David Lane, managing director, Ecclesiastical Insurance

David Lane talks to Niamh Mac Sweeney about challenges and opportunities for growth in the insurance industry.

Q: How is the insurance industry in Ireland performing?

There has been quite a lot of commentary recently about the challenges facing the insurance industry. A lot of this debate highlights increasing claims costs, the challenge of growing in a market with excess capacity (as M&A activity in the sector demonstrates the challenge of growth) and the public perception of the industry in general.

The insurance industry employs over 28,000 people and contributes in excess of €1.8bn in tax to the Irish Exchequer per annum, which should not be underestimated. It also covers a wide variety of areas that are all performing differently. But an indication of the value of the insurance industry is that at the end of 2014, the members of Insurance Ireland had handled almost 450,000 new claims with net incurred claims costs of €1,675m.

Q: How is Ecclesiastical performing in the Irish market?

Ecclesiastical is a specialist insurer, and over the last two years we have grown our business and returned a small profit. As a specialist, we focus on the areas of heritage, faith, charity and education where we cover a diverse range of risks.

We have a strong base from which we can grow our business and deliver sustainable, profitable results and that fuels our wider purpose which is to give back to the communities we serve. We have a Group-wide, three-year target of giving £50m back to the communities we serve by the end of 2016, and we are on target to do that.

Q: What are the key challenges for the industry and what is Ecclesiastical Insurance doing differently to the competition?

Firstly, claims costs are increasing significantly with the recently published Central Bank Bodily Injuries Thematic review showing a 27% increase in the cost of employer’s liability claims from 2012 to 2014.

Excess capacity has extended the long running ‘soft’ market which means that in some areas of the market risks are under-priced leading to instability and insurance companies making losses

Thirdly, the public perception and confidence in the insurance industry has not been helped by a number of companies going through well publicised challenges.

Ecclesiastical is different in lots of ways, from our unique ownership structure that enables us to generate returns for our shareholder that they redistribute into the community, to the way we operate as a specialist.

Q: What makes the Ecclesiastical Insurance proposition different?

As a specialist insurer our proposition is based around the expertise that we offer in our niches, our deep understanding of our markets and the risks associated with them and our personal service from our highly experienced and dedicated teams.

While the upturn is welcome, we do not plan or run our business based on that upturn

Q: Ecclesiastical operates as a specialist insurer. Can you explain more about these specialist areas?

We operate in four core sectors, heritage, faith, charity and education with a strong emphasis on being a specialist property insurer.

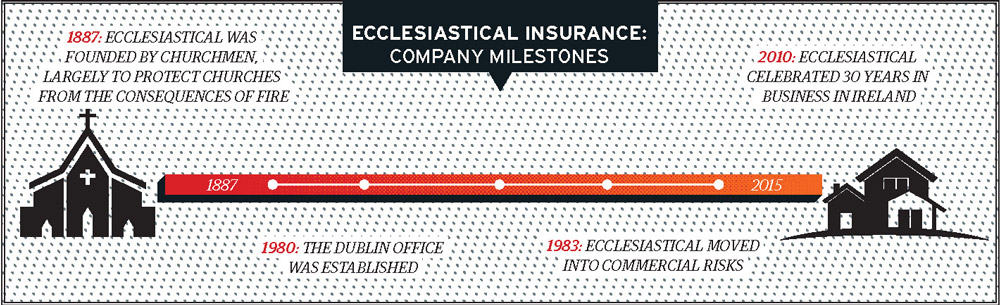

Ecclesiastical was originally founded to provide insurance for the Anglican Church and we entered the Irish market in the early 1980s to underwrite insurance for the Church of Ireland. This is still part of our business but we also work with many other religions.

Education covers risks across primary, secondary and third level and, being owned by a charity, we are particularly active in the charity and not-for-profit sector covering a wide variety of risks.

Until reasonably recently, we focused solely on commercial heritage risks but in the last few years we have expanded out into residential heritage and arts and culture.

Our expertise is particularly strong in heritage where our team have significant experience in surveying, evaluating and underwriting these types of risks.

Q: Ecclesiastical has been in Ireland for over 30 years. What do you attribute its successes here in Ireland to?

Our success in Ireland and across other territories can be attributed to a strong, experienced team who have a deep understanding of our markets and the risks associated with them.

Our team is committed to delivering our proposition that is based on expertise built up over many years and a personal, tailored service that focusses on particular areas of expertise.

Q: You were appointed MD in 2011. What have been the key challenges during your time in this role?

We went through a number of challenging years as a result of writing business that was either on the fringe or beyond our core areas of specialisation. It took some time to identify the issues but once we did, we took corrective action to rectify the situation and are now focused on growing within our core areas.

Q: What is your main focus now?

Over the last few years we have developed our profile in these core areas by supporting the sectors directly and working with a selection of specific insurance brokers.

Our main focus is to continue to develop and grow our Irish business to be a sustainable, profitable business unit allowing us to support the sectors and communities in which we operate.

Q: Given the economic growth Ireland is now experiencing, has there been a noticeable change in business for Ecclesiastical?

Like every business, we have had to manage our budgets carefully but as a specialist insurer, we are not necessarily subject to the normal economic swings.

While the upturn is welcome, we do not plan or run our business based on that upturn. We focus instead on the quality of the people in our business and the skills they leverage when assessing the risks we insure.

Q: During your time with Ecclesiastical, how have you grown the business?

In the early part of my time with Ecclesiastical we identified that we were writing business that did not fit within our core areas of expertise and we had to take corrective actions. It was a particularly challenging time for the team as these were not easy things to do and it led to a drop in our revenue line.

However, it was the right course of action and over the last two years we have grown our business by focusing on our core sectors. Indeed, there is headroom for further growth in these areas that will help us to deliver sustainable, profitable growth.

Q: And are there new opportunities in other markets that you want to explore?

Our growth is based on continually working with customers and prospects in our core sectors to develop and deepen our understanding of their needs and using our specialist expertise to deliver solutions to meet their requirements.

While technology is important in driving efficiency in our business, we place a strong emphasis on taking the time to develop personal relationships and deliver an excellent service.

In addition, we have been developing our residential heritage and arts and culture proposition in the last 12 months and will continue to explore similar opportunities.

Q: Do you have a particular leadership style and how do you motivate yourself and your team?

I am a strong believer in developing a clear vision, building a strong team and working with them in a collaborative way.

I like to focus on the outcomes so setting goals and expectations for the team at a business and personal level is critical along with monitoring our success through good data and management information. Once the team are in place and expectations are set, it is important to give people room to do their jobs and deliver on their goals.

Q: Are you driving by results?

Results are a strong motivating factor for me as when we deliver it enables us to donate more to good causes through our ownership structure. Providing the best risk management, cover and support when claims occur to our customers is fundamental to our business.