Stocks finished last week on a positive note, led higher by tech and energy stocks as oil posted its first back-to-back weekly gain in a couple of months. The gains also brought the technology-heavy Nasdaq Index back into positive territory for 2020. Ian Slattery reports.

Q1 earnings season is coming to a close as over 90% of large-cap US companies have reported. The results have been slightly worse than expected, but given the ongoing pandemic it is hard to get a clear view on what the rest of the year might hold. Indeed, over approximately 25% of the S&P 500 have suspended guidance and forecasts for the rest of the year.

Ian Slattery, Zurich Insurance

Economic data continued to be extremely poor with the non-farm payroll figures from the U.S. on Friday producing some startling numbers. Over 20 million Americans are out of work, unemployment is at 14.7% (the highest since WW2), and the number of Americans working was at its lowest level since 2011. The numbers next month are unlikely to be any better.

Oil prices recovered further finishing at $24 per barrel.

In Europe, negotiations continue over what a final centralised fiscal package may look like as a legal spat between Germany and the EU arose. The dispute centres on the legality of some of the ECB financing operations, an area of disagreement for some time. On the data front, eurozone March retail sales saw the largest decline since 2000, down over 11% for the month. Global PMIs also saw large falls for April as manufacturing data continues to hold up better than services, a theme we noted a number of weeks ago.

The overall virus news was broadly positive as new cases continue to grow at a decelerating rate as economies progress with plans to reopen with the UK the latest to publish a partial roadmap over the weekend. Finally, the US and China both spoke positively about trade developments following discussions on Thursday, raising hopes that the trade deal hasn’t been hit by the ongoing dispute over the origins of COVID-19.

Equities

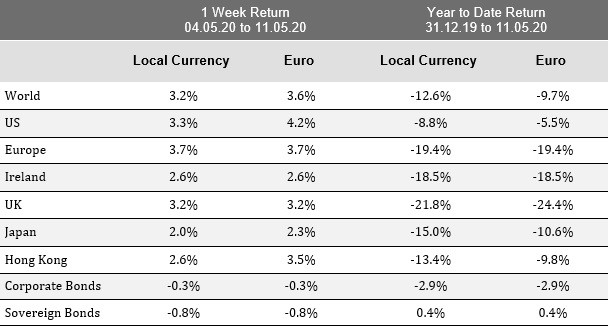

Global equities were up last week by 3.2% in local terms and 3.6% in euro terms. The influential US market was up by 3.3% in euro terms and 3.6% in local terms. Closer to home, Ireland was up 2.6%.

Fixed Income & FX

The US 10-year yield finished at 0.68% last week. The German equivalent finished at -0.53%. The Irish 10 year bond yield finished at 0.14%. The Euro/US Dollar exchange rate remained at 1.08, whilst Euro/GBP finished at 0.88.

Commodities

Oil prices recovered further finishing at $24 per barrel. Gold increased to $1,703 per troy ounce and is up 12% year to date in local terms and copper increased to $5,243 per tonne.

The week ahead

Tuesday 12th May

The latest US inflation figures are published.

Wednesday 13th May

UK GDP for Q1 is released as Fed Chair Powell speaks stateside.

Thursday 8th May

US retail sales for April & German GDP for Q1 go to print.