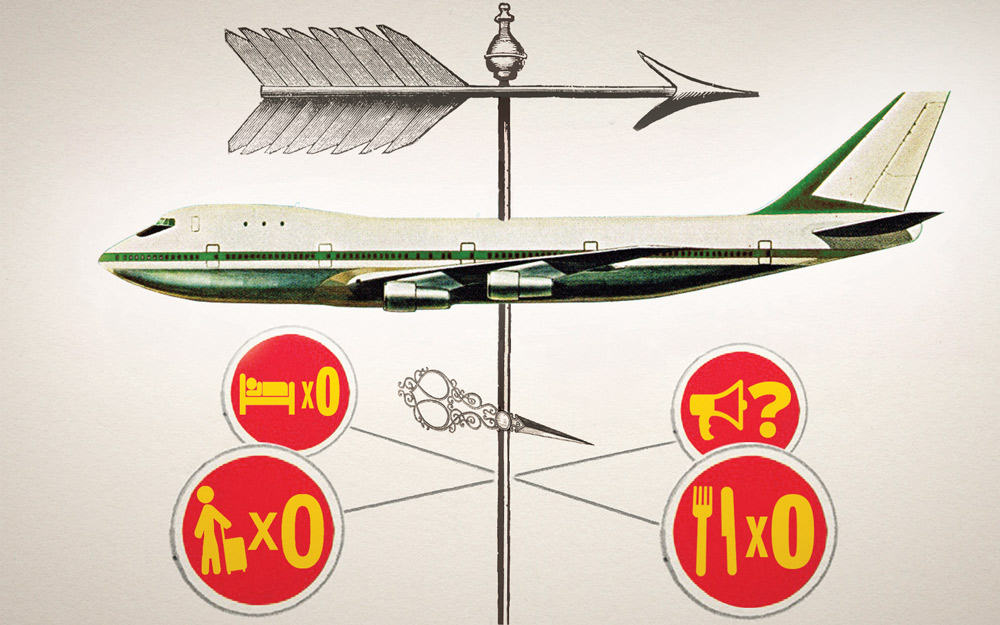

Attracting Chinese consumers to Ireland is going to take more than a direct flight, writes Mark Godfrey.

There’s been plenty of fantastical suggestions in the Irish media and political spheres recently about direct flights between China and Ireland.

Roscommon TD Denis Naughten brought the issue up with Enda Kenny in the Dáil: he wants Knock Airport to be the hub for Chinese inbound traffic into Ireland.

Such wishful thinking – while reflective of the emergence of Chinese tourists as the world’s top spending bloc – doesn’t, however, reflect an appreciation of the reality of what Chinese tourists require in a destination.

Getting a direct flight between China and Ireland may happen, but if the Chinese tourists aren’t properly informed and marketed to – as is currently the case – the direct flight isn’t going to deliver a wave of Chinese tourist spending.

The rise of the Chinese consumer is a compelling and continuing story. With all the gloom about China’s macroeconomic situation this summer the health of the Chinese retail and catering sector has been overlooked.

China’s retail and catering spending combined grew by 12% year on year in the first half of 2015 to a total of $172bn, up 11% year on year. That’s hardly anaemic.

DISPOSABLE YEN

Chinese money has also been boosting tills overseas. The past fortnight, following the annual China outbound travel peak, photos have poured in from around the world to my WeChat (a Chinese micro-blogging app) account, posted by friends on tour.

Chinese holidaymakers took to the skies for the annual ‘Golden Week’ holiday, as the break to celebrate National Day in the early days of October has become known.

Incredibly, border crossings by nationals of China have gone from 10 million to 116 million between 2000 and 2014. But the key beneficiaries of the largesse are regional neighbours.

Chinese tourists spent nearly $1bn in Japan in the first week of October: the old imperial foe is lacerated at home in Chinese propaganda but in contrast, a weaker yen has drawn droves of Chinese tourists who also appreciate the quality and relative safety of Japanese food and consumer products.

TOURIST TRENDS

Data shows that outbound Chinese tourists grew by 36.6% over last year during the first four days of the National Day holiday this month. The top destination was Japan, followed by Thailand, and South Korea were third with Hong Kong and Macao taking fourth and fifth place, according to Ctrip.com, China’s leading online travel agency.

The trends are clear and will continue, including a huge increase in the number of direct flights connecting China’s domestic cities to international destinations.

In 2006 there were 10 non-stop flights between the US and China, amounting to two million passenger trips per year. In 2014 the number of non-stop routes jumped to 35, with an additional three non-stop flights already announced for 2015.

While in number terms leading destinations are South East Asia (low cost and proximity are factors for the millions of first-time Chinese travellers), the fastest growth in China’s outbound travel is going to be headed towards Western Europe and the US.

Guangzhou night vista. Photo: llee_wu

VISITOR NUMBERS

While the US received 1.1 million Chinese visitors in 2011, it is set to receive 3.5 million in 2023, and in spending terms the growth looks even more striking. Chinese visitors will increase their spending in South East Asia from $16bn in 2013 to $44bn in 2023, but in the same period spending in North America will grow from $9bn to $38bn, according to research compiled by the InterContinental Hotel Group with Oxford Economics.

As they get wealthier and more ambitious, Chinese tourists seek out western destinations. But western destinations don’t appear to be prepared – and that’s not just Ireland.

According to consultancy Attract China, only 4% of the US hoteliers that are interested in attracting Chinese tourists know about UnionPay, the card payment processing system used by Chinese banks.

BIG SPENDER

Shopping and eating are the top preoccupations of Chinese tourists abroad – judging by the photos they post on social networks like WeChat – and China’s increased eagerness for travel presents great opportunities for vendors of quality products in Ireland. The waves of Chinese visitors flying into Tokyo are flocking to respected local sushi restaurants like Tsugu Sushimasa and Sushi Saito.

One of the reasons Chinese tourists don’t always spend big in local eateries when travelling in the west is because they rarely understand it. “What are the local specialities?”, I am constantly asked by Chinese friends preparing for a trip abroad. Several such friends, with a weekend’s downtime in Dublin following a medical conference, were messaging me recently for advice because there was little in the way of Mandarin language guidance to be found in their hotel or its vicinity.

As they get wealthier and more ambitious, Chinese tourists seek out western destinations

ACCESSIBILITY

Crucially, hospitality outlets need to make it easy for Chinese tourists. Given the trends in visitor numbers, there has to be Mandarin-language signage and leaflets in retail and dining outlets that want to benefit from tourists’ spending.

It’s not that Chinese tourists are not willing to spend on food and drink. For the wealthier ones it’s all about ‘lifestyle affirmation’ – they spend to show they can afford to spend, indulging in western hotels and restaurants.

China is not Japan: this is a trend that is going to run for some decades as new waves of Chinese gradually get the money and the desire to travel and sample the world.

Even as spending by outbound Japanese tourists began to level off in 2012, China became the top source of outbound tourist spending: $100bn in 2012, ahead of the second-placed US on $84bn, according to calculations by the UN World Tourism Organisation.

It’s not too difficult to market products to Chinese travellers who like to categorise or even pigeon hole categories and diets when on tour. This offers savvy companies a chance to create and market seafood as being unique to certain locations. But this requires marketing efforts.

WINDOW OF OPPORTUNITY

Chinese tourists tend to travel in huge numbers during China’s two big annual holidays, thus it’s easier to tailor marketing to intensive periods – in particular the first week of October.

Much of the marketing can be done at low cost. Digital marketing is key – for instance a presence on the various social media outlets like WeChat and Weibo on which Chinese document and research their travels.

Given the size of the Chinese diaspora it’s not hard for businesses to find Chinese language resources nearby. A particular resource is China’s vast overseas population of students: hiring in some interns to draft some marketing materials. But Mandarin-language brochures in tourist offices and a link up with Chinese travel agencies are also do-ables.

It’s also a good idea to run promotions around Chinese festivals: for example a promotion or at least an acknowledgement for Chinese New Year in the spring or the Mid-Autumn Festival, which falls near to the Chinese National Day in October.

The vast scale of China’s outbound tourist exodus offers opportunity to anyone who’s willing to market their hotel, restaurant or product to the world’s biggest tourism market of the future. But until the marketing is in place there’s no point pushing for a direct flight from China as an immediate solution in itself.