Revolut has had a strong year so far. The e-money institution topped the list of best startups in a recent poll. This success is in no small part thanks to their refreshing take on both business and personal finance dealing.

This article originally appeared on comparebanks.co.uk

By Matt Crabtree

Revolut recently expanded its offering to include a free business account, giving the company even greater appeal. We take a detailed look at the company in our full review of the Revolut business account.

Quick Look — Pros & Cons

Here’s a quick glimpse of everything we liked and disliked about Revolut’s new and improved business offering. We go into further details, below:

Pros

✔️ Quick and easy to get set up with a functional business account.

✔️ A range of price points, allowing you to choose a service that’s right for you.

✔️ A handy mobile app that’s packed full of features for helping you manage your money.

✔️ Competitive rates on international currencies and transfers.

Cons

❌ Most of the essential features only come with the paid accounts. The free one is limited.

❌ ATM transactions are charged.

❌ The account doesn’t accept cash deposits.

Overall, there are plenty of positives that we liked about the service. The negatives really depend on the type of business transactions that you make.

What is Revolut for Business?

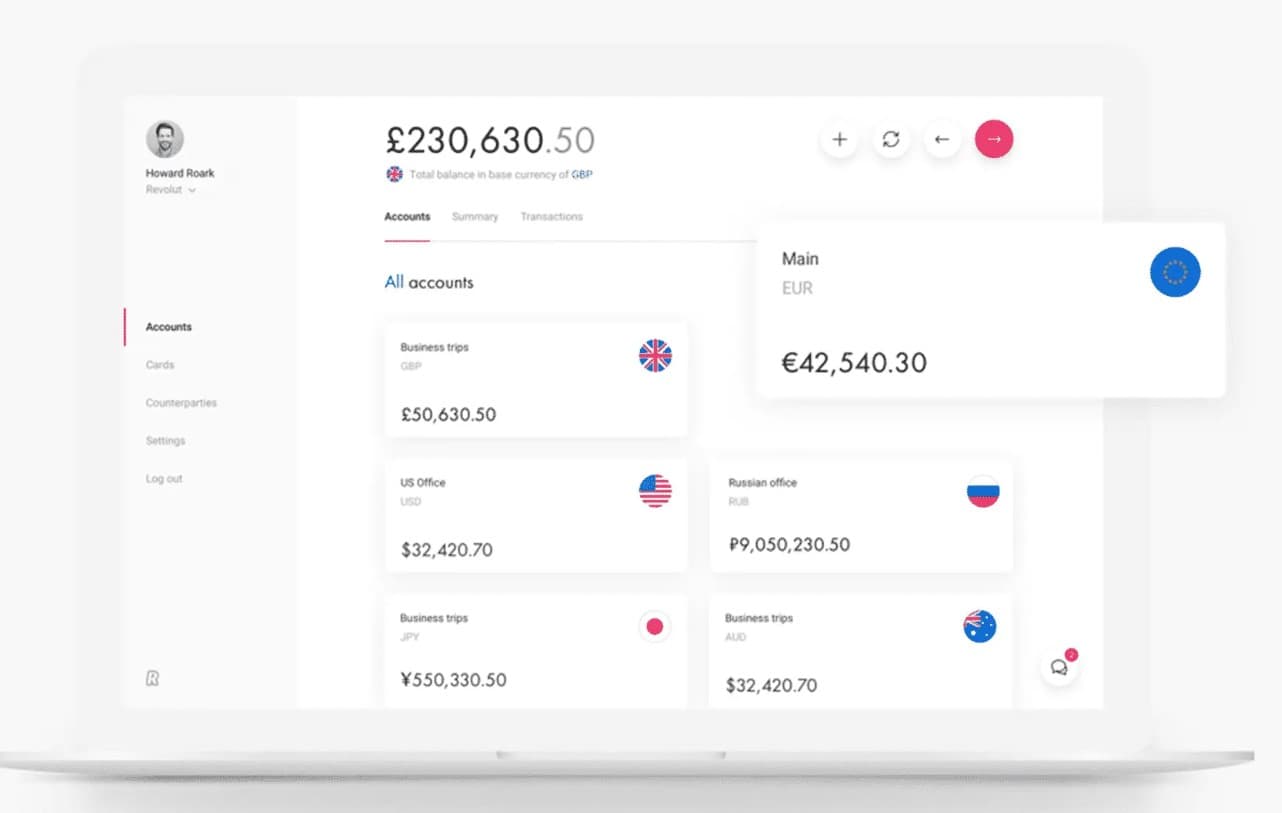

Manage your account online or from the mobile app

Revolut is a fintech firm founded in July 2015. They’ve grown to become one of the biggest startups in this sector, with over 25 million customers worldwide.

They offer financial services as well as currency exchange, both of which use the Revolut app. The company has brought innovation to the financial industry, providing quick and easy ways to get started with a business or personal account.

“Revolut for Business is a ‘business account platform for domestic and international payments, designed to save you time and money.’”

Business users have a choice between a few different options when it comes to Revolut products. However, as stated on the website, Revolut for Business is a ‘business account platform for domestic and international payments, designed to save you time and money.’

How does Revolut Business work?

Revolut uses a phone or tablet app in conjunction with a Mastercard or Visa to deliver a powerful experience. There are options for both freelancers and businesses of all sizes, from small startups to larger organisations.

Sign up is typically a fairly straightforward process. You need a business email address and details of your company, and you can sign up in minutes using the app. There’s no contract, and you can cancel at any time.

The app has several functions that allow you to manage your money. This includes account overviews, including your balance across 25+ different currencies. You can also view employee spending across Revolut’s prepaid cards.

There are four tiers of account for businesses, giving you the choice to select one that suits your needs. They range in terms of costs and scale. Paid services are charged monthly, and you can change your plan or cancel the service at any point.

What features does Revolut Business have?

There are a lot of features you can potentially benefit from with a Revolut for Business.

The ones you’ll get depend largely on how much you pay for the service. However, there are some basic features that are common to all tiers Revolut offers:

- Free payments to Revolut accounts. You can make unlimited, free payments to other Revolut accounts. This applies to all levels of their service.

- Additional team members. You can invite unlimited team members.

- Free local transfers. The account offers between five and unlimited monthly transactions through local accounts.

- Receive, hold and exchange currencies. You can select from 25+ currencies, and have local accounts in both GBP and EUR.

- Access to prepaid debit cards. These can be used for business expenses and ATM withdrawals.

Higher, paid tiers of the service also benefit from the following:

- 24/7 priority support. You can get dedicated support at any time of the day.

- Free international transfers. Ranging from 10 to unlimited per month.

- An allowance on real-rate foreign exchange. Get the same rate the banks do, ranging from £10k per month to unlimited.

All of these features, and more, aim to make your accounting and financial affairs quick and easy.

What are the fees for using Revolut Business?

Like most services in this sector, the better features come at a cost. However, the free accounts for businesses still provide a good level of services for those just starting out. Once you’ve established yourself though, you’ll need to pay for access to the better features.

The current price structure for accounts is as follows:

- Free Account. As the name suggests, £0 per month with some features.

- Grow Account. The first paid tier costs £25 per month and gives considerably more features than the free offering.

- Scale Account. For more developed companies, the £100 monthly fee provides a lot of scale for growth.

- Enterprise Account. For larger companies, a custom monthly fee gives you unlimited access to all the best features Revolut has to offer.

Other fees also apply once you go above the threshold of your monthly allowance:

- Additional team members cost £5 each.

- Local transfers cost £0.2 per transactions.

- International transactions cost £3.

- Foreign exchange transactions cost 0.4% of the transaction.

Who is Revolut Business for?

The beauty of the Revolut for Business account is that it scales based on the size of your company. The four tiers offer a diverse set of features to match the budgets of startups and small and medium-sized enterprises. Set up Payroll in clicks and save time with automated expenses.

Currently, it’s not quite the complete solution, as features like business loans or overdrafts have yet to be added. However, all of these functions are on the roadmap for the coming months. Once they include these features, Revolut could be among the market leaders.

What are the drawbacks of using Revolut Business?

Good as it is, Revolut’s service isn’t perfect. There are, like with any fintech provider, a few problems. The extent to which they affect you depends somewhat on what you plan on using the account for.

One of our biggest issues is that the free account doesn’t really give you much when it comes to transaction thresholds. Five free local transfers with Free plan seems quite limiting, particularly with a £0.20 charge on every subsequent one.

If you plan on making international transfers, then things are even worse. Even for the £25 per month option, you only get 10 free (£3 fee applies outside the monthly allowance).

There’s also no option to deposit cash into your account. Again, cash-based businesses will likely want to look elsewhere for their business accounts.

How safe is Revolut Business?

Safety is a top priority for Revolut, whether it’s for their business or personal accounts. Their website is secure and encrypted, and the app uses all of the security features we’ve come to expect from such technology.

In the UK, Revolut is not a bank but an e-money institution, authorised under the UK Electronic Money Regulations. This means, in particular, that FSCS protection does not apply to the e-money or payment services Revolut provides. Revolut keeps funds in ring-fenced accounts at Lloyds and Barclays. This means your capital is safe at all times.

Revolut Business Verdict

Overall, we’re very impressed with what Revolut has to offer on the business side of things.

Particularly with the addition of the free accounts, it now seems to cater to just about every startup and SME.

The app is simple to use and is full of features, and we particularly like how fast it is to get started with everything.

It’s not quite perfect — some of the limitations on free transactions mean that it could be expensive, particularly if you deal with overseas clients a lot. However, if you can overlook these issues, then there are few better accounts on the market right now.

For more information on Revolut Business, please click here.