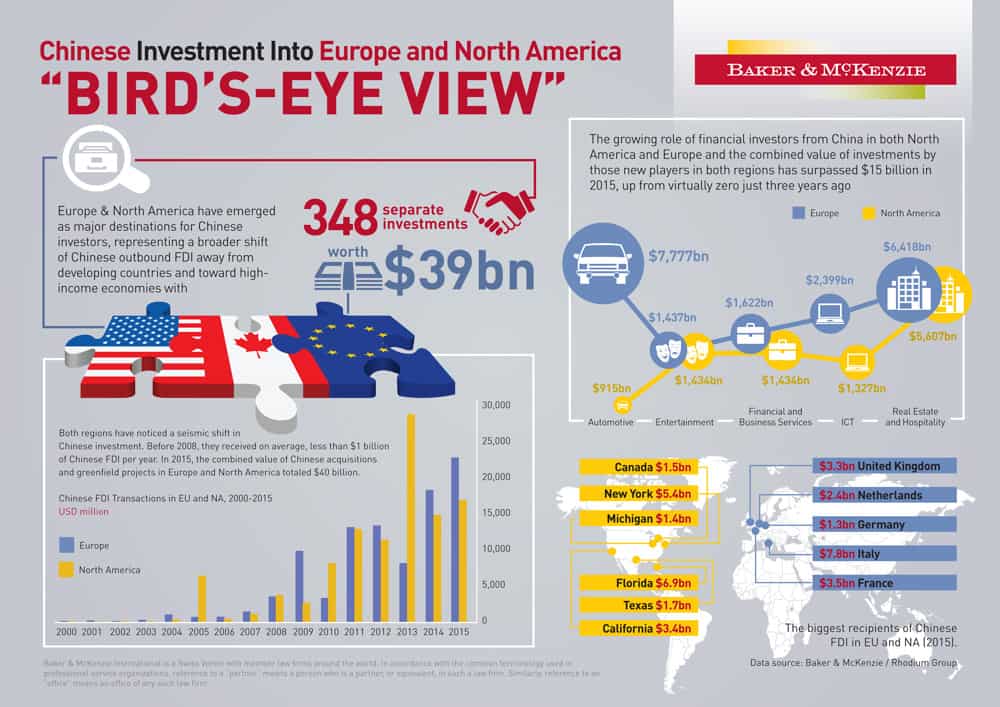

Chinese investors poured a record $40bn into Europe and North America in 2015, spending $29bn in just four industries: real estate and hospitality; automotive; financial and business services; and IT.

The first six weeks of 2016 have been the busiest period on record for announced Chinese M&A activity in Europe and North America, with $70bn of potential deals in the pipeline.

Chinese FDI in Europe hit a new all-time record of $23bn in 2015, about 35% higher than investment in North America. After a brief drop in 2013, investment in Europe doubled to more than $18bn in 2014.

Prior to that it grew from nearly zero before 2008 to an average of $8.6bn from 2008 to 2012, partially driven by privatisation and other opportunities arising from post-crisis restructuring.

But FDI in energy declined dramatically in Canada in the past two years, where investment in 2015 was down more than 90% from its 2013 peak. Chinese FDI in North America averaged $11bn a year from 2008 to 2013, reaching a record combined total of $29bn in 2013.

For larger deals, Chinese investors continue to prefer to take majority or full ownership. For deals worth over $500 million in 2015, collectively worth $22.9 billion, 90% of deals ended up in controlling stakes of more than 75%. State-owned enterprises account for the majority of these mega deals (60% of total value)

Europe has been a much greater attraction for Chinese investors seeking advanced manufacturing assets while North America has received more than twice as much investment in advanced services compared to Europe.

Chinese companies have recently developed an appetite for financial sector assets in both Europe and North America, with $4.6 billion invested in 2015 alone – which is more than total Chinese investment in financial services in the previous 14 years.

A few industries show similar levels of investment across the two regions since 2000. These include the real estate and hospitality sector and the agriculture and food sector.

“If you look at the big picture, Europe has led the way in developing advanced manufacturing processes, in part because of labour costs, while North America’s industrial decline has been offset by a focus on the service sector and, latterly, consumer technology,” said Danian Zhang, chief representative, Baker & McKenzie Shanghai. “So it’s natural Chinese investors would be drawn to the best of what each region has to offer.”

Chinese FDI into both Europe and North America has in aggregate been breaking records for the past five years. Some $205bn has been invested since the turn of the century ($108bn in North America and $97bn in Europe). Almost 80% of that has been invested since 2011 alone.

The strong start to 2016 – nearly $50 billion of pending deals in Europe and more than $20bn in North America – suggests these trends will continue to evolve in both regions with more sophisticated and diverse deal structures.

Photo: AK Rockefeller