Investor sentiment was buoyed at the Feds announcement that it would pause interest rate hikes and share in communication services fared best with Facebook releasing better than expected earnings. Ian Slattery reports.

Ian Slattery

Markets finished the week higher to record their best January since 1987, with volatility (as measured by the VIX index) declining to a two-month low.

Corporate earnings surprised to the upside last week but it was comments from the US Federal Reserve that particularly buoyed investor sentiment. Amidst weakening inflation and tighter financial conditions, the Fed confirmed they would pause interest rate hikes and remove stimulus slower than previously expected by maintaining their large bond balance sheet. This puts downward pressure on interest rates and should help to support borrowing costs.

Global growth still remains a concern, with eurozone growth slowing to 1.8% in 2018, its weakest pace in four years. However, unemployment remains at a 12-year low and there are signs of wage growth accelerating in the region. Monetary policy also remains accommodative in both Europe and Asia, which should keep interest rates low and support confidence in the near term.

Equities

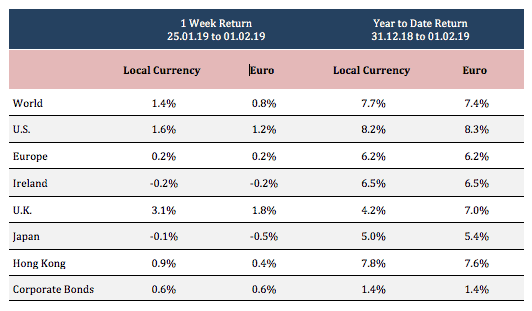

The MSCI World Index advanced 1.4%, with the U.S. (+1.6%) and the U.K (+3.1%) leading the move higher. Communication services shares fared best with Facebook releasing better than expected earnings.

Fixed Income & FX

The US 10-year yield fell sharply to 2.68% on the Feds dovish comments. The German equivalent yield fell to 0.17%. The Euro was stronger, rising to 1.146 against the U.S. dollar and 0.876 against the British pound.

Commodities

The weaker US dollar supported commodity prices across the board with oil finishing the week higher at $55.26. Gold advanced to $1,318 per troy ounce and despite Chinese growth concerns, Copper advanced to $6,116.

THE WEEK AHEAD

Tuesday 5th February:

- UK PMI services index

- Eurozone retail sales

Wednesday 6th February:

- US State of the Union Address

- Crude oil inventory report

Thursday 7th February:

- Bank of England minutes

- US jobless claims

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €21.9bn in investments of which pension assets amount to €10.2bn. Find out more about Zurich Life’s funds and investments here.

w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc