Ian Slattery looks at the markets final week of trading for 2017 but the focus now is on the new year and trading challenges and opportunities.

Ian Slattery

Markets closed the last week of 2017 on a negative note, albeit in light trading (volumes -28% vs the monthly average) in the holiday shortened trading period. For example, the bulk of the week’s losses came in the last trading hours on Friday, as fund managers appeared to be booking profits for the calendar year.

On a monthly basis, the tech-heavy NASDAQ was up 0.4% to post gains in 11 of the 12 months in 2017. The Dow was up 1.8% to record nine consecutive months of gains for the first time since 1959, whilst the S&P 500 was up 1% for its first nine-month winning streak since 1983.

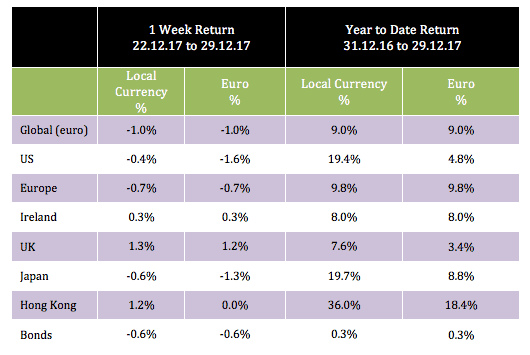

The global index in euro terms was down 1.0% last week, although Hong Kong bucked the trend and was up 1.2%

There was a trickle of positive US economic data during last week. November home sales were better than expected and retail spending data was positive in the period leading up to Christmas. The Conference Board’s Consumer Confidence Index, however, was lower after reaching a 17-year high in November.

The global index in euro terms was down 1% last week, although Hong Kong bucked the trend and was up 1.2% in local terms. Oil finished the year on a positive note, up 3.3% for the week, and 12.5% for the calendar year. Copper maintained its momentum also, and finished up 31.1% for 2017. The ten-year US bond yield finished the week at 2.41% and the ten-year German equivalent was at 0.42%. The EUR/USD rate closed the period at 1.20, whilst EUR/GBP was at 0.89.

THE WEEK AHEAD

Wednesday 3 January

German unemployment numbers are projected to drop slightly, but the rate is expected to hold steady at 5.5%.

Thursday 4 January

The US Federal Reserve releases the minutes of its December Federal Open Market Committee (FOMC) meeting, which saw the last rate hike of 2017. The minutes may shed further light on the committee’s plans for 2018.

Friday 5 January

December’s non-farm payrolls data from the US goes to print where the consensus expects an increase of 188,000 on the jobs front, whilst the unemployment rate may see a tick down to 4%.

The team at Zurich Investments is a long-established and highly-experienced team of investment managers who manage approximately €21.9bn in investment of which pension assets amount to €9.9bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc