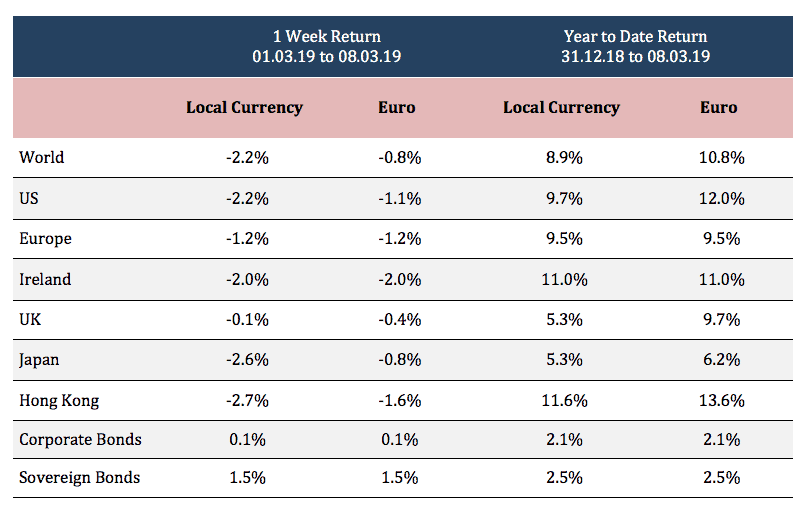

Global markets are up 10.8% this year in euro terms and while economic growth remains positive, the data continues to point to a slowdown, writes Ian Slattery.

Ian Slattery

In conjunction with reducing their 2019 growth forecasts from 1.7% to 1.1%, the European Central Bank (ECB) injected further liquidity into the eurozones banking system to spur growth and economic activity.

ECB President, Mario Draghi acknowledged the outlook for the next 22 months had deteriorated and as a result, confirmed that interest rates would remain steady throughout the year.

Elsewhere, the US market suffered its first weekly loss of the year and the yield on the 10-year Treasury note touched its lowest level since early January.

Meanwhile, volatility, as measured by the VIX, rose to its highest level in over a month. Finally, the Chinese bull market stuttered with a sharp sell-off on Friday as exports slumped in February and Beijing lowered its growth forecasts to 6% from 6.5% for 2019.

Equities

The MSCI World Index lost 0.8% in euro terms, with the US market falling 2.2% in US dollar terms. Larger cap defensive and interest sensitive sectors outperformed with utilities leading the way.

Fixed Income & FX

The US 10-year yield is at 2.63% while the equivalent German yield ended the week at just 0.07%. The dovish comments from the ECB saw the Euro weaken to 1.124 against the US dollar.

Commodities

It was a mixed week for commodities with Gold rising to $1,298 and Oil rising to $56.07 per barrel. Slowing global growth concerns weighed on Copper prices, finishing the week lower at $6,423.

THE WEEK AHEAD

Tuesday 12th March:

- UK GDP & Industrial Production

- US Consumer Price Index (CPI)

Wednesday 13th March:

- Eurozone Industrial Production

- Chinese Industrial Production

Thursday 14th March:

- German & French CPI US

- Jobless Claims & Retail Sales

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €21.9bn in investments of which pension assets amount to €10.2bn. Find out more about Zurich Life’s funds and investments here.

w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc