The US markets are showing positive signs of support by strong economic growth, however, in Europe the news is not as upbeat with the European Union reducing its growth forecasts. Ian Slattery reports.

Ian Slattery

The recovery in US equities this year remains on track with the markets finishing the week 0.1% higher. Corporate earnings supported the advance. Almost two-thirds of companies have now reported earnings with 71% beating analyst estimates. Volatility, as measured by the VIX index, has also eased.

The strong start to January bodes well for the remainder of the year. In 64% of years since 1944, the market has posted a January gain, with 92% of these occasions posting a full year gain. More importantly, though, market strength is supported by solid economic fundamentals in the US.

The economic data emerging from Europe is not as comforting, however. The European Union reduced its 2019 growth forecasts for the broader region from 1.9% to 1.3%. In Germany, industrial production declined for the fourth month in succession, while manufacturing orders declined 1.6% during the same period.

Equities

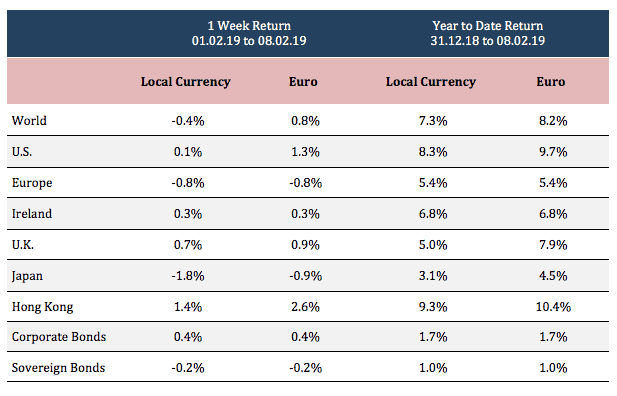

The MSCI World Index declined 0.4% in local currency terms. Europe and Japan weighed but the US did advance 0.1%. Utilities shares performed strongest in the US followed by industrials and information technology.

Fixed Income & FX

The US 10-year yield fell to 2.63% while the German equivalent yield slumped to 0.09% on economic growth concerns. The Euro weakened against the US dollar and GBP pound, declining to 1.132 and 0.874 respectively.

Commodities

Plans for OPEC cutbacks remain on track but a stronger dollar put pressure on oil prices, which declined to $52.72. Gold declined to $1,315 per troy ounce but despite Chinese growth concerns, Copper advanced to $6,191.

THE WEEK AHEAD

Wednesday 13th February:

- Eurozone Industrial Production

- US Consumer Price Index (CPI)

Thursday 14th February:

- Eurozone GDP Flash

- US Jobless Claims & PPI

Friday 15th February:

- UK Retail Sales

- US Industrial Production

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €21.9bn in investments of which pension assets amount to €10.2bn. Find out more about Zurich Life’s funds and investments here.

w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc