The five key takeaways are:

- Engage early with your bank

- Maintain strong communication with employees

- Use your data to make savings

- Adapt and respond to opportunities

- Stay connected to customers

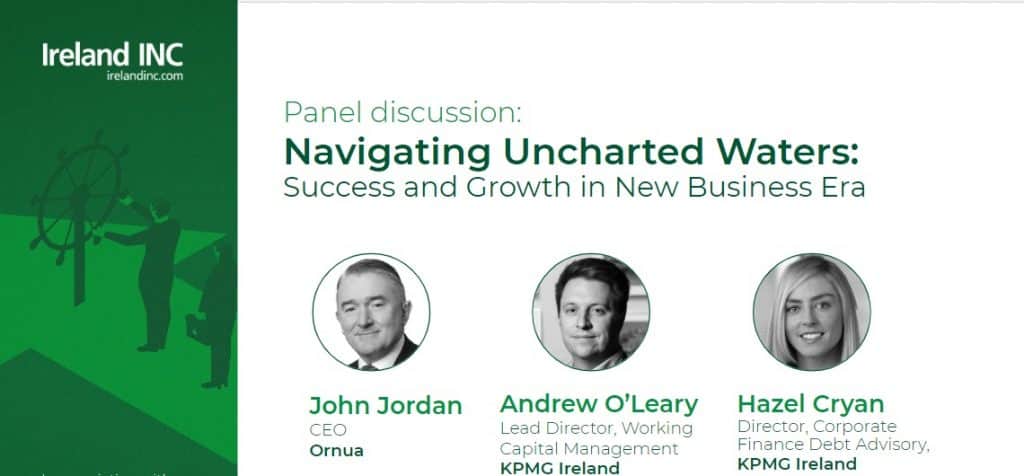

‘Navigating Uncharted Waters: Success and Growth in a New Business Era’ was the theme discussed by guest panellists John Jordan, Chief Executive of Ornua, Andrew O’Leary, Lead Director, Working Capital Management, KPMG Ireland and Hazel Cryan, Head of Debt Advisory, KPMG Ireland during a live webinar yesterday.

If you missed the webinar, you can see it here.

- Engage early with your bank

Many companies will be approaching the SBCI, pillar banks, and private lenders – relatively new ground for some – to stay afloat in these economically uncertain times. Hazel Cryan advised businesses to “engage with [their] bank or lender early,” even if it does not seem like you have a liquidity problem at present. She also suggested looking at your financial forecasts and figuring out where the ‘pinch points’ lie, as banks and lenders will rely on management and specific figures.

“Make a concerted effort to take overhead costs out of the system if you can, [and] make a clear ask of what you want from a bank,” Cryan said.

- Maintain strong communication with employees

Ornua has 2400 people working in 13 different sites in 8 countries around the world. With most businesses forced to take a ‘work from home’ approach under Covid-19 restrictions, it can become a challenge to maintain a strong level of communication between employees and management. John Jordan said that it’s vital to keep communication clear and consistent, despite these ever-present issues: “The most important thing is staying connected. Having strong communication,” he said. As an example, he told viewers how Ornua keeps communication channels open with weekly online briefings, and highlighted the growing social community taking off in the company through quizzes and regular yoga sessions.

The Ireland INC Leadership Series in association with KPMG launched on 28 April

- Use your data to make savings

Andrew O’Leary advised viewers to “drill into” their data – across cash flow, debtors, creditors and stock – to see where potential savings could be made, whether it is on a certain product line, certain customer relationships or supplier relationships. “That movement from cash flow into operations will naturally happen,” he said. “From that, companies will generally find areas of saving.”

- Adapt and respond to opportunities

While Covid-19 has certainly caused unfortunate complications, there are still opportunities within the field of business for adaptation and further development. Hazel Cryan turned to the example of hotels who have partnered with the HSE to offer rooms and beds to patients suffering from coronavirus. She also discussed a gin distillery client of hers that has recently turned its hand to producing hand sanitizers. “There are lots of positives,” she said, “and where people can, they’re trying to keep their people in employment.”

- Stay connected to customers

John Jordan emphasised the importance of ensuring people still feel connected to the business, especially if they have a stake in it. “The last thing a retailer wants is gaps on the shelves,” he said. In a discussion with their biggest customer, whom Ornua sends 60 different product lines to, they took out the bottom 40, and by focusing on the additional 20, they were able to increase output by 40% in the factory. Although it is a reduced choice for the consumer, they can be assured that there will be a product readily available.