Global investment manager Legal & General Investment Management (LGIM) outlines what net zero is and how companies navigate towards it.

By Amelia Tan, Head of Responsible Investing Strategy, LGIM

What does ‘net zero’ mean and why is it important?

‘Net zero’ is shorthand for the global effort to balance carbon-emitting ‘assets’ with carbon-absorbing ‘liabilities’.

We are focused on our net zero efforts because we recognise that the affects of climate change will be detrimental to the world, to our planet, to people and to national economies.

Reducing the carbon footprint of a portfolio is also relevant within the framework of net zero. What should be the components of a net zero approach for investors?

Given the gravity and scale of the challenge, investors should develop a net zero strategy to inform and define their decision-making.

How this is precisely defined will be up to each individual investor, but we see these as the key pillars that should inform any net zero strategy:

- Setting targets

- Strategic asset allocation

- Policy advocacy in your communications

- Activity around engagement and governance.

In what way could active ownership contribute to net zero in 2050?

Active ownership can contribute to reaching net zero by 2050 in three steps: identifying key issues, engagement with stakeholders and, where necessary, escalating to sanctions over ESG issues.

By working through these questions, investors can assess the activities of companies, enter dialogue with stakeholders, and through this engagement hold these companies to account for their progress toward net zero.

How should or could a decarbonisation strategy work together with an engagement strategy?

For example, we are committed to working with our clients to reach net zero in greenhouse gases (GHGs) by 2050, and we aim to have 70% of AUM aligned with this target by 2030.

By linking votes to specific data points aligned with a principles-based approach, investors can exert influence more consistently and across more markets by targeting companies that are not yet meeting ‘best practice’.

Where they are unable to demonstrate sufficient progress, investors can then leverage influence by voting against them and/or divesting their holdings from relevant funds.

How can institutional investors understand and incorporate climate change risks in their portfolios?

GHG emissions have long been the most common means for assessing climate change risk, but to meet the challenge of net zero, we must broaden our analysis.

There are four key questions institutional investors must ask to get a full picture of climate change risk:

1) What do different climate outcomes mean for the global economy?

2) What risks does climate change expose portfolios to?

3) What climate outcome is a portfolio aligned with?

4) How far away from the net zero 2050 target are my financed emissions?

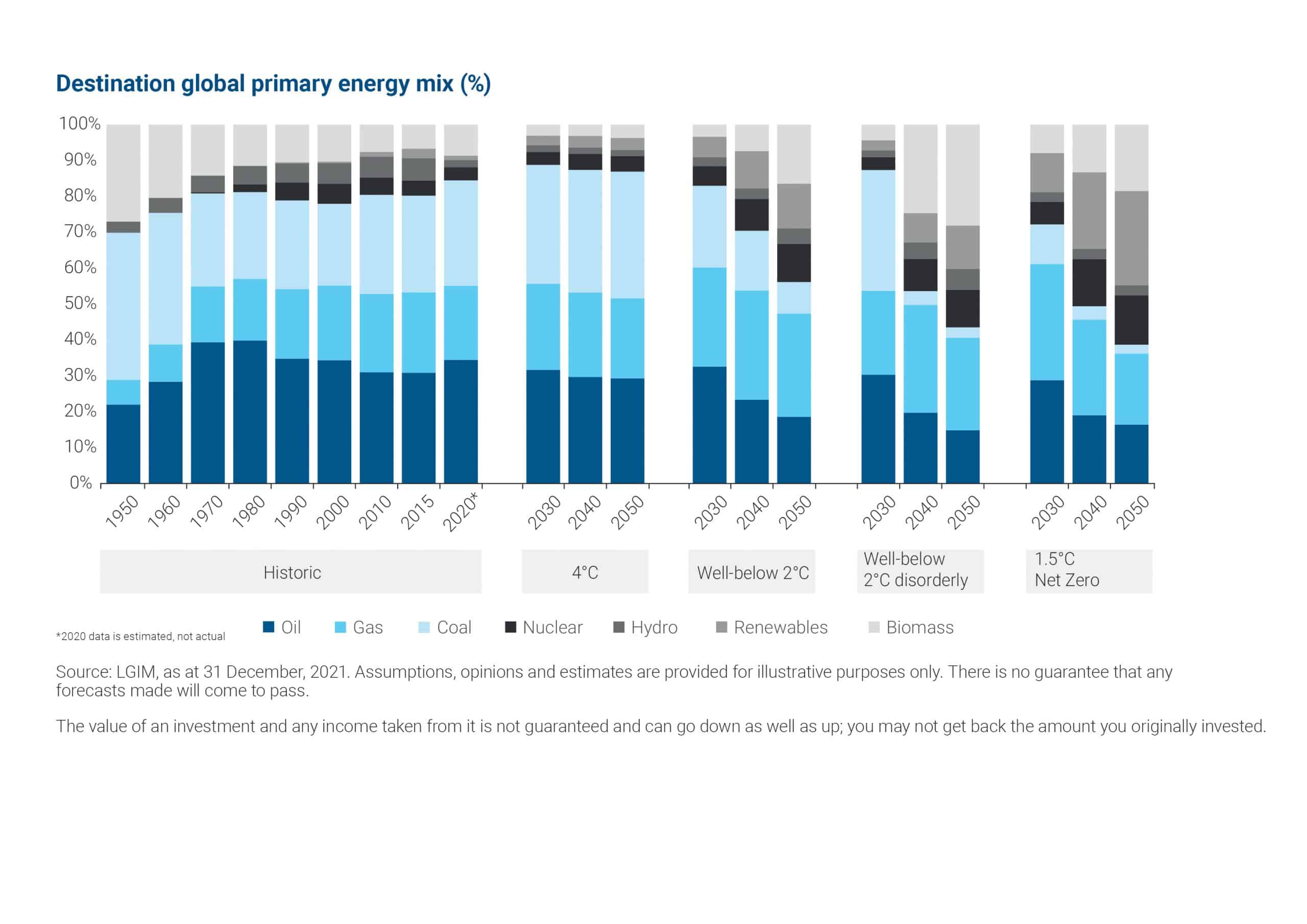

We have developed our own bottom-up energy transition scenarios – or ‘Destinations’ – that factor in inputs including carbon budgets, technology costs, energy demand and mixes, sectoral emissions pathways, and carbon prices.

These range from ‘1.5°C net zero’, to ‘orderly’ and ‘disorderly’ scenarios for below 2°C, to the 4°C rise that would arise from ‘inaction’, as we can see below:

Modelling in this way allows institutional investors to understand the company, sector and portfolio-level implications of climate change risk.

Once this understanding is arrived at, it can better inform how investors engage with and invest in both companies and sovereign issuers.

Which challenges do you see on the road to net zero?

At present, fewer than 10% of companies are on track for net zero, and there is no minimising the challenges many will face in reaching it.

We believe the most significant challenge is not determining whether a portfolio is net zero today, but rather how best to devise strategies that will effect long-term change in the market.

The key challenge here is finding successful ways to link the macro picture with portfolio construction.