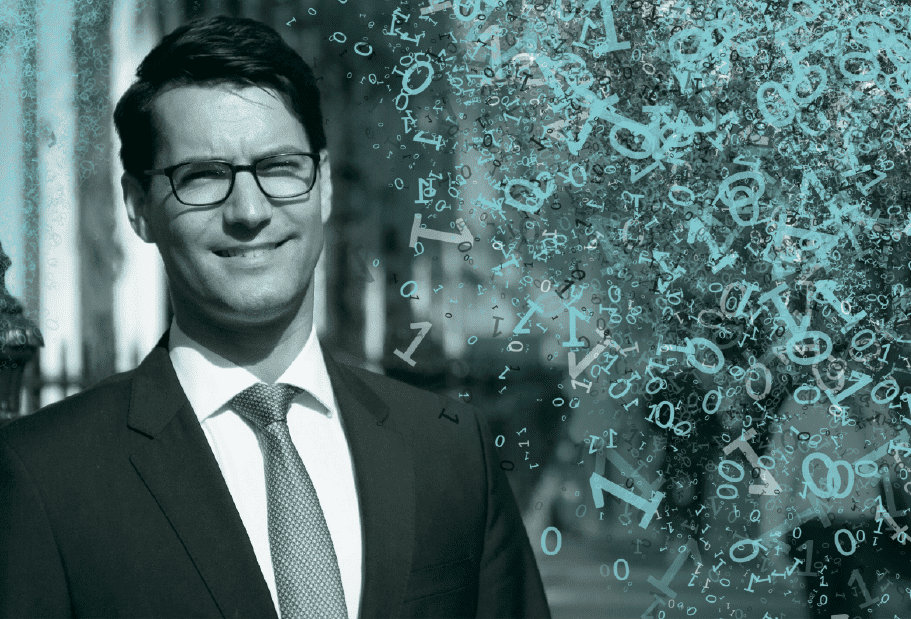

Ireland Country Manager for Visa Europe Philip Konopik tells Business & Finance about Visa’s global outlook in the local Irish market and the paradigm shift in consumer perspectives.

It’s an interesting time in the global e-payments game: with e-commerce and the growing demand for quick transfers of payments, the shift from cash to card has never been more relevant – or, as it were, vital.

According to Philip Konopik, Visa Europe Ireland Country Manager, card payments and electronic means of transaction are growing exponentially.

“One-in-three euros from the consumer perspective, or consumer expenditure, is spent on Visa card, so that’s a phenomenal growth in just a few years that we have been in the market,” he explains.

“If you compare that to somewhere like the Nordics, you’ll see that cash represents less than 2 per cent of consumer expenditure, so there’s a huge opportunity in terms of how much card spend can grow in the market.”

Smoothing out the process

Many consumers, merchants and clients do not particularly want to think about the payment process or the details of handing money over to people. This is where Philip wants to see Visa become as imperceptible as possible.

“In reality, what we want to become is completely invisible and I think that’s where we are successful.

“If you’re trying to buy a drink or send money to a friend or to split a bill, whatever it is, if we can make this as frictionless as possible, then we have done our job.”

The development and increasing popularity of more seamless, technological payments allows businesses and consumers to analyse data and activity for their own benefit in the short, medium and long run. This allows for healthier and more efficient engagement between all payment parties.

“I think with the advent of ‘big data’ you can also add an insights element” when it comes to making commerce frictionless, says Philip.

The big data effect

“Frictionless is fantastic but when you add insights and logic into that, then suddenly you have a different type of value that you can add into that commerce.

“Whether it’s rewarding customers for certain behaviours, helping merchants understand how to engage with consumers… whether it’s enabling partnerships, ties between merchants and between banks for the benefit of consumers and for the benefit of commerce, then that becomes really interesting.”

Philip is in no doubt about the importance of data-capturing and the role that big data plays in the new global and local payment structures. “We capture a lot of data and being able to leverage that to make the consumer experience and the business experience more valuable is a key part of what we can do.

“Frequency, where consumers spend, when they spend… from a merchant perspective we can track trends and correlations between how a merchant’s business can correlate to another one; there’s a lot of synergies to be had there.”

Research findings

Visa recently conducted research into the future of payments and cash in the marketplace. This research provided an analysis that allows the company to better understand the future of the digital marketplace.

“We had really come to a point where in a lot of markets where some merchants felt like cash was a lot cheaper than cards, there’s almost a resistance of ‘why would I accept card because I know I have to pay fees for every transaction?’

“We wanted to get to the bottom of whether this is true. If you take a holistic view of all costs that relate to cash and card in the business – you look at security, you look at the actual time spent on counting and reconciling, you look at fraud and security risks and you look at any banking fees or payment fees – we tried to take that big view to see what would come out.”

The study, entitled The Cost of Cash and the Future of Payments, surveyed 40 merchants in the Irish market and used a formula similar to what the European Central Bank used when looking at card and cash payments a few years ago.

“What we found for businesses in the Irish market was that already today it’s cheaper to accept card payment than it is to accept cash payment. When you compare accepting one euro on a card versus one euro in cash, the costs come out significantly lower.

“Now that’s interesting for a number of reasons. I think for small businesses that are already trying to resist this consumer evolution, they’re actually losing out because they’re using a metric which assumes that ‘I don’t have any costs by accepting cash’.

“But they don’t really consider the cost of cashing up at the end of the day, the cost of insurance, the cost of potential risk of fraud or robbery, the cost of going to the bank and cashing all that money into the bank and the transportation. When you count that time into it, every euro becomes quite expensive to manage.”

The paradigm shift

Consumer behaviour is definitely evolving and there is an almost uncompromising demand for all businesses to have e-payment structures at their disposal. Philip sees this paradigm shift as a natural progression from the traditional means to a system with which users can easily integrate.

“Generally, what we are seeing is a strong consumer adoption moving away from cash on to digital payments, and card being one of those. Technology is evolving every day – and in reality cards are just a physical representation of a number that links back to a bank account; to a credit card account.

“But those are just temporary, in a way, even though we’re going to see a lot more usage moving that way. Biometrics, fingerprints, facial recognition, all of these things are ways to authenticate the user.

“Once you have that and have it linked to payment credentials, then really you’re flying. I think this is just the start of what is going to be an exciting journey. The consumer demand is definitely there.”

Visa Ireland will be hosting a special event in Dublin Chamber of Commerce on October 25th to reveal their research findings from the Cost of Cash and the Future of Payments study. For information on attending the event email visaireland@edelman.com