Although Brexit is weighing on sentiment, stocks continue to make gains and the markets hold out hope for a positive outcome to trade negotiations between the US and China. Ian Slattery reports.

Stocks advanced for the fourth week in succession, marking the longest stretch of weekly gains since August 2018. The move came on the back of some large US banks reporting better-than-expected earnings growth, which in turn saw the financial sector as a whole propel the market higher.

Volatility, as measured by the VIX, declined and defensive sectors such as utilities and consumer staples lagged as the appetite for risk increased. From an economic perspective, trade negotiations between the US and China are ongoing, with the markets still hopeful of a positive outcome. Meanwhile, the Federal Reserve continues to allay investor fears with their more dovish commentary.

In Europe, German data showed GDP slowed to 1.5% in 2018, compared with 2.2% in 2017, the slowest rate of growth in five years. Uncertainty around Brexit is also weighing on sentiment. Growth in Asia has also been soft, forcing central banks to adoptive an accommodative approach to policy.

Equities

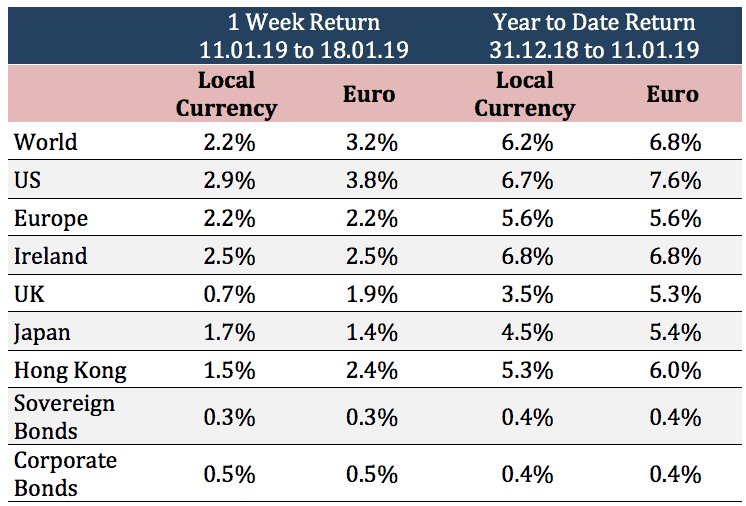

The MSCI World Index advanced 2.2%, with the US (+2.9%) leading the move higher on the back of positive earnings. Around 60 companies from the S&P 500 will report fourth quarter earnings during the week ahead.

Fixed Income & FX

The US 10-year yield ticked higher to 2.78% with the German yield at 0.26% as the bid for safe-haven assets moderated. The EUR/USD weakened to 1.136 and the EUR/GBP declined to 0.883 on slowing growth concerns.

Commodities

Oil prices continued to rebound with supply cuts and trade talk optimism taking centre stage, sending prices to $53.80. Gold moved marginally lower to $1,282 per troy ounce, while Copper prices ticked higher to $6,030.

THE WEEK AHEAD

Tuesday 22nd January:

- World Economic Forum begins

- US existing home sales

Wednesday 23rd January:

- Bank of Japan policy briefing

- Canadian retail sales announced

Thursday 24th January:

- ECB interest rates decision

- US jobless claims released

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €21.9bn in investments of which pension assets amount to €10.2bn. Find out more about Zurich Life’s funds and investments here.

w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc