Some national regulators, for example, have been heard to argue that a fund should not be allowed to export into other Member States if it is not first sold in its own Member State.

The same regulators have suggested that all marketing literature should be required to seek pre-approval by each host Member State before it can be issued. Others rightly note that an ex-ante approval process would not sit well with a truly pan-EU market.

Darina Barrett, KPMG

It seems that at the heart of some of these comments is a degree of distrust between national regulators. Some say that all Member States need strong gatekeepers, implying that they think others are not.

If funds can do business more easily across borders, they can achieve larger economies of scale and compete to deliver better value and innovation for consumers

It is not clear how these views will be addressed other than over time and with greater powers given to ESMA to accelerate supervisory convergence.

Neither is there a magic wand to address the strong national bias among, in particular, retail investors or the predominance of certain types of distribution channels in different Member States. Digital distribution platforms and different generational approaches may smooth out this bias over time.

Firms have an opportunity to frame the debate and adjust the tone of the narrative. Suggesting specific practical changes that will ease operational costs and inefficiencies will be welcomed by officials in Brussels as they seek to navigate this seemingly simple yet politically challenging debate.