Deals were announced at Hong Kong Fintech Week during Enterprise Ireland’s trade mission to China

In total, fourteen Irish fintech companies backed by the Irish Government, through Enterprise Ireland, are showcasing Ireland’s fintech capabilities at Hong Kong Fintech Week this week. The companies represent fintech areas including Regtech, Payments, Banking, InsurTech, Cloud Communications and Biometrics.

Global Shares deal worth US$15 million over five years

Global Shares, Deloitte ‘FinTech Company of the Year’ and leading provider of equity compensation management solutions for global corporations, today announced that it will form a strategic partnership with Huanying International, one of the top online brokerage firms in Hong Kong and mainland China, to provide ESOP administration, share dealing, global compliance, financial reporting, and asset management services to new economy companies. The deal will be worth more than USD 15M in revenue over the next 5 years. Global Shares today also announced further expansion in Asia with the opening of a new office in Beijing, following the official launch of Global Shares’ Hong Kong Office earlier this year.

CurrencyFair expanding into Asia as part of a €20million investment and creation of 90 jobs

CurrencyFair, a leading provider of International Money Transfer services to consumers and businesses worldwide announced a major expansion into Asia through the signing of a strategic partnership with Hong Kong-based Convoy Payments Limited. The partnership which was formalised today, is part of a €20 million (approximately HK$182 million) investment plan to drive rapid global growth which will also see the creation of 90 new jobs over the next 18 months. The new jobs will be created globally with particular emphasis on product development, customer service, compliance and marketing and global partnership development.

Irish fintech expansion into Asia

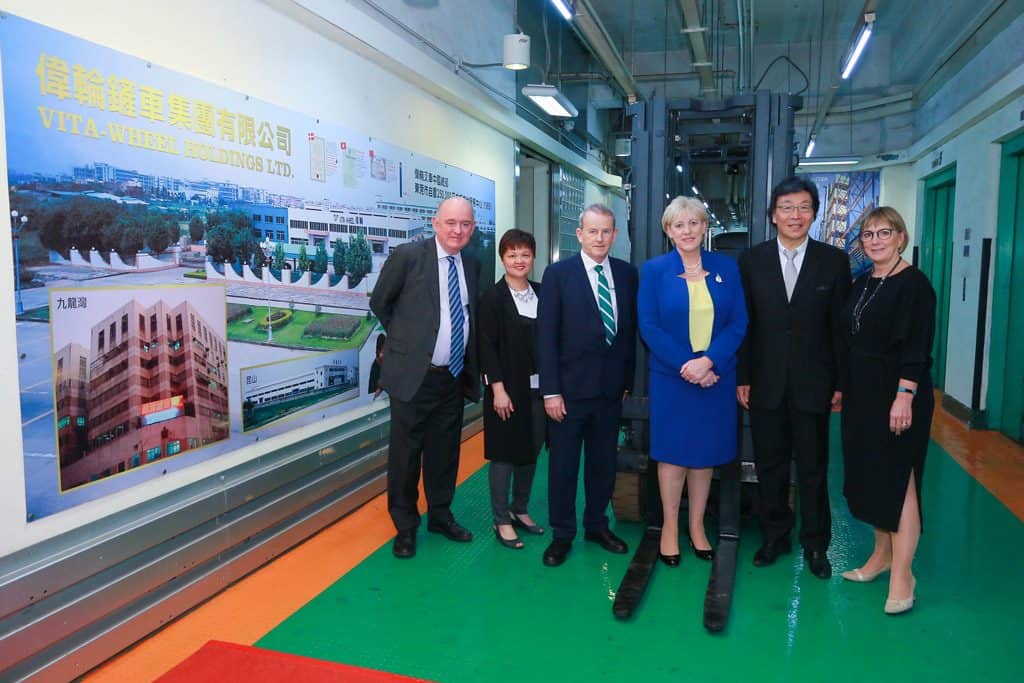

Minister for Business, Enterprise and Innovation, Heather Humphreys TD leads trade mission to Hong Kong and China with Enterprise Ireland CEO Julie Sinnamon. Pictured with Minister Humphreys and Julie Sinnamon is Robert Moffett, technical director of Combilift with Chinese partners Vita Wheel.

Irish Minister for Business, Enterprise and Innovation, Heather Humphreys commented on the breadth of the deals,“Enterprise Ireland client companies are securing new contracts in global markets at an unprecedented level. The deals we’ve seen formalised today by Global Shares, Know Your Customer and CurrencyFair at Hong Kong Fintech Week demonstrate how much value Irish fintech companies can deliver to partners worldwide. It’s heartening to see recognition from companies the world over for the Irish fintech advantage.”

Commenting on the new partnerships, Enterprise Ireland CEO Julie Sinnamon said:

The acceleration of fintech in Asia provides excellent opportunities for Irish companies to grow through strategic partnerships like the ones we’ve seen formalised here at Hong Kong FinTech week. Today’s announcements highlight Ireland’s reputation as a significant source of fintech innovation and demonstrates the role Irish fintech companies can play in delivering solutions for our partners in Asia Pacific.

Commenting on the expansion of Irish fintech companies in Hong Kong, Mo Harvey, Enterprise Ireland’s FinTech & Financial Services Lead, APAC said,

As Asia’s largest financial hub, Hong Kong is one of the most forward-looking cities in Asia when it comes to fintech deployment. Historically, Irish fintech companies have performed exceptionally well in Hong Kong. A strong cohort of over twenty Irish fintech companies are active in Hong Kong including key players such as FEXCO, Daon, Know Your Customer, CurrencyFair, Intuition Publishing, Fenergo, Fineos, Tax Back International, Corvil, Global Shares and Financial Risk Solutions. Between them, these companies have secured significant wins with some of the world’s leading financial services companies in Hong Kong such as HSBC, Standard Chartered and Bank of China as well as local Hong Kong entities such as the Securities & Futures Commission and the Hong Kong Jockey Club.

Harvey continued: “We see real opportunity in the areas of regtech, payments, blockchain and big data and expect there to be a significant increase in the number of Irish companies entering the Hong Kong market in the next 6 to 12 months. There will be a particular focus on Regtech, cloud and banking companies in order to Hong Kong’s new virtual bank initiative which will create opportunities for collaboration and disruption. These companies have one thing in common – their choice of Hong Kong as their operational base to take on both the local market and expand into other Asia Pacific markets including mainland China.”