Trading room at Zurich Life Investments Ireland

In the latest review of the markets, Ian Slattery reports that equities were higher as earnings continue to beat expectations.

Stocks were higher on the week as earnings season continued. Of the first 80 companies in the S&P 500 to report, over 75% have beaten earnings expectations by over 7%. Reaction to the earnings has been mostly upbeat and encouraging GDP data out of China helped global markets record a positive week.

Ian Slattery

US economic data was mixed but there were some signs of continued housing sector strength as existing home sales were up and consumer prices posted their biggest year-on-year increase since October 2014.

Global bond yields fell slightly during the week as the ECB rate decision meeting did not stoke fears of an end to the asset purchase programme. The benchmark refinancing and deposit rates were left unchanged, as expected. President Draghi gave away very little in the subsequent press conference, with markets now looking to the December meetings of the Federal Reserve and ECB as the next ‘live’ meetings.

Encouraging GDP data out of China helped global markets record a positive week

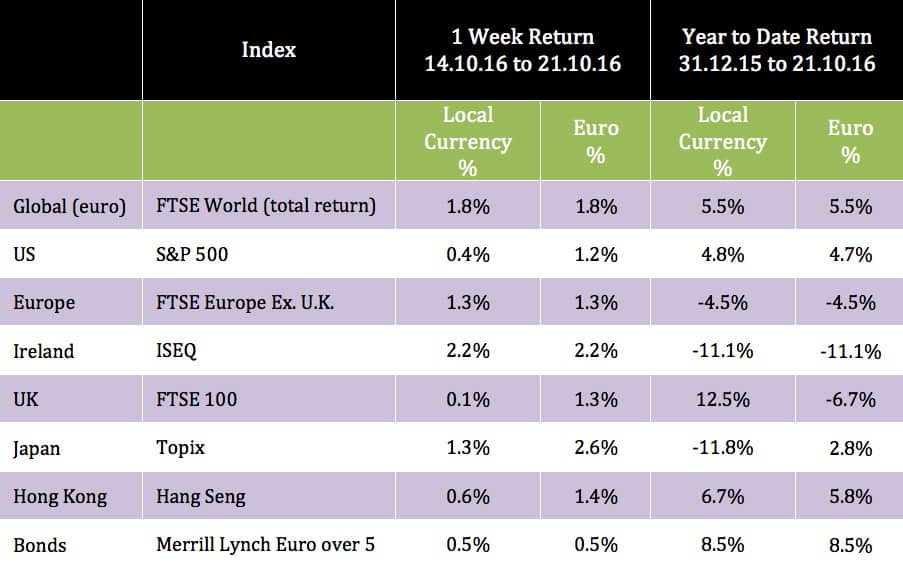

The global index was up 1.8% with the majority of key exchanges posting positive returns, with Ireland climbing 2.2%. Oil touched a 15-month high as US inventories fell before finishing the week up 1%. Gold reversed its short-term downward trend and was up 1.2% in dollar terms.

The 10-year German bond yield fell on the back of the aforementioned lack of ‘tapering talk’ at the ECB meeting, but remained in positive territory, closing the week with a yield of 0.01%. The euro weakened against the dollar, yen and sterling which added to returns for Irish investors with holdings in these jurisdictions.

THE WEEK AHEAD

Tuesday October 25th-Thursday October 27th

Tech earnings dominate, with Alphabet (Google), Twitter, Amazon, LinkedIn and Apple all reporting.

Thursday October 27th

The first reading of UK GDP growth for Q3 is released where growth is expected to slow to 1.5% from 2.1% (year-on-year).

Friday October 28th

The consensus is for Q3 US GDP growth to rise to 2.5% (year-on-year) from 1.4% last quarter.

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €20bn in investment of which pension assets amount to €9.5bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds, Twitter: @ZurichLife, LinkedIn: linkedin.com/company/zurich-life-assurance-plc