The Irish Government needs to prepare for the country’s rising population and opportunities, but the planning must start now, writes Mary Rose Burke, Ibec.

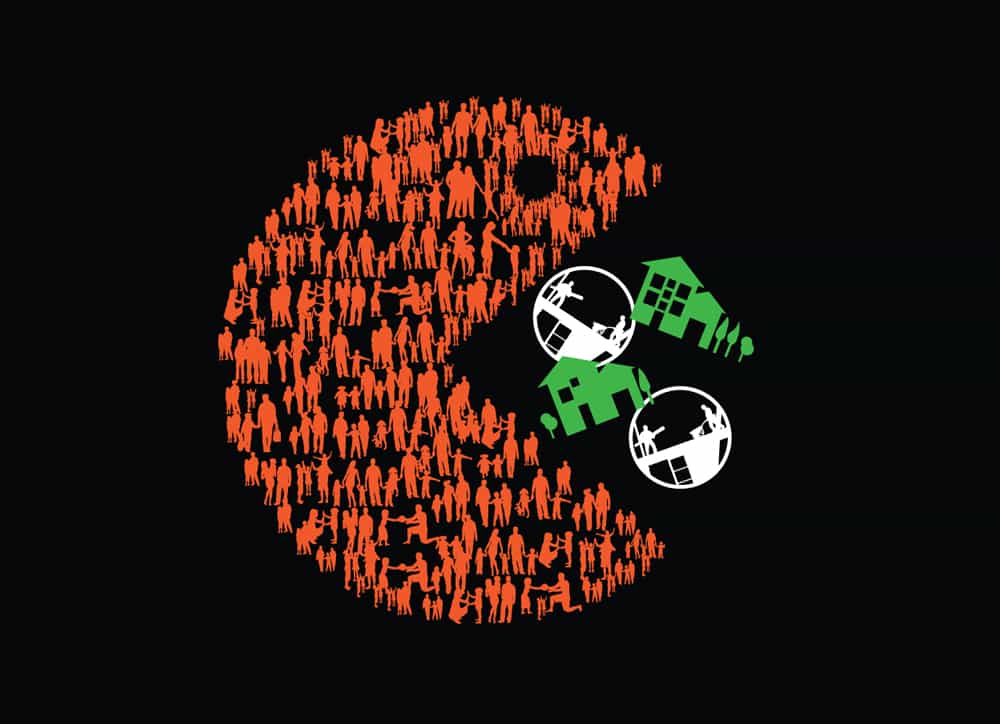

If current trends continue, in less than 50 years the island of Ireland will have a population of 10 million. This is something that should be embraced, as it brings with it a whole range of new opportunities.

We should think big. We should aim for an Ireland with the state-of-the-art infrastructure, and a dynamic labour force with the right skill mix and level of income to underpin such ambition. However, current plans are far from adequate. When it comes to investment, the country must prepare for significant economic and demographic growth.

Sizeable infrastructure gaps in the transport, health, education, energy and environmental services sectors will curtail growth unless they are addressed as a priority. Thankfully, we currently enjoy a very benign funding backdrop.

Record low borrowing costs mean we now have a once in a generation opportunity to ramp up public infrastructure investment to 4% of GDP by 2020. And there is also the potential to find new financial ways of connecting the stock of private capital with productive investment to achieve this target.

BOTTLENECKS

Of course, we have to invest wisely. Our transport network, for example, is far from complete. During the boom years we successfully connected Dublin to the other main cities, but not to all the regions. There is still a job to do to better connect all of our major cities to each other.

Housing is also fast emerging a major concern for employers. Under supply in key urban centres has the potential to undermine competitiveness and make it more difficult to attract and retain talented workers. The Government needs to do much more to address supply shortages.

A new national investment plan needs to be supported by a streamlined planning process and a new spacial strategy: a strategy that sets out a blueprint for a better balance of social, economic and infrastructure development across the entire island. The tax system also needs to be reformed so that it supports long-term growth and encourages productive investment.

Despite welcome moves to reduce the income tax burden in the last budget, there is scope to do a lot more. With many companies unable to afford pay rises, this is a crucial means of increasing disposable incomes and, in turn, boosting economic activity and tax returns.

More effort is needed to ensure that the recovery is the reality of every city, town and village in Ireland

SKILLED WORKERS

Mary Rose Burke, Ibec

At 51% Ireland still has one of the highest marginal tax rates in the OECD. And it kicks in at a very low level. The decision to retain an even higher marginal tax rate for those earning over €70,000 means we risk losing our best and brightest to competing jurisdictions; countries with more sensible tax codes.

A single worker earning €75,000 here, for example, takes home about €6,000 less than a similar worker in the UK.

This is making it difficult for Irish business to attract and retain skilled workers. It also flies in the face of the shared aim of making Ireland a leading centre of design and innovation.

The next budget must prioritise further cuts to the marginal rate and adjust the bands to give more money back to workers. The disparity of treatment between the self-employed and PAYE workers is another unjustified anomaly in the system that should be addressed as a priority.

Over the last two years Irish businesses have put 100,000 people back to work; in jobs that provide families with new opportunities, and entire communities with a fresh sense of value and purpose. Unemployment is set to fall below 9% this year. This is remarkable progress, but not everyone has benefitted.

More effort is needed to ensure that the recovery is the reality of every city, town and village in Ireland. We now have an opportunity to lay the foundations for a new phase of our country’s social and economic development; we need to grasp it.