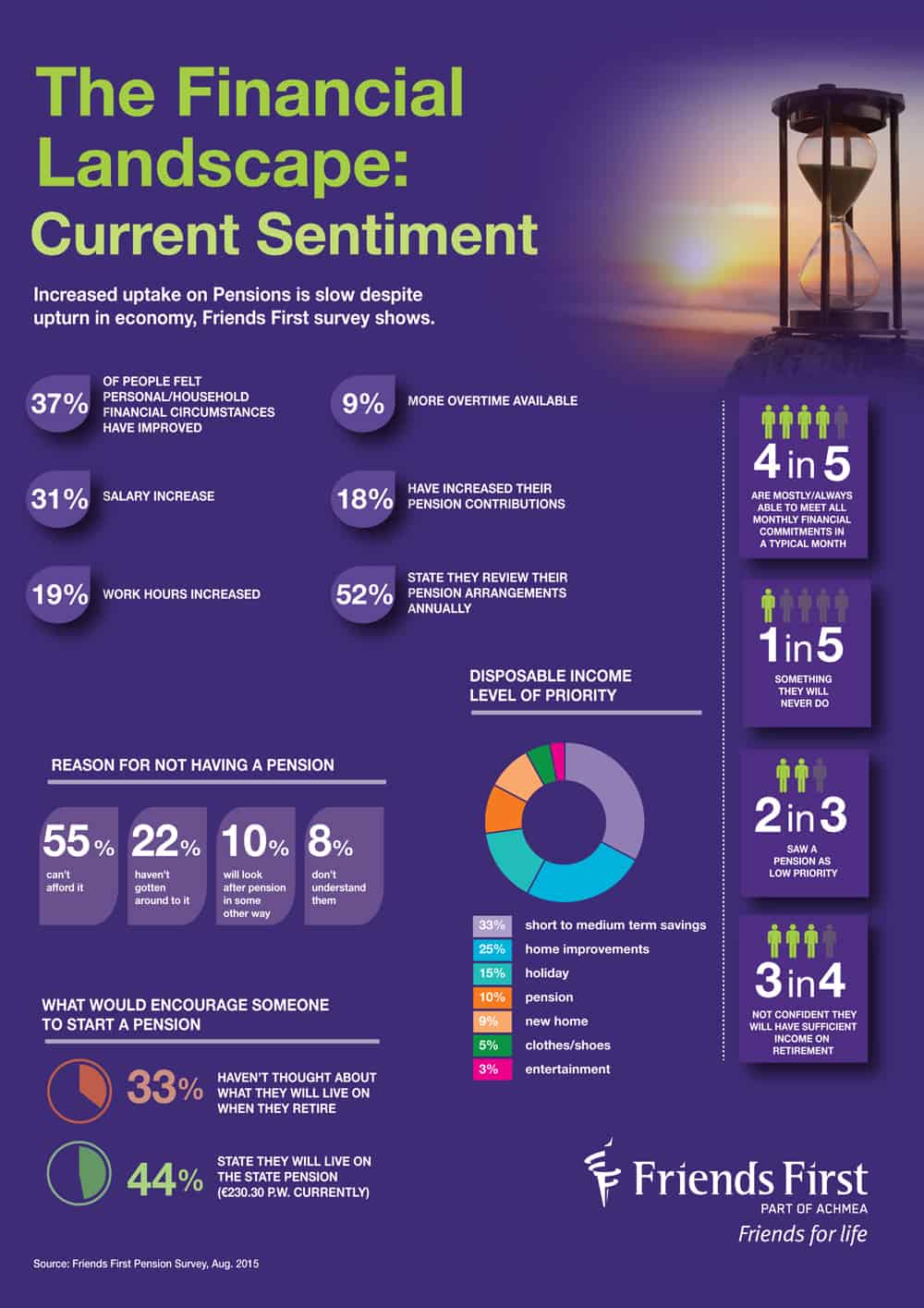

Annual pension research conducted by Friends First reveals household finances have improved for some households, but a large portion of the population do not have a private pension plan in place.

The research showed that 76% of respondents were not confident of having sufficient income on retirement. When those without a private pension were asked what they would live on when they retired, 44% indicated the State pension would be their sole income in retirement, with a further 33% admitting they hadn’t thought about it.

However, 46% of adults have private pension ownership, with an increase seen in those aged 25 to 34.

For those who do have a pension, the trend for reducing contributions appears to have ceased with a modest increase in premiums by almost 20% of this group.

Commenting on the findings, Simon Hoffman of Friends First said: “The postponement of financial planning for the future is still a concern. We have an ageing population and the number set to rely on the State pension as their sole retirement is around the 890,000 mark. This will put a huge strain on the State in the coming years as those without a private pension may struggle financially in their retirement and will be depending on a pension that is less than the current minimum wage.”

“However, with improving economic circumstances and consumer spending beginning to increase, pension affordability should become less of a barrier. The bottom line is although it is better to start early, it is never too late to start making provisions for a comfortable retirement.”

Behaviour & Attitudes carried out the online survey of 1,001 adults aged 25-55 in the Republic of Ireland on behalf of Friends First.