Marc Coleman, economist and founder of Octavian Consulting, discusses the ‘double-divide’ in this economic crisis.

This week, in the national print media, Irish President Michael D. Higgins highlighted a paper written by NESC as a potential solution to our current economic crisis.

The paper, titled “The Transition to a Low-Carbon and More Digital Future,” has a useful sub-section on funding issues that affected business before this crisis, and which are greatly aggravated by it now. The input of the Strategic Banking Corporation of Ireland and other commercial contributions is also welcome, if understated.

As a plan to tackle the current economic crisis, it is not a criticism of NESC’s efforts to say that it is not designed to meet the ‘here and now’ questions facing businesses, such as: Will customers return? When? Do I make staff redundant, lay them off, or use the temporary wage subsidy scheme? Can I claim force majeure to cancel contracts entered into before the crisis? Will my landlord give me a rental holiday? What if they will not? How can I afford to pay my local authority rates when my business is down 90%?

Like other publicly funded bodies, NESC does not answer these questions.

The cry of ‘this time we will have no austerity’ comes from those who – immunised from the realities of our economy – do not seem to realise that austerity is a brutal reality facing us now in the private sector, a reality that institutions like NESC, the ESRI and University academics – who dominate discourse on our airwaves – will never really understand in reality (as against theory).

And this reflects the gaping gulf – already in existence – that now exists in Ireland. A gulf in understanding. A gulf in exposure. A gulf in experience.

The cry of ‘this time we will have no austerity’ comes from those who – immunised from the realities of our economy – do not seem to realise that austerity is a brutal reality facing us now in the private sector

As the latest Stability Programme Update forecasts show, this gulf is widening. My first article in Business & Finance showed how, in the last crisis, government current spending actually grew between 2008 and 2014, while both capital spending and private sector consumption fell dramatically.

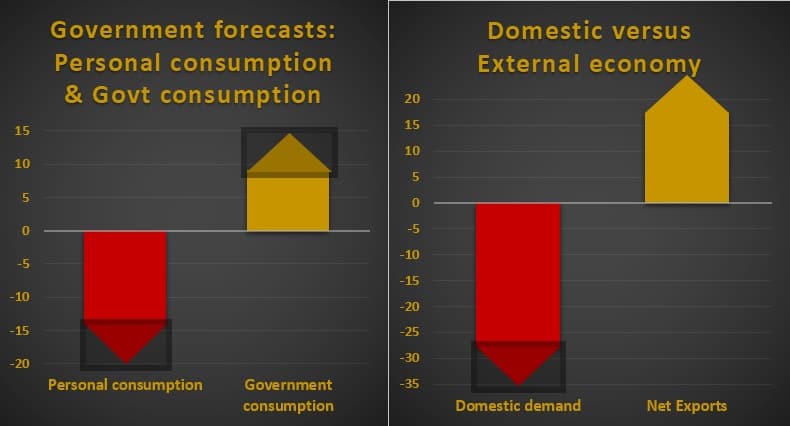

According to the government’s Stability Programme Update published the week of 21 April, this divergence – already evident – is returning with a vengeance, with governmental consumption set to rise this year by 9.1 per cent, while personal consumption is set to fall by 14.2 per cent, taking with it tens of thousands of jobs that may never be recovered.

The other divide is between the external and internal economies. In the first aforementioned Business & Finance article, I also explained how our external economy – characterised as it is by our low corporation tax regime and a well-resourced and highly professional IDA (as well as other national advantages) bounced back with a rapid “V-shaped” recovery after barely a year of recession. By contrast, our highly taxed domestic economy dragged along the bottom for four agonising years with a slow recovery that – in some parts of our economy – had yet to fully kick in when this new crisis struck. The latest Stability Programme Update suggests more of the same, with Net Exports predicted to grow this year by 17.4 per cent, while domestic demand are set to fall by 27.9 per cent.

As Michael D. Higgins’ article and several other media appearances demonstrate, the sheltered and multinational sectors of our economy hold all the cards when dictating the policy narrative. They have the resources, access to power, and security needed to make their case and dominate ‘debate.’ I put ‘debate’ in inverted commas because I am not sure we still have debate. Despite public spending increasing by 16 billion during the recovery, and despite tax cuts being few and far between, there was not one single media outlet supporting the case of private sector workers and entrepreneurs for even a partial restoration of their after tax pay (despite the agreed consensus that public pay should be restored).

My own publication, ‘An Economic Response to Covid-19,’ was an attempt to balance this by looking at the crisis from the point of view of a private sector that will have to – for the second time in a decade – take the risks, create the jobs and generate the tax revenues to power the recovery we all want to see.

The first broadcast media outlet to cover these ideas was Newstalk. The reality of the economic downturn means the effects of recession are immediately felt by private enterprise and the need to promote ideas for recovery therefore more readily understood. If our policy analysis and formation does not rapidly re-balance and diversify its perspective then our private sector will go under, taking down with it a public sector that depends on the taxes it generates. Furthermore, our politics – already shaken by the last general elections – may be crip pled forever. The time to act is now.

For Coleman’s weekly updates see: Businessandfinance.com