All major markets were down last week with global markets falling by -8.1%. Commodities such as oil and gold also fell. Ian Slattery reports.

Macroeconomic data released on Friday showed activity in China’s factory sector contracted sharply in February. The manufacturing purchasing managers’ index plunged to 35.7 and the non-manufacturing number also fell to its lowest ever level.

Ian Slattery, Zurich Investments

The S&P 500 recorded its fastest correction in history, according to Deutsche Bank Global Research. All sectors within the S&P 500 suffered a correction, with energy stocks faring the worst due to falling oil prices. Communication services stocks held up the best, helped by earnings growth in Netflix shares.

Communication services stocks held up the best, helped by earnings growth in Netflix shares

Asian stocks and European equity futures climbed Monday amid signs of support from central banks. Elsewhere, French President Emmanuel Macron is under pressure over a decision to push through pension reforms and, over in Israel, voters head to the polls for the third time in less than a year.

US ISM manufacturing statistics and some final readings of European PMIs are due, while it’s a quieter day in terms of corporate earnings.

Equities

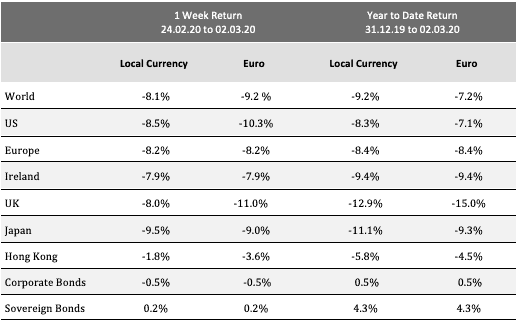

All major markets were down last week with global markets falling by -8.1% in local terms and -9.2% in euro terms. Japan led the fall and was down by -9.5% in local terms and -9.0% in euro terms.

Fixed Income & FX

The US 10 year yield finished at 1.10% last week. The German equivalent finished at -0.63%. The Irish 10 year bond yield remained at -0.19%. The Euro/US Dollar exchange rate finished at 1.11, whilst Euro/GBP finished at 0.87.

Commodities

Oil continued to fall finishing at $46 per barrel. Gold fell to $1,606 per troy ounce, and copper decreased to $5,617 per tonne.

The week ahead

Wednesday 26th February:

- US ISM manufacturing data for February released

Thursday 27th February:

- Eurozone Preliminary CPI data for February released

Friday 28th February:

- Chinese trade balance data released