Marc Coleman, founder of Octavian Public Affairs, discusses the decline in exchequer returns versus the growth in corporation tax

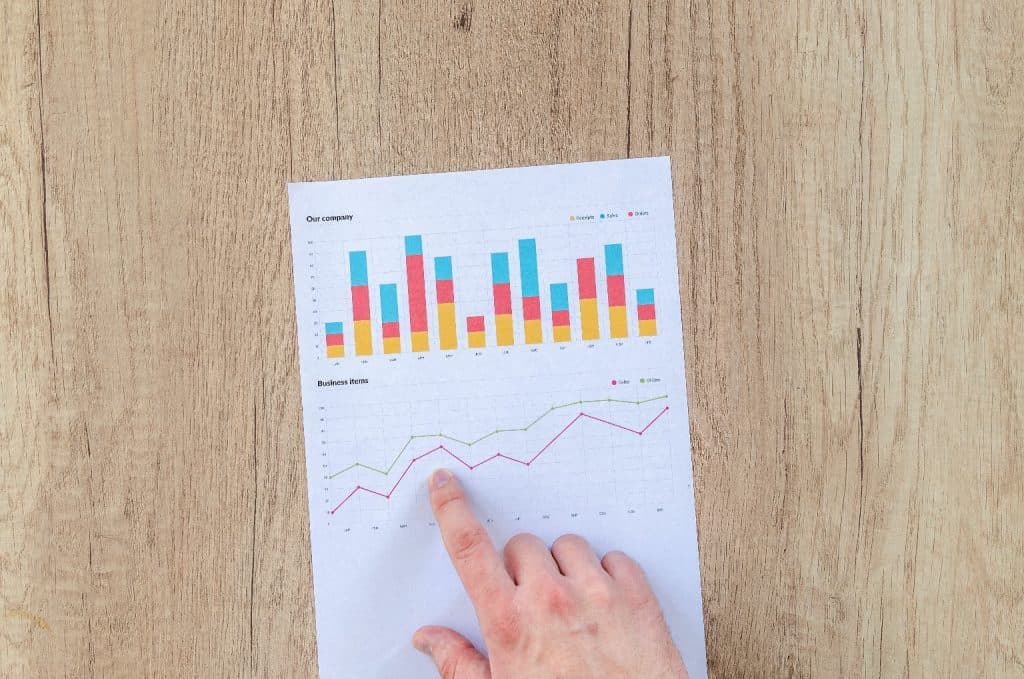

Following a slight increase – caused by bumper corporation tax receipts in the year to June – in tax receipts in the first seven months of 2020 were, compared to the same period of 2019, down by 2.5 per cent.

The modest extent of the decline reflects the lagged effect of last year’s (in accrual terms) very strong growth in corporation taxes whose cash impact is now being felt. However from a rate of 91.8 per cent increase in the year to May the rate of annual corporation tax revenue growth slowed to 41.2 per cent in the year to June and to 31.4 per cent in the year to July, taking with it the overall year-on-year tax growth from positive to negative territory. Other categories where lagged impacts drove positive cash performances were Capital Gains Tax, where revenues to July were 7.7 per cent ahead of last year (compared to 7.0 per cent in June) and Stamp duties (7.2 per cent compared to 13.7 per cent).

VAT receipts, which reflect (albeit with some lag) more recent economic developments declined by 22.7 per cent compared to a 20.5 per cent decline in the year to June while deterioration was also seen in customs duties (20.1 per cent compared to 16.6 per cent in the year to June) and, more modestly but perhaps for significant in the long-term, income taxes which registered their first cumulative decline, of 0.7 per cent, since the crisis began.

On a monthly (rather than cumulative) basis, corporation taxes in July were 62 per cent lower in July than in July 2019 while Customs duties, VAT and Income Tax receipts were, respectively, declines of 44.4 per cent, 30 per cent and 8 per cent. Capital Acquisitions Tax registered a 15.5 per cent decline but capital gains tax rose 16.6 per cent. Stamp duties fell by 20.4 per cent.

Although not yet very perceptible in percentage terms, the upturn in the number of cases of Covid-19 – combined with a continued double digit weekly rate of growth in global cases – has caused the government to delay the re-opening of pubs, a partial delay in Phase 4 of the lockdown wind-down the objective being to prioritise the Phase 5 re-opening of schools.