Global markets gain further ground as trade optimism rises, but Brexit negotiations show no sign of a resolution, writes Ian Slattery.

Ian Slattery

Markets moved higher once more last week; despite some mixed economic data. Optimism over a US-China trade deal continued to grow as plans for another direct summit are in the making.

German industrial production data disappointed by dropping to a 2012 low, and economic concerns throughout the single market remain heightened. The release of the latest Federal Reserve minutes reinforced recent comments from committee members that current conditions justify a pause in rate hikes.

Little progress was made in respect to Brexit negotiations, as internal party politics came to the fore in the UK with party resignations on both sides of the aisle.

Equities

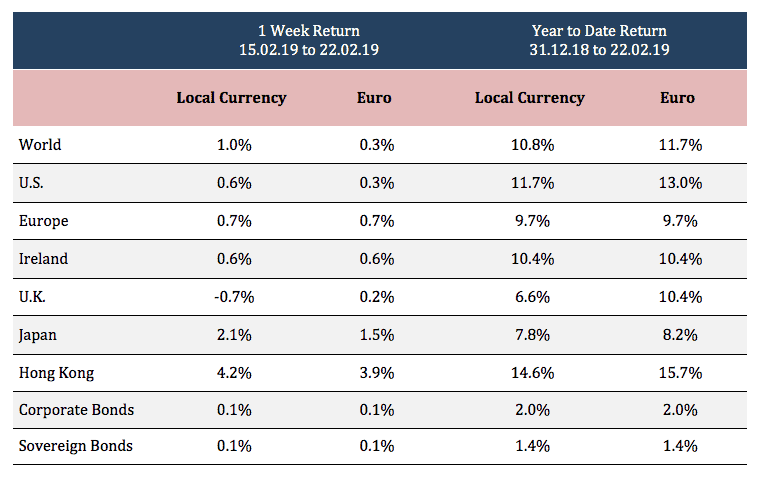

The MSCI World Index advanced 1.0% in local currency terms, and remains up over 10% year-to-date. Stocks in Japan and Hong Kong led global equities higher, with the UK disappointing.

Fixed Income & FX

The US 10-year yield is at 2.66%, a slight tick up from 2.65% last week, while the equivalent German yield was steady at 0.10%. The Euro strengthened against the US dollar to 1.134.

Commodities

Oil saw a further positive move in prices, ending the week up over 3% to finish at above $59 per barrel. Gold and Copper prices finished the week at $1,328 per troy ounce and $6,519 respectively.

THE WEEK AHEAD

Wednesday 27th February

- US Factor Orders

- US Pending Home Sales

Thursday 28th February

- US GDP growth for Q4 2018

Friday 1st March

- Eurozone CPI and PMI data

- Eurozone Unemployment data

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €21.9bn in investments of which pension assets amount to €10.2bn. Find out more about Zurich Life’s funds and investments here.

w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc