Pictured: Stafford Bagot, Managing Partner based out of Heidrick & Struggles’ Dublin office.

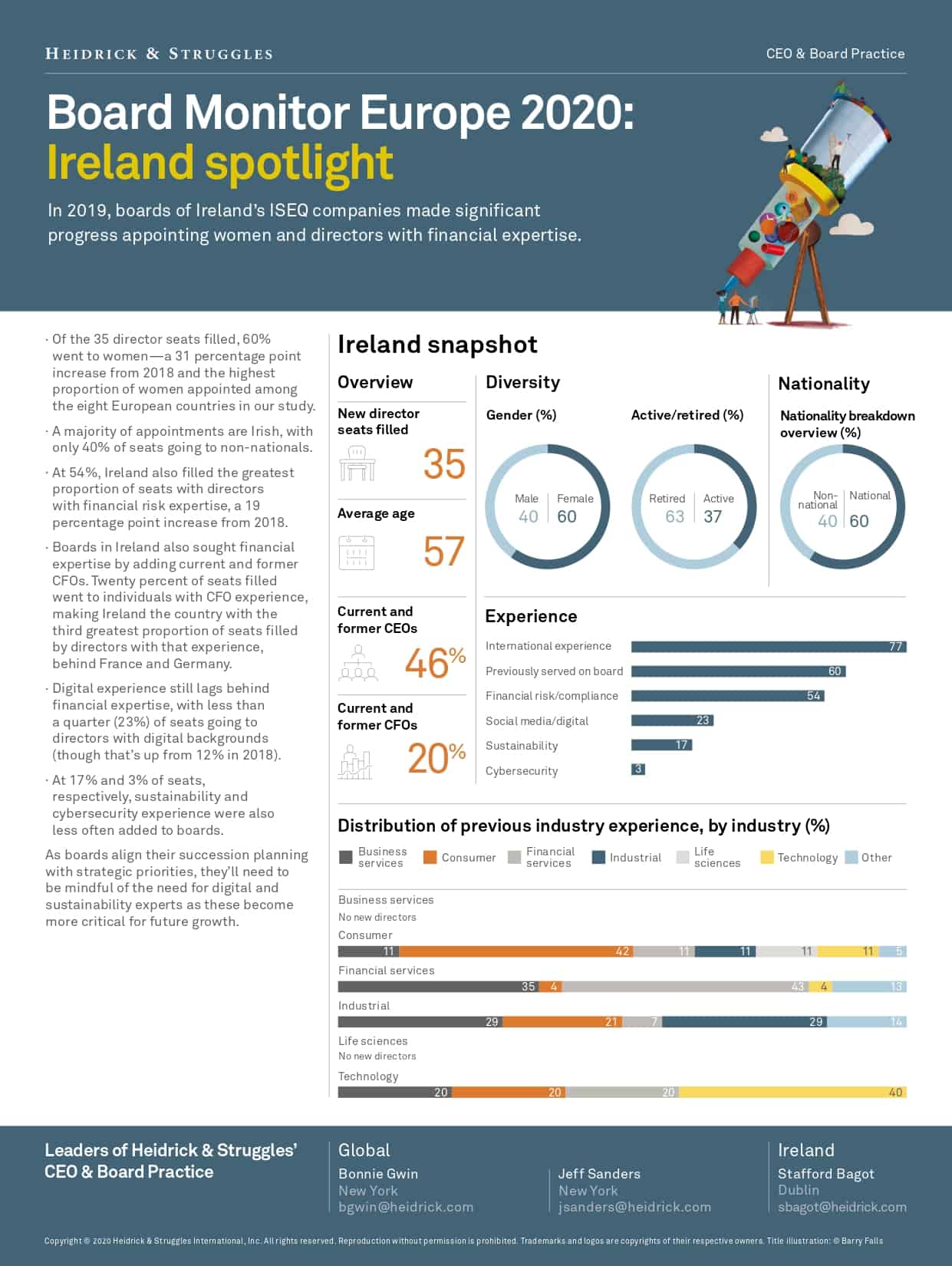

A new report from Executive Search Firm, Heidrick & Struggles has found that 60% of seats on Irish boards went to women last year, the highest figure in Europe; this stands in stark contrast to 2018 when Ireland sat at the very bottom of the pile. The 2019 figure is 11% higher than the European average and is a massive 31% increase for Ireland since 2018 when fewer than one-third of board appointments went to women.

The Heidrick & Struggles European Board Monitor 2020 Report, which analyses board compositions across Europe, also found that 40% of new Irish Appointments went to non-nationals. The Report found that boards are prioritising experience and, in particular, financial risk expertise ahead of Brexit – a trend that is likely to continue through the pandemic.

Speaking about the Irish findings, Stafford Bagot, who leads Heidrick & Struggles‘ operations in Ireland from the firm’s Dublin office, said: “The pandemic is an opportunity for boards to take stock and restructure. As remote working has drastically changed how the world is working, companies can now begin to look past barriers such as geography when it comes to picking the best talent for their boards.”

The Board Monitor highlighted that Ireland has performed significantly better in 2019 in terms of gender diversity compared with the previous year. While the European average is 49%, Ireland has seen 60% of new director seats go to women. This is excellent progress and we hope that this momentum keeps up. It is essential that we ensure that we build an appropriately represented pipeline of talent in terms of both gender and ethnic diversity, to feed into our boards.

“It is indisputable that minority representation in the most powerful jobs in Ireland must increase. The perpetuation of underrepresentation of these groups is multifaceted. The average age of new board appointees in Ireland last year was 57, demonstrating the priority placed experience. Indeed, in light of COVID and Brexit, I think a lot of boards are exhibiting a preference for appointees who are seasoned in restructuring, risk, and crisis management. However, a tendency to go for ‘tried and tested’ appointees and to stick with what has worked in times of crisis previously, as opposed to seeking out those with more diverse experience, could reinforce a lack of diversity by narrowing the candidate pool. Newer – and perhaps younger – voices at the table can however support agility and provide perspectives from demographics that may be closer to an organisation’s customer base, and these are areas in which we expect more diverse hires to excel.”

Board Monitor Europe – Ireland

Key Report Insights:

- 46% of newly appointed directors had prior CEO experience, and a further 20% had CFO experience reflecting a perceived need for such experience ahead of Brexit. At 54%, Ireland also filled the greatest proportion of seats with directors with financial risk expertise, a 19% increase from 2018. As the pandemic has created further economic uncertainty, this trend is likely to continue.

- A majority of appointments are Irish, with 40% of seats going to non-nationals. The high share of non-national appointments may in part be due to the large number of technology companies with regional headquarters in Ireland.

- Ireland is positioned slightly above the European average in terms of appointing those with digital experience at 23%. Less prominent were board appointees with cybersecurity expertise (3%), which we expect will become a growing priority for boards with remote working the foreseeable norm. ESG has really come to the fore over the past year, particularly from an investment perspective, and 17% of Board appointees in 2019 brought experience in this field. Boards should consider their medium to long-term strategies in striking the right balance of experience; digital and sustainability are likely to be critical drivers for growth in the coming years, while cybersecurity is an operational threat that should not be neglected.

Read the report here.