Central banks globally dominated the markets during the week, writes Ian Slattery.

Ian Slattery

Central banks took centre stage last week, with key guidance for the rest of 2018 emanating from both sides of the Atlantic. The US Federal Reserve increased rates by 25bps (0.25%), as forecasted, and also signalled that another two-rate hikes could be expected in 2018.

The European Central Bank (ECB) also announced a policy shift in extending the QE programme for another three months until the end of 2018 – although notably reducing the amount of bond purchases from €30 billion per month to €15 billion. However, President Draghi simultaneously pushed out rate-hike expectations to Q319, which buoyed both equity and bond markets whilst sending the euro lower against the dollar.

The White House announced $50 worth of potential tariffs on China, giving an indication that the ‘trade war’ rhetoric is likely to be in focus for markets going forward. Latin American markets also came under some pressure, with assets in Brazil and Argentina losing value due to a myriad of economic policy issues.

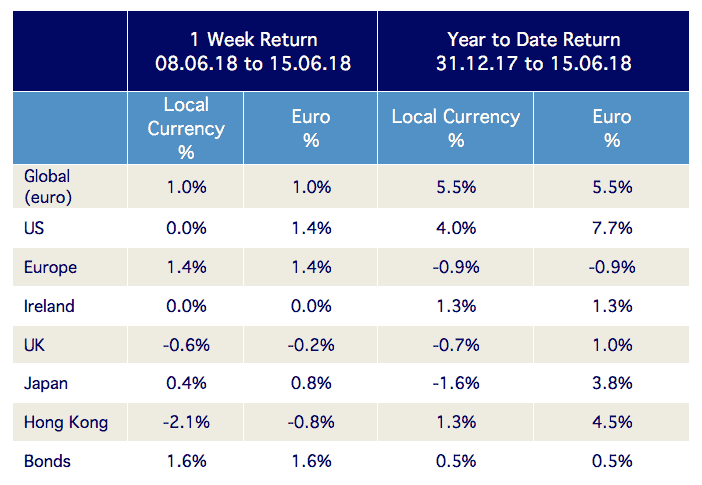

The global index rose during the week, bringing the year-to-date gain to 5.5%.

Oil was broadly flat, closing just above $65 per barrel. Gold was lower, down 1.5% in dollar terms, whilst copper also lost value during the week.

The 10-year US bond yield finished the week at 2.92% from 2.95%. The German equivalent closed at 0.40%. The EUR/USD rate finished at 1.16, whilst EUR/GBP was at 0.87.

THE WEEK AHEAD

Wednesday 20 June

A host of central bankers will speak at the ECB Central Bank Forum in Portugal, including President Mario Draghi and Federal Reserve Chair Jerome Powell.

Friday 22 June

June composite Purchasing Managers’ Index (PMI) data for Europe is expected to decline slightly to 53.5 from 53.8, which still indicates a continuing expansion.

Organization of the Petroleum Exporting Countries (OPEC) meets in Vienna to potentially negotiate a further production agreement between the bloc of oil producing countries.

The team at Zurich Investments is a long-established and highly-experienced team of investment managers who manage approximately €22.1bn in investment of which pension assets amount to €10.1bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc